Foreign exchange

European emissions trading on track

The EU emissions trading scheme is on track to start in January 2005, with the European Commission having approved 16 out of 25 of the EU member National Allocation Plans that lie at the heart of the scheme, said Peter Vis, acting head of the Industrial…

Energy traders urged to pre-register for risk poll

Energy traders wishing to take part in Energy Risk/Risk’s 12th annual Commodity Rankings can now pre-register to vote to avoid missing important voter updates and deadlines in the magazines’ annual survey of the energy business.

California ISO gets tough on generators with new software

Power suppliers in California will face financial penalties if they deviate from pre-specified generation levels as of December 1. This is one of the main changes brought in by a new software system implemented by the California independent system…

Gazprom completes Rosneft merger, appoints head of new company

Sergei Bogdanchikov will retain his job as chief executive of Gazpromneft, the new company formed yesterday by the merger of Russian gas monopoly Gazprom and state oil company Rosneft. He was previously head of Rosneft.

Ten years at the top

A decade of commodity rankings has seen many players come and go – but as James Ockenden finds, the top two investment banks, Morgan Stanley and Goldman Sachs, have been solid all the way

EEX launches daily CO 2 price index

The European Energy Exchange (EEX) will from today publish a reference price for the trade in CO 2 certificates throughout Europe on each trading day. The move comes in preparation for the European Union emissions trading scheme (ETS), which will start…

US Midwest a step closer to wholesale power market

After several delays, the Midwest wholesale power market might now be on course for launch next March. The Midwest independent transmission system operator (Miso) today announced the creation of three financial hubs for the wholesale trading of…

A legal rollercoaster

US-based Polygon wants to see a better restructuring deal for British Energy’sshareholders. But the hedge fund faces a struggle to prevent the UK nuclear powergenerator from delisting. Joe Marsh reports

Allegheny Energy makes $152m from share sale

Pennsylvania-based Allegheny Energy has sold 10 million shares for $151.5 million to four institutional investors. The company intends to use the proceeds to reduce debt as part of its plan to repay $1.5 billion in debt by the end of 2005.

Pemex signs up to OpenLink’s Endur

Mexican state-owned petroleum company Petroleos Mexicanos (Pemex) has licensed OpenLink’s Endur energy trading and risk management system for its natural gas division.

Pemex signs for OpenLink’s Endur

Mexican state-owned petroleum company Petroleos Mexicanos (Pemex) has licensed OpenLink’s Endur energy trading and risk management system for its natural gas division.

Williams to retain energy trading business

Oklahoma-based energy company Williams said late last week it will continue operating its energy trading business, having failed to sell the rest of the wholesale power division. The company is focusing on long-term supply contracts and doing only a very…

Energy users to join Italian power exchange by 2005

Energy consumers are now expected to start trading on the Italian wholesale power exchange by the start of 2005, said Paolo Ghislandi, secretary-general of Aiget, the Milan-based Italian association of energy traders and suppliers.

Texan retail therapy

Certain large Texas electricity suppliers want to reduce debt following significantlosses. So their retail divisions are trying harder than ever to squeeze moreprofits from a fiercely competitive retail market. JoeMarsh reports

Good neighbours

Spanish and Portuguese energy market participants are hopeful that a joint Spanish-Portuguesepower market is imminent. But how competitive will the Portuguese side of themarket be? Joe Marsh reports

A fresh landscape

Prebon Energy’s Kevin McDermott says that much has changed in the electricitybroking world post-Enron. And it’s all for the better. By Paul Lyon

The matrix

Abstract: Portfolio-wide risk management requires a model that accounts correctlyfor the volatility of, and the correlations between electricity forward products.In this paper Kjersti Aas and KjetilK°aresen discuss a joint model for electricityforward…

Teething troubles

Following decades of cloistered state control and the exit of a number of largeUS players, the Australian power market is going through a period of hiccups. Paul Lyon reports on the outlook for the country’s electricity sector

Covering all the bases

Abstract: Many articles have discussed constructing models for either spot orforward prices. Yet none cover the whole process of constructing a joint modelfor both. Here, Andreas Huber and MonikaKrca develop a multi-factor model thatcaptures both the…

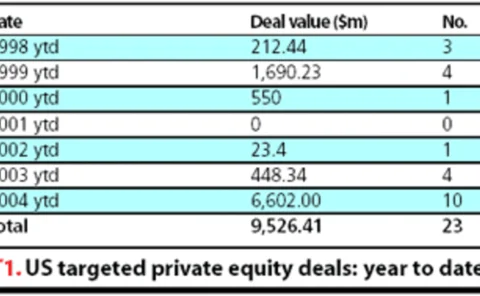

Buyouts are back

Private equity funds have been making bold inroads into energy markets in the past year – the number of deals has doubled since 2003, and the acquisitions are getting bigger. CatherineLacoursiere reports

Dominion agrees price for USGen assets

Virginia-based energy producer Dominion looks set to acquire three power plants from Maryland-based USGen New England for $656 million. However, an auction process is due to take place before the deal closes to ensure no other bidders are willing to top…

SG sets up $100m credit facility for Kazakh energy company

SG Corporate & Investment Banking (SGCIB) said earlier this week that it has arranged an unsecured 66-month $100 million loan and hedging facility for Canada-based PetroKazakhstan Kumkol Resources (PKKR). PKKR is a subsidiary of PetroKazakhstan Inc, an…

Merrill Lynch snaps up Entergy-Koch Trading

Investment bank Merrill Lynch is set to acquire the energy trading businesses of Entergy-Koch Trading (EKT), a joint venture between New Orleans-based Entergy Corp and Koch Industries in Kansas. Energy Risk reported in June that the bank was a top…

ABN continues BNP raid

ABN Amro has hired five senior energy derivatives executives, two of whom join from BNP Paribas. The move comes just three months after the Dutch bank poached Wayne Harburn and Vincent Chevance from French rival BNP. The pair now serve as global head of…