Feature

Higher or lower?

Kevin Foster looks at how credit rating agencies assign a rating to companies in the energy sector and what kind of factors are taken into account

Demystifying credit risk

Satyan Malhotra, Fred Cohen and Rafael Cavestany formulate an analysis for the measurement of credit risk in the energy industry

A whole new ball game

Enron’s bankruptcy has changed the playing field for credit risk in the energy sector. Kevin Foster reports on the renewed significance of assessing credit quality

Heeding the warning signs

Following the Enron bankruptcy, the use of bond-spread analysis has become increasingly important. Mark Williams looks at how firms can benefit from it

Proper procedures

Rajiv Arora examines the processes necessary for effectively measuring, managing and hedging credit risks

Finding a solution to the credit problem

Peter Stockman of Accenture outlines what energy companies can do, internally, to manage credit more effectively and addresses the potential benefits of participating in a multilateral netting solution for the industry

Discovering new frontiers

Joerg Engels and Volker Linde report on the changes Germany’s deregulated energy market will have to make as a result of the country’s banking act

Europe’s patchwork path to liberalisation

In the three years since the European Union’s Electricity Directive came into effect much has changed in Europe’s energy industry, but the industry is still far from achieving the goal of a pan-European energy market, as Matt Horsbrugh discovers

Utilities renegotiate to survive

For the past 10 years, Argentina’s privatised utilities have been icons of successful energy sector reform. But with the country’s deepening crisis, they face increased difficulties. What can investors do to mitigate such risks, asks Maria Kielmas

Mixed signals from the east

Flaws in Poland’s electricity regime have crippled Warsaw’s two-year-old power exchange. But Slovenia’s power exchange is faring rather better. Peter Joy reports

A cure for Enron flu

Brett Humphreys discusses recent events in the energy sector and the role risk managers can play in improving the industry

Worth waiting for?

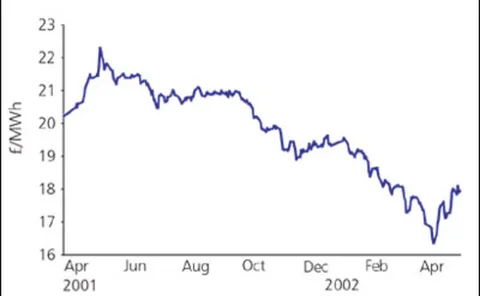

Just over a year on from the delayed launch of the UK’s new electricity trading arrangements, prices have dropped to new lows. But just how low can generators go, asks Joel Hanley

Storing up the gains?

Natural gas prices are climbing again, and energy companies are reacting by putting in place new hedges, as Kevin Foster discovers

Keeping score

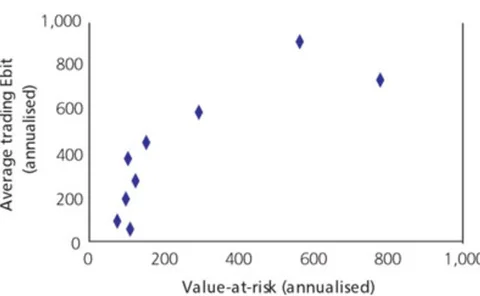

This month Brett Humphreys and Zach Jonasson show how energy trading firms can compare performance using publicly available corporate information

Banks take shelter in derivatives

While some banks have found the weather derivatives market a non-starter, others are doing deals worth more than $100 million. Eurof Thomas reports

A smooth handover?

A change in the way weekly natural gas storage figures are reported is proceeding fairly smoothly – but it may still cause price swings, as Kevin Foster discovers

Green scheme down under

Robin Lancaster reports on Australia’s government-mandated renewable energy certificates market, which – after a slow start – is expected to pick up fast

Covering the threat

Since September 11, energy companies have had to re-assess the threat of terrorist attack. Despite the insurance industry introducing new terms and products, some companies remain unprotected, as Joel Hanley discovers

Building blocks for complex probability distributions

Brett Humphreys demonstrates how to construct more accurate return distributions and use them to price options

Counterparty concerns

Following the California crisis and the fall of Enron, energy firms are finally paying more attention to credit risk. Here Fred Cohen, Satyan Malhotra and Rafael Cavestany present some overarching issues senior management must address in implementing an…

Stand-off over hub plans

German firms Ruhrgas and BEB Erdgas & Erdöl and Norway’s Statoil say they want to work with Gasunie on developing the northwest European natural gas trading hub. Gasunie is making similar noises. So why the separate plans, asks Peter Joy

Pause for thought?

Electricity deregulation in Ontario promises to avoid the price hikes and power shortages seen in some markets. So why are end-users unhappy? Kevin Foster reports