Electricity

Turbulent times

The new Renewable Sources Act obliges German utility companies to buy all the wind power generated in the country on any one day. And it is adding a new volatility to the German power market. By Stella Farrington

Midwest power market to start on April 1

The US energy market regulator yesterday gave the Midwest Independent System Operator (Miso) the go-ahead to launch its wholesale energy market on April 1, after several delays.

New heads for RWE Trading and RWE Power

Brian Count will leave his post as chief executive of RWE Trading, the trading arm of German utility RWE, as of July 1, when he will be replaced by Peter Terium, head of RWE group controlling. And Jan Zilius is expected to take over as chief executive of…

Real-time trading

In an efficient, real-time power market, low-cost generation units are dispatched ahead of those with higher operating costs, and the market price reflects balanced generation and load. Here Shulang Chen discusses the basic functions of a real-time…

A bid for power

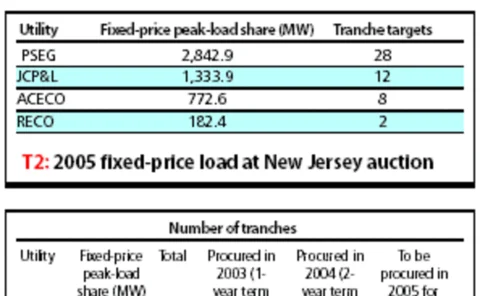

Clock auctions are a fairly recent method for utilities of procuring electricity from suppliers, but only New Jersey has an established process. Yet Ohio and Illinois are showing interest. Joe Marsh reports

IPE launches UK electricity baseload index

The International Petroleum Exchange (IPE) has launched a UK electricity baseload index in response, it said, to industry demand for a viable index on which to base physical deals. The first pricing period will be for the March 2005 contract.

Fortum to buy Eon’s Finnish subsidiary

Finnish energy company Fortum is to buy a majority stake in the Finnish arm of German utility Eon from the parent company and has also offered to buy the City of Espoo’s 34.2% shareholding. Fortum will pay Eon 390 million euros ($509 million) for its 65…

Mirant to pay $460m to settle California energy crisis claims

Bankrupt Atlanta-based energy marketer Mirant will pay $460 million to California power utilities and public agencies to resolve claims related to the state’s energy crisis in 2000 and 2001. The California utilities and agencies in the settlement were…

Dutch-Norwegian power transmission link may spur electricity trading

A newly agreed Norway-Netherlands electricity transmission link will lead to power trading between the two countries, said Swiss power and automation technology group ABB. The link will also increase the reliability of electricity supply, said the…

Duke to settle California power crisis allegations

US power company Duke Energy and some of its subsidiaries will pay $207.5 million to settle allegations that it acted improperly during the California power crisis in 2000/2001. The US Federal Energy Regulatory Commission (Ferc) approved the settlement…

AsiaRisk Awards

Here we feature two outstanding winners from our sister publication AsiaRisk’s Annual Awards, published in October. Thanks largely to Macquarie Bank, alternative investments are gaining a real foothold in Australia, while Westpac has been instumental in…

Trading techniques

Merchant generators make daily decisions on how to get the most from their assets.How much capacity should be sold in the day-ahead market and how much shouldbe set aside for the hourly market are seldom-studied but thorny questions. ShulangChen looks at…

Trading techniques

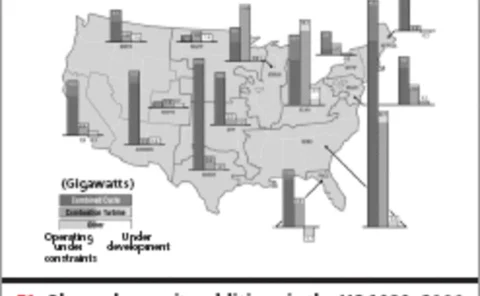

A majority of merchant power plants built during the last few years in the US are combined-cycle units fired by natural gas. This article discusses asset-backed trading strategies for a merchant single-block power plant, showing how unit dispatches can…

Calpine trades up

US power company Calpine installed a new trading floor this year due both to its own growth and its aim to provide more companies with energy services. Joe Marsh reports

Caring competition

What are the theoretical consequences of restructuring electricity markets on emissions? Here, Benoît Sévi shows that changes in supply and consumption and restructuring for competition has environmental effects, and argues that strong public policies…

Utility 2025: a vision

Power companies will face enormous political, societal, and technological change over the next 20 years. Douglas Houseman and Dennis Taylor of Capgemini look at how the utility of the future should embrace change

Dominion buys 310MW plant from Dynegy and NRG

Dominion Virginia Power, the power utility subsidiary of Dominion, today completed the purchase of the 310-megawatt Commonwealth power plant in Chesapeake, Virginia. The move is consistent with its aim of reducing the cost of long-term power purchase…

California ISO gets tough on generators with new software

Power suppliers in California will face financial penalties if they deviate from pre-specified generation levels as of December 1. This is one of the main changes brought in by a new software system implemented by the California independent system…

Dynegy to buy Sithe Energies from Exelon

Dynegy is set to reduce the effect of some of its loss-making tolling and financial swap contracts, buy power plants in the northeast US and acquire a supply agreement to increase stable cashflow and service debt.

Clear intentions

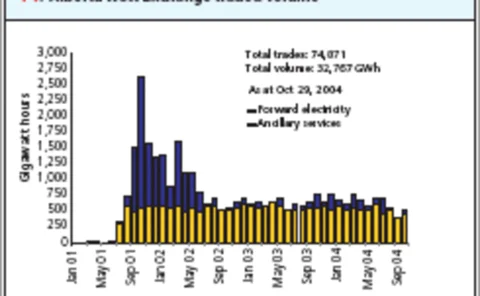

The Alberta Watt Exchange in Calgary is already clearing over-the-counter electricity contracts and from next year will be able to clear natural gas as well. But how much liquidity will it attract? Joe Marsh reports

Nymex to launch New England electricity futures contract

The New York Mercantile Exchange will introduce a New England swap futures contract on its ClearPort trading platform on October 31.

US Midwest a step closer to wholesale power market

After several delays, the Midwest wholesale power market might now be on course for launch next March. The Midwest independent transmission system operator (Miso) today announced the creation of three financial hubs for the wholesale trading of…

Calpine to provide Newmarket with energy services

Calpine Energy Services (CES), part of California-based power company Calpine Corp, is to provide energy services to Newmarket Services Company. Newmarket is a newly formed subsidiary of New York- and London-based asset acquisition firm MMC Energy and…

Duke sells part-built power plant to Nevada Power

The big US energy asset sell-off continued late last week, when Nevada Power Company bought a part-built 1,200 megawatt power plant for $182 million from Duke Energy. North Carolina-based Duke will receive proceeds and tax benefits of $330 million from…