Energy transition

Skylar’s Perkins sees potential for volatility in US natural gas

Bill Perkins believes rising demand and reduced risk warehousing will create opportunities for natural gas traders: video

Gas market participants rail against mandatory bundling

The Agency for the Cooperation of Energy Regulators hopes a new network code on capacity allocation will promote a more efficient and open gas market in Europe. But market participants warn the principle of mandatory bundling embedded in the code could…

Cutting edge: Minimising risk when hedging crude oil options

In this paper, Christian-Oliver Ewald, Roy Nawar and Tak Kuen Siu study the performance of locally risk-minimising hedging strategies in the context of futures and options written on crude oil. In contradiction to prior research, the authors show it is…

Energy Risk USA: Energy market participants struggle with reporting

Dodd-Frank rules on swap data reporting creating a headache for energy market participants

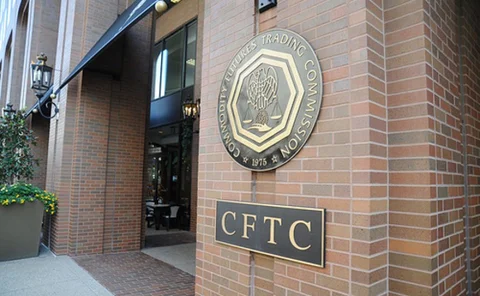

Energy Risk USA: New CFTC position limits due in June, O'Malia says

CFTC will soon unveil revised rule on commodity position limits after a court rejected its previous effort, says O'Malia

Mandatory bundling will damage trading in European gas, say firms

Capacity Allocation Mechanism network code could restrict gas trade at physical hubs and interconnection points

Turning points: Torsten Amelung, Statkraft

As the proportion of power generated from renewables goes up, the business model of traditional utilities is increasingly under threat, says Torsten Amelung, Statkraft’s senior vice-president of trading, origination and business development. He speaks to…

Citi head of LNG origination departs

Rodney Malcolm replaced by Mike Curry, head of North American electricity sales

Applied risk management series: Venturing beyond VAR

In this article, Carlos Blanco and José Ramón Aragonés review the historical simulation methodology used to estimate value-at-risk and expected tail loss, while including adjustments to traditional assumptions that can help improve risk forecasts for…

Renewables push proves challenging for Germany

An abundance of renewables capacity in Germany has caused extreme price movements, pushing volatility and trading activity increasingly towards short-term markets – forcing physical and financial market players to rethink their approach to electricity…

Evolution Markets opens Singapore coal desk

Hiemstra to lead new Asian office; EDF Trading hires power traders; Barclays loses head of commodity research; Vitol enters ag commodities; Davies leaves Trayport

Renewable PPAs find favour among corporates

A small but growing number of companies are using renewable energy power purchase agreements to lock in cheap forward electricity prices. But it may take some time before going green becomes a sound risk management strategy for all firms, writes…

Volatility set to return to US natural gas market, warn analysts

Booming shale production has brought US natural gas prices to 10-year lows and dampened market volatility, making life difficult for traders. But with rising demand from industrial users, power generators and exporters of liquefied natural gas,…

Ferc ruling raises hope of greater regulatory certainty

The US Federal Energy Regulatory Authority has seen its authority sapped by squabbles over turf – most recently, losing a court battle over an attempt to fine Brian Hunter, a former natural gas trader at imploded hedge fund Amaranth Advisors. Could there…

Ferc won’t appeal Hunter ruling, says Wellinghoff

Ferc chairman says agency won’t appeal ruling against it, but will seek to persuade Congress to change the law

South Korean power outage fears loom high on agenda

A lack of investment in generation capacity and safety-related nuclear shutdowns left South Korea facing warnings of severe power shortages over the past year. That is putting investment in energy infrastructure and security of supply high on the…

Evolution Markets creates Singapore physical coal desk

Evolution Markets is latest firm to ramp up efforts brokering coal cargoes in Asia

Lack of regulatory clarity hampering PRA code of conduct

Price reporting agencies expect to release updated industry code of conduct shortly, but warn regulatory uncertainty could delay their efforts