Infrastructure

All bases covered

In 1997, Norwegian energy firm Statoil implemented an enterprise-wide risk management system with the help of Goldman Sachs. Eight years on, few energy companies can rival its approach. Joe Marsh discovers why

Both sides of the fence

Ernst Eberlein and Gerhard Stahl analyse price series of 25 energy spotrates simultaneously using Lévy models. This model class allows thecapture of stochastic behaviour of these financial instruments.Theimplications of this analysis will form the…

Turbulent times

The new Renewable Sources Act obliges German utility companies to buy all the wind power generated in the country on any one day. And it is adding a new volatility to the German power market. By Stella Farrington

Germany’s closed shop

Despite six years of liberalisation, Germany’s gas market is still virtually closed to outside competition. Writing from Germany, Stella Farrington looks at whether new regulation is finally about to bring change

Hanging on at the top

This year’s User Choice Awards demonstrate that quality counts. In a fast-changing market, the top vendors and packages have managed to stay ahead of the pack. But the winners cannot rest easy. With IT budgets deflated, it’s a competitive market, and…

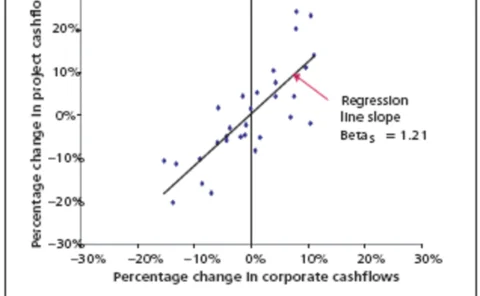

The sum of its parts

One can view a corporation’s individual projects as a portfolio of options – useful risk management tools to be used if their risk/return ratios are better than that of the firm as a whole. But how to work out the equity cost of capital at this…

A good bet for 2005

2005 is forecast to be a tough year for many hedge funds, but the saturation of some of their traditional markets could prove a boon to the energy sector, finds Stella Farrington

TriOptima trims six companies' oil swap portfolios

TriOptima, a Swedish company dedicated to reducing over-the-counter swap portfolios, has expanded its service into energy. The company has terminated its first group of multilateral OTC oil derivative swaps, with six companies eliminating unnecessary…

BarCap launches commodity-linked credit product

Fixed-income investors can now make use of a credit instrument that provides access to commodities as an asset class, says Barclays Capital. The investment bank has launched Apollo, a collateralised commodity obligation (CCO), which uses derivatives…

Mirant settles price-reporting charges

A subsidiary of Atlanta-based energy company Mirant has settled charges with the US Commodity Futures Trading Commission (CFTC) of false reporting of natural gas prices. The commission found that Mirant Americas Energy Marketing (MAEM) traders made false…

AsiaRisk Awards

Here we feature two outstanding winners from our sister publication AsiaRisk’s Annual Awards, published in October. Thanks largely to Macquarie Bank, alternative investments are gaining a real foothold in Australia, while Westpac has been instumental in…

Weather wisdom with risk management

Mark Tawney from Swiss Re spells out the implications of not keeping an eye to the weather

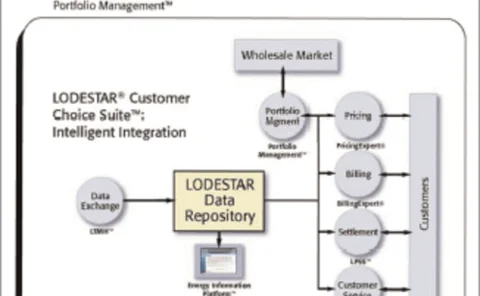

Strengthen your portfolio performance

Reduce costs and minimise exposure withLODESTAR® Portfolio ManagementTM

Energy users demand trading oversight

The debate continues over whether speculative traders are distorting energy prices, following a letter sent by the Industrial Energy Consumers of America (IECA) to Congress last week. “Energy markets have changed drastically, and regulatory oversight,…

European emissions trading on track

The EU emissions trading scheme is on track to start in January 2005, with the European Commission having approved 16 out of 25 of the EU member National Allocation Plans that lie at the heart of the scheme, said Peter Vis, acting head of the Industrial…

Williams to retain energy trading business

Oklahoma-based energy company Williams said late last week it will continue operating its energy trading business, having failed to sell the rest of the wholesale power division. The company is focusing on long-term supply contracts and doing only a very…

DTE Energy Trading opts for Amerex STP solution

DTE Energy Trading, a subsidiary of Detroit-based DTE Energy, has implemented Amerex Energy’s straight-through processing (STP) product, Xcheck - a web-based trade confirmation system that replaces the manual process of generating, transmitting and…

Texan retail therapy

Certain large Texas electricity suppliers want to reduce debt following significantlosses. So their retail divisions are trying harder than ever to squeeze moreprofits from a fiercely competitive retail market. JoeMarsh reports

A history lesson

Abstract: The size of bid/ask spreads in electricity options has both valuationand credit implications. Here, Ted Kury of The Energy Authority shows how toderive theoretical spreads using historical option price data so they can beused as liquidity…

A fresh landscape

Prebon Energy’s Kevin McDermott says that much has changed in the electricitybroking world post-Enron. And it’s all for the better. By Paul Lyon

The matrix

Abstract: Portfolio-wide risk management requires a model that accounts correctlyfor the volatility of, and the correlations between electricity forward products.In this paper Kjersti Aas and KjetilK°aresen discuss a joint model for electricityforward…

Teething troubles

Following decades of cloistered state control and the exit of a number of largeUS players, the Australian power market is going through a period of hiccups. Paul Lyon reports on the outlook for the country’s electricity sector

Covering all the bases

Abstract: Many articles have discussed constructing models for either spot orforward prices. Yet none cover the whole process of constructing a joint modelfor both. Here, Andreas Huber and MonikaKrca develop a multi-factor model thatcaptures both the…

SunGard acquires ASP pioneer Kiodex

SunGard has acquired New York based Kiodex, a supplier of web-based risk management, financial reporting, FAS 133 compliance and market data solutions for companies exposed to commodity price risk.