Energy transition

CFTC may alter stance on physical gas deals

Agency expected to respond to natural gas industry fears about Dodd-Frank swap definition

CFTC offers last-minute Dodd-Frank relief

Agency eases compliance burden for commodity and energy firms

Basis trading to emerge in European gas

Natural gas basis swaps increasingly used in over-the-counter market and could eventually trade on exchanges

As banks retreat who will dominate US power trading?

Squeezed by the Volcker rule and Basel III, banks have been pulling back from US electricity markets. Who will become the new power-trading champions, and should hedgers be worried about liquidity? Alexander Osipovich reports

QE3: The next big driver for oil prices?

Quantitative easing has been touted as the next big driver of oil prices. However, analysing and predicting the market behaviour it actually generates is difficult. Jay Maroo talks to experts about what they expect from QE and how this might impact risk…

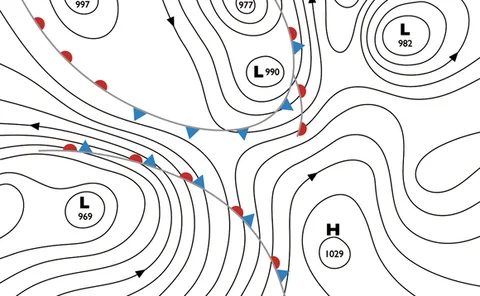

Energy firms tune in to weather forecasts

As weather forecasting becomes more accurate, utilities and banks are increasingly turning to it – not only to predict power and gas demand – but also to find arbitrage opportunities, writes Gillian Carr

Is risk modelling keeping up with the energy market?

Lean times in energy and commodity derivatives trading have caused a cutback in the amount of time and resources spent on energy risk modelling – a worrying trend that could leave firms unprepared for future market challenges, argue some experts. Mark…

Energy Risk Europe: Indexes won’t be included in MAD, say panellists

Energy indexes may not be included in EU market abuse rules, but remain likely to be hit by further scrutiny

Energy Risk Europe 2012: Oil price “much lower” in 10 years – Credit Suisse

A slowdown in Chinese oil demand growth coupled with increasing supply will mean oil prices will be much lower in 10 years, forecasts Ric Deverell, head of commodities research at Credit Suisse

Energy Risk Europe 2012: EU power market integration faces next set of hurdles

The next stages of creating an integrated European electricity market should focus on the intra-day market, direct current cables and preparing trading strategies post-2014, say panellists at Energy Risk Europe

Energy Risk Europe: EC official questions energy industry estimates of clearing costs

Recent industry estimates of the cost of clearing are met with scepticism during a roundtable discussion at Energy Risk Europe

Energy Risk Europe 2012: Speculation tending to push oil prices lower

In recent years, speculation in oil markets has been associated with price falls more than price rises, but speculative activity is transforming the oil market into an asset play subject to new macroeconomic influences, says Leo Drollas, chief economist…

Energy Risk's Asia awards 2012

Energy Risk's annual Asia awards, now in their fifth year, honour innovation and achievement in Asian energy derivatives markets. A ceremony for the winners was held in Singapore on September 26 and here we reveal the winners and why they triumphed