Energy

National Bank of Canada reunites heavy hitters for energy push

National Bank of Canada (NBC) has expanded its energy derivatives team in Calgary with three new managing directors, with the aim of attracting more utility and energy-consumer customers.

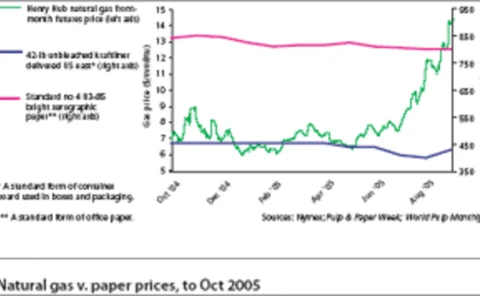

Papering over the cracks

High energy prices are forcing pulp-and-paper makers to take action against falling profits, yet most companies are still shying away from energy price hedging. But that situation may be slowly changing. Joe Marsh reports

UKPX to launch carbon spot contract on Climex

London-based energy exchange UKPX will co-operate with Dutch emissions exchange New Values to launch a UKPX spot contract for carbon emissions certificates.

Standard Bank invests in biodiesel

South Africa-based Standard Bank has entered the biodiesel sector with an $8 million equity investment in Biodiesel Energy Trading (BET).

BP Singapore chooses Oilspace’s Oilwatch

Global energy major BP’s Singapore division is implementing Oilspace’s Oilwatch, a web-based portal for real-time, aggregated energy prices, news and analytics. BP Singapore is rolling out the service across the Asia-Pacific region.

HSBC is first major bank to go ‘carbon neutral’.

HSBC has reduced its net CO2 emissions to zero by reducing energy use, buying ‘green’ electricity and then offsetting the remaining CO2 emissions by investing in carbon projects.

Tullett Prebon forms wet freight derivatives venture

Tullett Prebon, part of Collins Stewart Tullett, is the latest interdealer broker to partner with a shipping broker to offer forward freight agreements (FFAs). It has started a venture with three international shipping brokers with the aim of…

Decisions, decisions

Where next for the price of a barrel of oil? It’s an important question for producers and consumers, for whom managing oil price risk has never been more crucial. Oliver Holtaway finds that the answer to that question is not necessarily ‘up’.

Marginal improvements

Despite reduced production in the wake of hurricane Katrina, no new US refineries are in the pipeline. Instead, refiners are operating at full tilt as they come under pressure to expand capacity. By Catherine Lacoursiere

Don’t blame Opec

As well as urging Opec to open up international access to its reserves, politicians in large oil-consuming nations should be encouraging investment in new refinery capacity, writes David Hufton

The cream of the crop

The employment market for oil and energy traders has been from one extreme to the other in a short space of time – especially in oil. Andy Webb looks at where the recruitment market is headed next

The cream of the crop

The employment market for oil and energy traders has been from one extreme to the other in a short space of time – especially in oil. Andy Webb looks at where the recruitment market is headed next

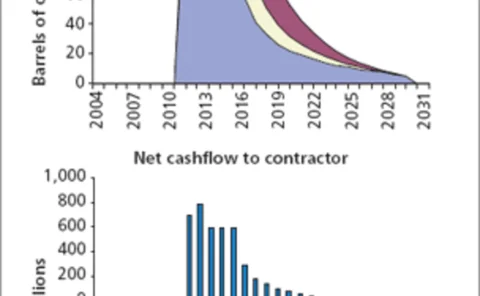

The risks of E&P

After two years of soaring oil prices, oil majors are still building low oil-price forecasts into future investment plans. Is this sound risk management, or are they being too risk averse? By Stella Farrington

EEX to launch carbon derivatives contract

The European Energy Exchange (EEX) plans to launch a futures contract for carbon emissions allowances in October, pending regulatory approval.

Amerex's Prokop joins Energy Data Hub board

The Energy Data Hub has appointed Mike Prokop, senior vice president at energy brokerage Amerex, to its board of directors.

Risk management key for freight, says Baltic Exchange chief

Baltic Exchange chief executive Jeremy Penn has stressed the importance of risk management at a forum of freight derivatives brokers and traders this week.

LCH.Clearnet launches OTC clearing for freight derivatives

LCH.Clearnet has launched an OTC clearing service for the forward freight agreements (FFAs).

Nymex pit opens in London

Some 76 individuals and 12 companies showed up to trade Brent and gas oil futures on the first day of trade at the New York Mercantile Exchange’s London trading floor today (Monday).

Indian exchange to list IPE Brent crude futures

Oil traders in India will from September 15 be able to trade rupee-denominated Brent crude futures, settled monthly by reference to the benchmark IPE Brent crude futures contract.

TFS starts brokering CDM and JI emissions credits

TFS, a New York-based inter-dealer broker, has started brokering emissions credits under the Kyoto Protocol’s Clean Development Mechanism (CDM) and Joint Implementation (JI) schemes.

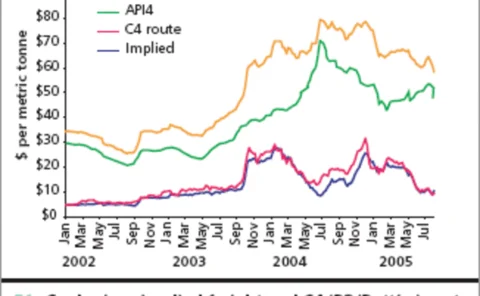

Trading routes open

The coal and dry bulk shipping markets are tightly intertwined and the strong influence of each on the other provides some interesting arbitrage opportunities, which are starting to draw wider attention, writes Barry Parker

King coal still fired up

Despite the soaring cost of emissions reduction credits, the EU emissions trading scheme has yet to dampen utilities’ demand for coal. But, finds Oliver Holtaway, it may affect their long-term investment decisions