Foreign exchange

ECX and Powernext team up on carbon trading

French electricity exchange Powernext and the Amsterdam-based European Climate Exchange (ECX) have agreed to jointly offer carbon futures and spot contracts. The partnership is complimentary, because ECX lists a futures contract and Powernext offers a CO…

European Commission to examine energy-sector competition

The European Commission (EC) today launched an inquiry into competition in natural gas and electricity markets, in response to concerns from consumers and new market entrants about the development of wholesale markets and limited consumer choice.

Powernext to launch spot carbon contract in late June

French electricity exchange Powernext will launch its delayed CO 2 emissions spot market on June 24, barring any technical or administrative difficulties among market members.

Just a seasonal swing?

US natural gas market volatility is keeping trading volume high. But is this just a seasonal phenomenon or part of a long-term trend? Catherine Lacoursiere reports

Sharon Brown-Hruska

The CFTC’s Sharon Brown-Hruska believes in minimal market interference, even, as she tells Joe Marsh , when it comes to hedge funds

Getting it together

The US Committee of Chief Risk Officers is proposing an energy data hub to improve price transparency in the natural gas market, but index publisher Platts is concerned over some aspects of the initiative. Joe Marsh reports

UBS expands energy group and starts trading oil in Canada

UBS Commodities Canada moved into larger Calgary offices in May to accommodate its expanding energy-trading team, including a shift into crude oil. The firm, part of investment bank UBS, has hired its first crude oil trader, its first options trader and…

UK business paying £1bn/year too much for energy

UK businesses are failing to manage energy buying efficiently and as a result are exposed to volatile prices, losing up to £1 billion ($1.81 billion) a year, a new survey has found.

Spectron brokers first 'clean' spark spread

Energy broker Spectron has facilitated the UK’s first carbon-neutral, or 'clean', spark spread trade.

DrKW launches retail carbon product

Dresdner Kleinwort Wasserstein has paved the way for private investors to gain exposure to the carbon emissions market with a new securitised product.

GlobalView technology to support ConfirmHub

US-based GlobalView Software has been chosen as the exclusive technology provider to ConfirmHub, a joint venture by brokers Icap, Amerex Energy and Prebon Energy. ConfirmHub is a post-execution, straight-through processing (STP) trade-confirmation…

Barclays Capital in first Leba carbon index trade

Barclays Capital has completed the first financial carbon trade using the new Leba Carbon Index for "a significant volume" of EU emissions allowances.

Peaking patterns

Weather is increasingly affecting power market dynamics, with prices as variableas the temperatures. But the volatility has spawned a growing variety of methodsofmanaging peak load demand. By Catherine Lacoursiere

Point Carbon buys Natsource Scandinavia’s analysis unit

Carbon emissions consultancy Point Carbon has bought Natsource-Tullett Scandinavia, Europe’s largest power and gas analysis firm, but will disband Natsource’s Oslo brokerage operations. The move adds power and natural gas market analysis to Point Carbon…

Icap-Hyde hires Toyne to head tanker FFA broking

Icap-Hyde, a London-based joint forward freight and shipping derivatives-broking venture between broker Icap and shipping broker JE Hyde, has added to its team. Simon Toyne has joined as director of tanker forward freight agreements (FFAs), responsible…

Polish power exchange chooses OMX software for trading and clearing

In a move to develop its electricity spot and derivatives market, the Polish Power Exchange (PolPX) will use the Condico system from Stockholm-based OMX, the owner and operator of the Swedish stock exchange.

IPE-ECX carbon futures contract faces fierce competition

London’s International Petroleum Exchange (IPE) and the Amsterdam-based European Climate Exchange (ECX) are set to offer CO 2 futures contracts under the EU Emissions Trading Scheme (ETS).

EEX set to compete with EXAA in Austrian spot power market

Austrian energy exchange EXAA will soon have competition for spot trading of physical power in its home market. From April 1, Austrian companies will be able to trade electricity for delivery to most of Austria directly on Germany's European Energy…

Turbulent times

The new Renewable Sources Act obliges German utility companies to buy all the wind power generated in the country on any one day. And it is adding a new volatility to the German power market. By Stella Farrington

Germany’s closed shop

Despite six years of liberalisation, Germany’s gas market is still virtually closed to outside competition. Writing from Germany, Stella Farrington looks at whether new regulation is finally about to bring change

Midwest power market to start on April 1

The US energy market regulator yesterday gave the Midwest Independent System Operator (Miso) the go-ahead to launch its wholesale energy market on April 1, after several delays.

Powernext selects Trayport for emissions trading, awaits CO 2 allocation

French electricity exchange Powernext will use software supplier Trayport’s Global Vision platform for CO 2 emissions trading, but is still waiting to start the spot emissions market it first announced in January.

Hanging on at the top

This year’s User Choice Awards demonstrate that quality counts. In a fast-changing market, the top vendors and packages have managed to stay ahead of the pack. But the winners cannot rest easy. With IT budgets deflated, it’s a competitive market, and…

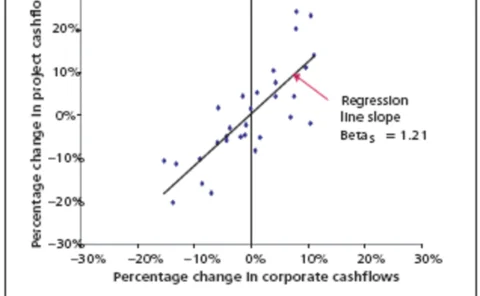

The sum of its parts

One can view a corporation’s individual projects as a portfolio of options – useful risk management tools to be used if their risk/return ratios are better than that of the firm as a whole. But how to work out the equity cost of capital at this…