Electricity

Trayport alliance to offer streamlined trading

Trayport, the software company behind trading platform GlobalVision, has entered into an alliance with Excelergy Corporation to offer a flexible package combining Excelergy’s trading and retail solutions with Trayport’s front-end energy trading platform.

The fuel of the future?

Could coal as a source of electricity generation be back on the monitors of many US utilities? Logical Information Machines’ Sandy Fielden looks at the reasons behind higher coal prices in the country and considers whether coal can really compete in the…

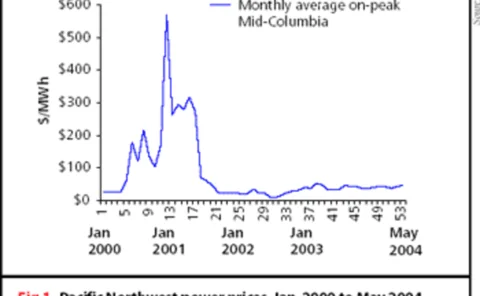

Northwest in excess

The Bonneville Power Administration’s power buyback scheme to tackle electricity shortages in the US Pacific Northwest in 2001 has worked rather too well. The region was left with bankrupt aluminium producers and a surplus of power that is not proving…

IPE puts back relaunch of power futures

London’s International Petroleum Exchange (IPE) has put back its relaunch date for UK electricity futures – it will now start listing them by the end of September. The exchange had originally intended to launch the contracts around the end of this month.

TXU and CSFB form energy trading company

Dallas-based TXU has entered into a joint partnership with Credit Suisse First Boston (CSFB) to create an independent entity to market and trade power, natural gas and other energy-related commodities in North America.

FOA close to releasing UK power trading guidelines

The UK Futures and Options Association (FOA) says it is close to releasing final drafts of guidelines on various areas of the UK power market. The problem areas identified by the FOA's Power Trading Forum (PTF) are reference pricing, credit risk…

Nymex introduces trading in western electricity futures

The New York Mercantile Exchange (Nymex) is to introduce trading in four western electricity futures contracts, based on Dow Jones Electricity Indexes, on its ClearPort electronic platform beginning with the June 4 trading session, which starts at 3:15…

FEA unveils updated power exposure solution

Financial Engineering Associates (FEA), the Berkeley-based subsidiary of technology company Barra, today unveiled its @Energy/Power Generation 2.0 solution for power plant optimisation, risk exposure assessment and valuation

GL Trade sets up gateway to EEX and signs up Calyon Financial

GL Trade, a Paris-based provider of financial data, clearing, trading and settlement soulutions, has set up a gateway to the Leipzig-based European Energy Exchange. Global derivatives broker Calyon Financial, formerly Carr Futures, has taken up this…

European power trading on the up, says Prospex report

European electricity trading volumes increased in 2003, with Germany seeing the biggest volumes, overtaking the Nordic region for the first time. So says a new report from London-based Prospex Research, European Power Trading 2004 .

The waiting game

The Italian power market has finally opened to competition, but how long willenergy users have to wait until they can trade on the new electricity exchange? Joe Marsh reports

A history lesson

Abstract: The size of bid/ask spreads in electricity options has both valuationand credit implications. Here, Ted Kury of The Energy Authority shows how toderive theoretical spreads using historical option price data so they can beused as liquidity…

Thomas Brooks

Thomas Brooks, president of Constellation Power Source, outlines his contributionto the Constellation Group’s success. By Joe Marsh

New clearing system for Nordic market

Nord Pool Clearing, the clearing organization for the Nordic power exchange Nord Pool, has launched a new clearing system for the electricity derivative market. OM Technology is the system provider.

Golden procurement

The new energy procurement rules are designed to boost reliability and injectsome confidence back in to California’s ailing power market. But not allagree that they will keep California’s lights on. By CatherineLacoursière

House of the year – electricity

Winner: EDF Trading

Broker of the year

Winner: Spectron

Trading techniques

Abstract: A majority of merchant power plants built during the last few years in the US are combined-cycle units fired by natural gas. This article discusses asset-backed trading strategies for a merchant single-block power plant, showing how unit…

FirstEnergy to blame for US blackout, say reports

Utilities in Ohio – chiefly FirstEnergy – were at fault for the US blackout in August, conclude separate reports from a US-Canadian task force and Michigan regulators. But the midwest system operator does not escape blame. By Joe Marsh

Richard Rosen

Richard Rosen of the Tellus Institute in Boston controversially believes thatthere is no need for a wholesale power market. By Paul Lyon

JP Morgan Chase plans electricity trading foray

JP Morgan Chase is planning to enter power trading, just as the US energy regulator overturns its onerous stock-holding limit rule. PaulLyon reports

Goldman Sachs buys 3,300MW of power generation capacity

Godman Sachs has agreed to buy US power producer Cogentrix, in a deal that willmore than quadruple the bank’s generation capacity. JoeMarsh reports