Foreign exchange

Greenpeace protest at IPE fuels debate on emissions trading

Greenpeace’s invasion of London’s International Petroleum Exchange (IPE) on Wednesday was intended to draw attention to the environmental impact of ‘big oil’ on the day the Kyoto Protocol came into force. However, by attacking an exchange that is about…

UK broker trade group to launch emissions indexes

The London Energy Brokers’ Association (Leba) will launch a series of ‘green indices’, which it says are designed as independent benchmarks for the European emissions market. The association will release both spot and forward indexes, with the aim of…

A good bet for 2005

2005 is forecast to be a tough year for many hedge funds, but the saturation of some of their traditional markets could prove a boon to the energy sector, finds Stella Farrington

IPE launches UK electricity baseload index

The International Petroleum Exchange (IPE) has launched a UK electricity baseload index in response, it said, to industry demand for a viable index on which to base physical deals. The first pricing period will be for the March 2005 contract.

BofA reports improved commodity-trading income

North Carolina-based Bank of America yesterday reported revenues of $45 million from commodity trading in its full-year 2004 results, up from a loss of $45 million for 2003. The investment bank's recovery came amid strong overall financial results for…

Mirant to pay $460m to settle California energy crisis claims

Bankrupt Atlanta-based energy marketer Mirant will pay $460 million to California power utilities and public agencies to resolve claims related to the state’s energy crisis in 2000 and 2001. The California utilities and agencies in the settlement were…

Risk Management Inc signs four utility clients

Risk Management Inc (RMI), a Chicago-based energy consultancy and brokerage, has signed up four new utility customers for its energy risk management and hedging services. The City of Glendale Water & Power and Pasadena Water & Power, both in California,…

Amerex gains sulpur dioxide trading privileges on CCX

Houston-based broker Amerex Energy has obtained SO 2 trading privileges on the Chicago Climate Exchange (CCX), an emissions-trading marketplace. Amerex can now broker futures contracts in trading increments of 25-tonne SO2 allowances. The standard over…

European partnership plans emissions trading market

Pan-European exchange operator Euronext plans to launch an emissions trading market in March 2005 in conjunction with French electricity exchange Powernext and French state-owned investment bank Caisse des Dépôts et Consignations.

Caught short

Given the difficulty China Aviation Oil is having closing its remaining illiquid positions, its derivative trading losses may be greater than first thought. James Ockenden and Stella Farrington report

Sovereign solutions

As we saw last month, most governments prefer stabilisation funds over hedging to protect against oil price risks. But multilateral institutions such as the World Bank advise otherwise. By Maria Kielmas

GE Commercial Finance Energy Financial Services to arrange and underwrite debt

Energy companies now have another option when it comes to choosing who will help finance a project or arrange a debt placement for them. GE Commercial Finance Energy Financial Services is to broaden its role as an equity and debt investor to include…

European Commission blocks acquisition of Gás de Portugal

The European Commission has blocked the joint acquisition of Gás de Portugal (GDP), the country’s incumbent gas company, by Energias de Portugal (EDP) and Italian energy company Eni, because it would impede competition.

China Aviation gets six week breather

China Aviation Oil (CAOSCO) has been granted a six week extension by the High Court of Singapore to its deadline to submit its scheme of arrangement restructuring plan, due today. The new deadline is January 21, 2005.

Duke to settle California power crisis allegations

US power company Duke Energy and some of its subsidiaries will pay $207.5 million to settle allegations that it acted improperly during the California power crisis in 2000/2001. The US Federal Energy Regulatory Commission (Ferc) approved the settlement…

AsiaRisk Awards

Here we feature two outstanding winners from our sister publication AsiaRisk’s Annual Awards, published in October. Thanks largely to Macquarie Bank, alternative investments are gaining a real foothold in Australia, while Westpac has been instumental in…

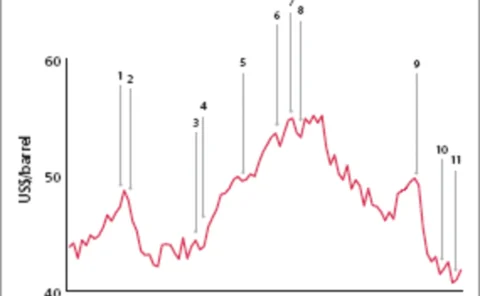

Merrill Lynch sees oil staying high in 2005

The oil price, which has roughly doubled since the start of 2000, and risen by over 60% this year, is likely to remain historically high in 2005 due to a structural shift in the market, said Robin Batchelor, co-fund manager of Merrill Lynch’s World…

Weather wisdom with risk management

Mark Tawney from Swiss Re spells out the implications of not keeping an eye to the weather

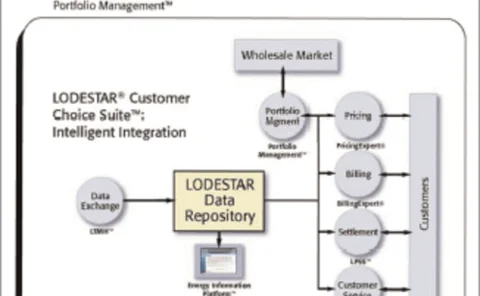

Strengthen your portfolio performance

Reduce costs and minimise exposure withLODESTAR® Portfolio ManagementTM

London to be world carbon market centre

The UK’s early move into carbon emissions trading means London is now well placed to become a world centre for the emerging carbon market, UK Environment Minister Elliot Morley said Wednesday.

Saudi to up oil output to 12.5 million b/d

Saudi Arabia’s total oil production capacity is now at 11 million barrels a day (b/d) and plans are in place to increase it to 12.5 million b/d, Saudi Arabia’s Minister of Petroleum and Mineral Resources, Mr Ali Al-Naimi, said Monday.

CFTC allows US firms to trade on EEX

The US Commodity Futures Trading Commission has permitted US companies to trade power derivatives on the European Energy Exchange with immediate effect, EEX said Thursday.

Energy users demand trading oversight

The debate continues over whether speculative traders are distorting energy prices, following a letter sent by the Industrial Energy Consumers of America (IECA) to Congress last week. “Energy markets have changed drastically, and regulatory oversight,…

EEX to launch spot carbon contract

German-based electronic exchange European Energy Exchange (EEX) is to launch a spot contract to trade EU carbon emissions allowances in January 2005.