Electricity

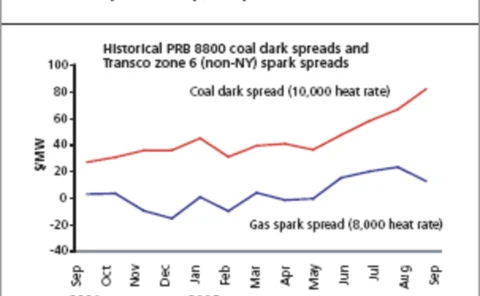

Counting on coal

NRG Energy's move to buy Texas Genco seems a wise one for a company with strong dark-spread exposure, but it has its risks, despite the target company being backed by an active hedging programme. Joe Marsh reports

Playing power games

Thanks to increasing consolidation, it seems the country-specific energy exchange will soon be a thing of the past in Europe. But is this level of competition premature?

Congestion charges

As the US' premier regional transmission organisation, PJM Interconnection's pricing and transmission congestion models must be foolproof. Sandy Fielden describes how they work and the associated risk management mechanisms available to participants

Endex lists Belgian power forwards

Dutch electricity exchange Endex started listing Belgian power forwards today. Belgian utility Electrabel and German utility Essent did the first trade today, a November baseload contract.

No sign of a slowdown

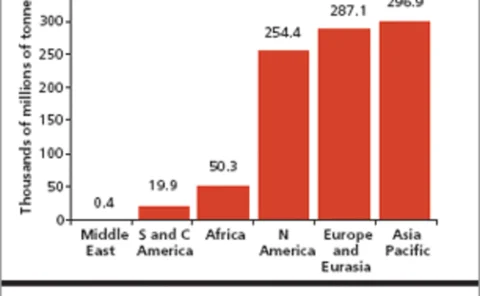

The fundamental outlook for coal looks price supportive for some years to come, but with other fuel prices sky high, coal looks set to retain its market share of electricity generation this decade. Stella Farrington reports

Getting a head-start

North American Energy Credit and Clearing may have gained an advantage by being the first to clear over-the-counter physical electricity contracts. But it still has to prove that it is reliable and efficient. Joe Marsh reports

EEX launches French physical power futures

Germany’s European Energy Exchange (EEX) has started offering physical power futures with delivery in France, another step towards its stated aim of further ‘Europeanisation’. This is the second product the EEX has offered beyond German borders,…

Belgian power exchange to launch early 2006

The Belgian day-ahead electricity market is due to start in early 2006 on the Belgian power exchange (Belpex) in a link-up with Dutch power exchange APX and French energy exchange Powernext. This is the first time three power exchanges will be linked…

Clearing service launches for physical power in US

North American Energy Credit and Clearing (NECC), the Clearing Corporation (CCorp) and Atlanta-based commodity-trading platform IntercontinentalExchange (Ice) have launched a physical clearing service for the US energy markets.

Nord Pool names new head of financial markets, launches new contract

Oslo-based electricity exchange Nord Pool has made two new appointments and is about to launch a new contract for hedging the power price difference between the German and Nordic power markets.

Valuing interruptus

Managing wholesale spot power price volatility by turning off supply offers a way of reducing price spikes, but measuring the value of such interruptibility involves costly modelling techniques. JK Winsen suggests a simpler alternative

Spectron brokers first 'clean' spark spread

Energy broker Spectron has facilitated the UK’s first carbon-neutral, or 'clean', spark spread trade.

Peaking patterns

Weather is increasingly affecting power market dynamics, with prices as variableas the temperatures. But the volatility has spawned a growing variety of methodsofmanaging peak load demand. By Catherine Lacoursiere

Reuters launches order-routing system for commodities

Global information company Reuters has launched Reuters Order Routing for Commodities (RORC), a new trading solution for the European energy market.

Nord Pool hires ex-Natsource brokers, eyes power spread contract

Nordic power exchange Nord Pool has hired brokers from the Oslo office of energy broker Natsource, which would fit with rumours that Natsource is closing its Scandinavian business. Natsource president Jack Cogen declined to comment.

Jeff Rosenzweig

Evolution Markets’ gas and power desk has grown strongly since it was set up six months ago. Joe Marsh talks to its managing director, Jeff Rosenzweig

Real option valuation

Many non-financial assets can be viewed as ‘real options’ linked to an underlying variable such as a commodity price. Here, Thomas Dawson and Jennifer Considine show that the stock price of an electricity generating company is significantly correlated…

Polish power exchange chooses OMX software for trading and clearing

In a move to develop its electricity spot and derivatives market, the Polish Power Exchange (PolPX) will use the Condico system from Stockholm-based OMX, the owner and operator of the Swedish stock exchange.

EEX set to compete with EXAA in Austrian spot power market

Austrian energy exchange EXAA will soon have competition for spot trading of physical power in its home market. From April 1, Austrian companies will be able to trade electricity for delivery to most of Austria directly on Germany's European Energy…

Turbulent times

The new Renewable Sources Act obliges German utility companies to buy all the wind power generated in the country on any one day. And it is adding a new volatility to the German power market. By Stella Farrington

Midwest power market to start on April 1

The US energy market regulator yesterday gave the Midwest Independent System Operator (Miso) the go-ahead to launch its wholesale energy market on April 1, after several delays.