Infrastructure

EnergyCurves to market North American energy data

Four energy brokers have formed a Houston-based company called EnergyCurves to provide North American power and gas data services to the energy markets. The initial EnergyCurves products will be forward price curves for the North American gas and power…

User Choice winners revealed

Energy Risk's first User Choice Awards have been a tremendous success, with over 450 valid votes showing which vendors and data providers are the preferred suppliers to the energy industry in 2004.

US companies fined for sharing gas storage data

Three US energy companies are to pay penalties totalling $8.1 million for sharing natural gas storage inventory data with their customers and affiliates. This is the result of a settlement with US interstate energy regulator the Federal Energy Regulatory…

APGA supports Ferc decision to fine three companies

The American Public Gas Association (APGA) has applauded the US Federal Energy Regulatory Commission (Ferc) for its decision to fine three energy companies $8.1 million for sharing natural gas storage inventory data with their customers and affiliates. …

Wolverine to be market maker for Japanese weather futures

Wolverine Trading, the Chicago-based energy trading company, will be the lead market maker for Japanese weather futures soon to be offered by the Chicago Mercantile Exchange (CME).

King of convenience

The need for Sarbanes-Oxley certification has boosted sales of internet servicerisk systems, says web pioneer Martin Chavez of Kiodex. By James Ockenden

Faith in the figures

There are signs that price reporting will remain voluntary, despite the drop-offin reporting levels, but proposals are still being made on all sides. EricFishhaut looks at the progress being made to achieve greater price transparency

Amerex to distribute market data on GlobalView

Energy broker Amerex is to distribute its power and natural gas market data through GlobalView Software, the Houston-based provider of data management solutions for the energy markets.

Banks make first Isda emissions trade

Investment banks Dresdner Kleinwort Wasserstein and Fortis Bank have made the first ever trade of European Union emission allowances (EUAs) using an annex to the International Swaps and Derivatives Association (Isda) Master Agreement.

GFI to go public

GFI Group has announced its intentions to become a public company, filing for an initial public offering (IPO) with the US Securities and Exchanges Commission (SEC).

Senator releases Enron evidence

US Senator Maria Cantwell (Democrat, Washington) and Washington State’s Snohomish County Public Utility District (PUD) yesterday released financial documents and audiotapes that allegedly show how Enron illegally obtained at least $1.1 billion in profits…

Natural gas storage swaps catch on

London-based GFI has brokered its first over-the-counter (OTC) swap based on US natural gas inventory data, between Houston-based hedge fund Centaurus and another unnamed hedge fund. Centaurus also traded a second such swap on the same day, with an…

CCRO and S&P form liquidity working group

The US Committee of Chief Risk Officers (CCRO) has established a working group along with rating agency Standard & Poor’s (S&P) to define the most effective metrics integral to assessing the liquidity demands of energy supply and wholesale marketing…

Price reporting is improving, says CCRO director

Confidence in the energy markets is returning partially thanks to an improvement in the price reporting practices of energy companies, according to Robert Anderson, executive director of the US-based Committee of Chief Risk Officers (CCRO).

De Vitry warns of energy market regulatory pressures

Benoit de Vitry, global head of commodities and emerging markets rates at Barclays Capital in London, today said that regulatory rules could adversely impact the development of a mature energy trading market.

The waiting game

The Italian power market has finally opened to competition, but how long willenergy users have to wait until they can trade on the new electricity exchange? Joe Marsh reports

Isda raises Basel-linked concerns

Bankers have been preparing for the implementation of the Basel II Capital Accordfor a number of years. But Isda says that it is still concerned about the effectthe Accord may have on the commodities markets. By Paul Lyon

ESB wins Esso price battle

Esso and Ireland’s Electricity Supply Board entered into a seemingly straightforward15-year contract for the sale and purchase of natural gas in 1999. But the contracthas raised the issue of how to define ‘market price’. By James Ockenden

Energia selects SunGard’s Entegrate ZaiNet

Energia, part of the Viridian Group, has selected SunGard’s Entegrate ZaiNet for the straight-through processing and risk management of its physical and financial power and gas contracts.

Crude protection

Oil producers are divided over the value of hedging oil prices. Are investorslooking for high returns and high risk, or more stable revenues? And how muchdoes hedging actually boost an oil producer’s value? By Joe Marsh

ESB wins Esso price battle

A high court judge has rejected claims by Esso it should be allowed to raise the price of gas supplied to Ireland’s Electricity Supply Board (ESB) on the basis of prices reported in the Heren Report .

RMS releases updated Climetrix weather trading system

Risk Management Solutions (RMS), a California-based provider of products and services for the management of natural hazard risk, today released version 4.0 of its Climetrix weather derivatives trading and risk management system.

Taking the slow road

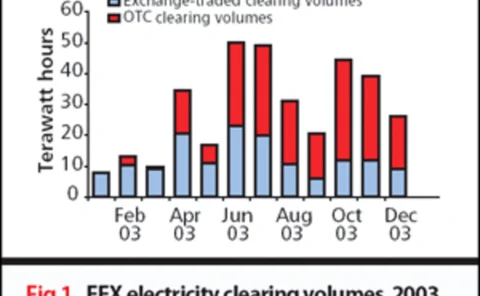

Recent developments suggest that clearing is likely to gain widespread acceptance in the European energy market. Market participants feel it is a question of how and when – not if – robust, liquid solutions will emerge. By Joe Marsh

Ex-Merrill Lynch energy trader pleads guilty to fraud

At 24, Daniel Gordon headed Merrill Lynch’s energy trading business. He has now pleaded guilty to a $43 million fraud. Paul Lyon reports