Infrastructure

New GlobalView head makes u-turns on hubs

Contrary to reports in September, new GlobalView chief Steve Gott says he remains committed to the Energy Data Hub and ConfirmHub ventures. Following a management overhaul, it seems it is business as usual

What drives natural gas?

Natural gas prices in the US are at an all-time high. The Gulf Coast hurricanes and record summer heat have taken their toll, and business is feeling the effect. Studying and applying seasonality can often protect aganst the volatility of these markets,…

Utilities shift towards longer-term hedging

US and Canadian regulated utilities are increasingly looking to put on longer-term hedges, even more than three years out in some cases. Such was one of the findings of an informal survey of the audience at a utility risk-management conference in Chicago…

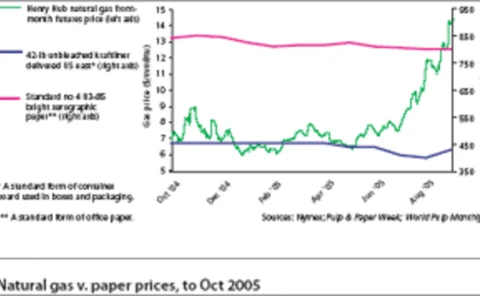

Papering over the cracks

High energy prices are forcing pulp-and-paper makers to take action against falling profits, yet most companies are still shying away from energy price hedging. But that situation may be slowly changing. Joe Marsh reports

BP Singapore chooses Oilspace’s Oilwatch

Global energy major BP’s Singapore division is implementing Oilspace’s Oilwatch, a web-based portal for real-time, aggregated energy prices, news and analytics. BP Singapore is rolling out the service across the Asia-Pacific region.

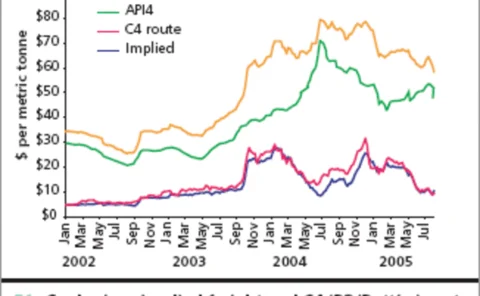

Trading routes open

The coal and dry bulk shipping markets are tightly intertwined and the strong influence of each on the other provides some interesting arbitrage opportunities, which are starting to draw wider attention, writes Barry Parker

King coal still fired up

Despite the soaring cost of emissions reduction credits, the EU emissions trading scheme has yet to dampen utilities’ demand for coal. But, finds Oliver Holtaway, it may affect their long-term investment decisions

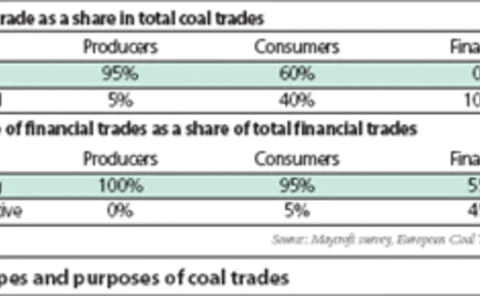

Coal facing changes

Coal derivatives trading is gaining popularity among coal consumers, producers and financial institutions in Europe, according to a recent survey of market players. Cyriel de Jong and Kasper Walet discuss the study’s results

A disciplined approach

E&P companies tend not to strategically hedge in a rising market. But there are good reasons for them to do so, and some are sticking to their hedging strategies, despite suffering losses on their derivatives contracts. By Joe Marsh

Baiting the hook

End-users such as utilities and industrial companies are not showing the same keenness as hedge funds for trading weather derivatives, despite the efforts of banks, dealers and brokers to lure them in. By Joe Marsh

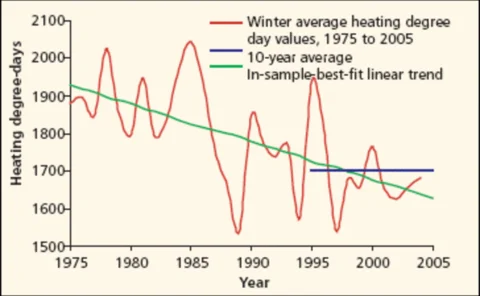

Pricing the weather

Pricing weather derivatives is different from valuing other derivatives contracts – actuarial methods play a greater role. Steve Jewson looks at the varied approaches available

Strength in numbers

Weather derivatives seem to have a bright future: the market is enjoying record liquidity levels as new players, trading ever more diverse products, flood into the market. Oliver Holtaway reports

In pole position

Sakonnet’s Thurstan Bannister says a sound footing in risk management and a customer-facing approach is the secret of his company’s success. By Stella Farrington

The technology trap

Large banks are increasingly looking to energy trading to improve liquidity and develop relationships with large institutional and industrial clients. James Kemp looks at some of the technological challenges they face

Making a connection

Addressing both sophisticated multi-asset trading and physical asset optimisation – while complying with stringent new regulation – are challenges few software firms claim to have the entire solution to. Oliver Holtaway reports

A growing concern

Despite high natural gas prices, Canadian fertiliser maker Agrium has been posting strong profits, while some rivals have struggled. The company’s risk-management strategy has been a significant factor in its success. By Joe Marsh

Evolution to open Calgary office in July

Energy broker Evolution Markets will open an office in Calgary, the centre of the Canadian energy-trading markets, in early July.

Just a seasonal swing?

US natural gas market volatility is keeping trading volume high. But is this just a seasonal phenomenon or part of a long-term trend? Catherine Lacoursiere reports

Getting it together

The US Committee of Chief Risk Officers is proposing an energy data hub to improve price transparency in the natural gas market, but index publisher Platts is concerned over some aspects of the initiative. Joe Marsh reports

GlobalView technology to support ConfirmHub

US-based GlobalView Software has been chosen as the exclusive technology provider to ConfirmHub, a joint venture by brokers Icap, Amerex Energy and Prebon Energy. ConfirmHub is a post-execution, straight-through processing (STP) trade-confirmation…

Peaking patterns

Weather is increasingly affecting power market dynamics, with prices as variableas the temperatures. But the volatility has spawned a growing variety of methodsofmanaging peak load demand. By Catherine Lacoursiere

CCRO data hub update to follow Energy Risk USA conference

The US-based Committee of Chief Risk Officers (CCRO) will give a presentation in Houston next Wednesday, May 11, on the energy data hub it is developing. The session will follow the last presentation of the Energy Risk USA 2005 conference and will take…