Feature

A look in the rear view

Utilities and regulators often disagree over the purpose of energy price risk management. Manitoba Hydro's recent experience with backtesting its hedging strategy is a case in point

Any fool can do it

Some quant techniques are easier than you might think. In the second part of his set of ten tips and tricks for aspiring energy quants, Neil Palmer shows why..

Pioneers

Today's vibrant and dynamic energy markets are a far cry from the illiquid, opaque trading that existed 25 years ago, yet they owe much to the visionary pioneers who started those early markets. Here, Energy Risk honours some of those early pioneers, as…

2005 in review

The energy markets were a dynamic place to be in 2005, with high volatility and an explosion of new players hitting the scene. Inevitably, though, it wasn't all smooth sailing. Energy Risk looks back over the highs and lows of 2005, from the launch of…

To build or not to build

Europe needs more power. But a lack of clear pricing signals and the unknown impact of new environmental legislation is making risk forecasting difficult, and could hinder new plant construction

Industrial users - Taming the flame

Industrial users of natural gas in North America are investing in physical hedges while gradually returning to the financial markets

Europe - An uncertain future

European natural gas demand is expected to rise in the next three decades. But, as Anouk Honore finds, the overall picture is not easy to predict, and depends on what happens in individual countries - particularly Italy and Spain

Prepay agreements - The ten-year pitch

Standard & Poor's recently passed the $1 billion mark in terms of natural gas prepayment deals it has rated since 2003. Joe Marsh looks at how these work and why municipal utilities might want to consider them

Coal turns a corner

Asian coal-trading is still proving a tough nut to crack. But the underlying market is developing, and a growing need for better risk management suggests it is only a matter of time before a paper market takes off

Counting on coal

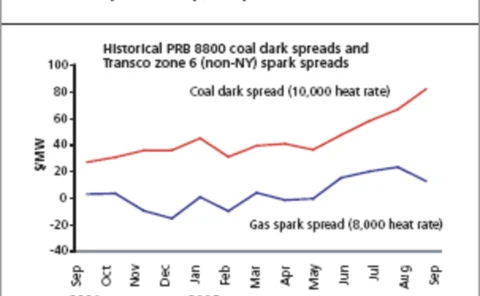

NRG Energy's move to buy Texas Genco seems a wise one for a company with strong dark-spread exposure, but it has its risks, despite the target company being backed by an active hedging programme. Joe Marsh reports

Papering over the cracks

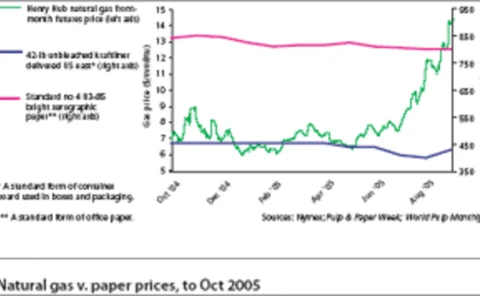

High energy prices are forcing pulp-and-paper makers to take action against falling profits, yet most companies are still shying away from energy price hedging. But that situation may be slowly changing. Joe Marsh reports