Energy

No sign of a slowdown

The fundamental outlook for coal looks price supportive for some years to come, but with other fuel prices sky high, coal looks set to retain its market share of electricity generation this decade. Stella Farrington reports

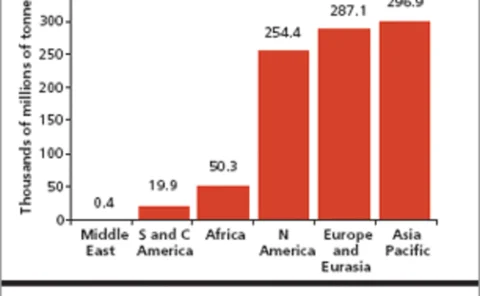

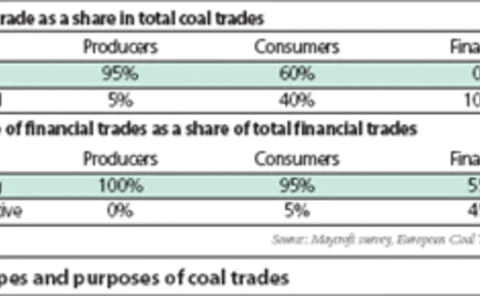

Coal facing changes

Coal derivatives trading is gaining popularity among coal consumers, producers and financial institutions in Europe, according to a recent survey of market players. Cyriel de Jong and Kasper Walet discuss the study’s results

James Tweed and Dave Wardley

At the end of last year, JAMES TWEED and DAVE WARDLEY launched the first hedge fund dedicated solely to trading freight. Stella Farrington meets them

A disciplined approach

E&P companies tend not to strategically hedge in a rising market. But there are good reasons for them to do so, and some are sticking to their hedging strategies, despite suffering losses on their derivatives contracts. By Joe Marsh

Icap to acquire United Fuels International

Interdealer broker Icap is to acquire the majority of the assets of United Fuels International, a leading US-based energy broking business with 2004 turnover of $24 million.

GFI buys Starsupply

Interdealer broker GFI Group has agreed to acquire Starsupply Petroleum, a leading broker of oil products and related derivative and option contracts.

TFS brokers first Nymex emissions contract

Global broker Tradition Financial Services (TFS) has brokered the first transaction on the New York Mercantile Exchange (Nymex) emissions futures contract.

Evolution expands US west coast emissions brokerage ops

Energy broker Evolution Markets has expanded its environmental market operations for the western US with the hire of Laura Meadors, an expert in environmental market design and analysis. She is based in the San Francisco office, which opened in February…

Baiting the hook

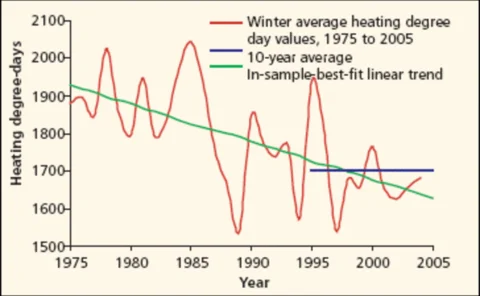

End-users such as utilities and industrial companies are not showing the same keenness as hedge funds for trading weather derivatives, despite the efforts of banks, dealers and brokers to lure them in. By Joe Marsh

Growing up fast

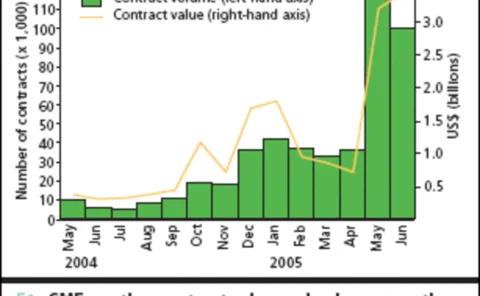

Weather trading is seeing strong volume growth in the US, largely due to the influx of hedge funds into the market. Why such a big increase in interest, and what sort of strategies are the funds adopting? By Joe Marsh

Pricing the weather

Pricing weather derivatives is different from valuing other derivatives contracts – actuarial methods play a greater role. Steve Jewson looks at the varied approaches available

Strength in numbers

Weather derivatives seem to have a bright future: the market is enjoying record liquidity levels as new players, trading ever more diverse products, flood into the market. Oliver Holtaway reports

Editor

"Although end-users seem slow to enter the weather space, hedge funds already see it as a hotspot"

BNP Paribas strengthens energy derivatives team

French bank BNP Paribas has strengthened its commodity derivatives team in New York, London and Singapore, particularly on the energy side.

Nymex, Icap to launch gas, crude oil daily settlement derivatives

The New York Mercantile Exchange (Nymex) and inter-dealer broker Icap are to launch an electronic market in same-day over-the-counter (OTC) options on prompt-month settlement prices for crude oil and natural gas. Starting on Monday (July 18), the…

Some brokers taking wrong approach to freight, says senior broker

Inter-dealer brokers could be taking the wrong approach by entering the freight derivatives market through joint ventures with physical shipping brokers rather than directly broking physical freight, says a senior energy broker.

Making a connection

Addressing both sophisticated multi-asset trading and physical asset optimisation – while complying with stringent new regulation – are challenges few software firms claim to have the entire solution to. Oliver Holtaway reports

A growing concern

Despite high natural gas prices, Canadian fertiliser maker Agrium has been posting strong profits, while some rivals have struggled. The company’s risk-management strategy has been a significant factor in its success. By Joe Marsh

Banking on tankers

Logical Information Machines’ Sandy Fielden provides an analyst’s perspective of new opportunities for freight risk management with a specific focus on the crude (dirty) tanker trade from the Caribbean to the US Gulf

Austrian Energy Exchange launches emissions trading

The Austrian Energy Exchange, EXAA, joined the ranks of European exchanges trading emissions yesterday with its first spot auction of European Union CO 2 allowances (EUAs).

Swiss Re to launch emissions desk

Global reinsurance firm Swiss Re will set up an emissions desk in within a month, says Chris Walker, New York-based managing director of the greenhouse gas risk solutions team at the company.

ECX and Powernext team up on carbon trading

French electricity exchange Powernext and the Amsterdam-based European Climate Exchange (ECX) have agreed to jointly offer carbon futures and spot contracts. The partnership is complimentary, because ECX lists a futures contract and Powernext offers a CO…

Nymex to launch emissions futures on ClearPort

The New York Mercantile Exchange (Nymex) is to introduce sulphur dioxide (SO 2 ) and nitrogen oxide (NOx) futures contracts on Nymex ClearPort on June 19 for the June 20 trading session, the exchange said today.

GFI launches oil and gas broking in London

Inter-dealer broker GFI has opened a London desk to broke crude and gas oil derivatives, including options, the company announced yesterday.