Exchanges

OTC weather trades fall; exchange trades rise

The weather derivatives market is shifting from an over-the-counter (OTC) market to an exchange traded one, according to the 2004 Weather Risk Management Association (WRMA) survey.

Natural gas storage swaps catch on

London-based GFI has brokered its first over-the-counter (OTC) swap based on US natural gas inventory data, between Houston-based hedge fund Centaurus and another unnamed hedge fund. Centaurus also traded a second such swap on the same day, with an…

Baltic Exchange forms asset derivatives advisory group

The London-based Baltic Exchange has formed an independent advisory group to enhance the emerging market for ship vessel asset derivatives. The group consists of key users, derivative brokers and physical panellists and will act as an information…

Nymex president to quit

Bo Collins, president of The New York Mercantile Exchange (Nymex), will leave the exchange at the end of this month. Nymex said the decision not to renew his contract was by made by "mutual agreement."

Pressure group calls for debarment of Reliant’s US Dept of Defense contracts

Public Citizen, the Washington DC-based pressure group, has called for the debarment of Reliant Energy from its newly awarded $35.9 million electricity contract by the US Department of Defense while it is under federal indictment for its role in creating…

Nymex introduces trading in western electricity futures

The New York Mercantile Exchange (Nymex) is to introduce trading in four western electricity futures contracts, based on Dow Jones Electricity Indexes, on its ClearPort electronic platform beginning with the June 4 trading session, which starts at 3:15…

EU emissions trading to see moderate start, says survey

Companies expect emissions trading to experience a “moderate start” in the European Union (EU), before seeing a steady increase in volumes. This was the conclusion of a recent survey carried out by the Leipzig-based European Energy Exchange (EEX) and 3C,…

Prebon sets up coal desk

London-based broker Prebon may have failed in its bid to lure three coal traders from fellow broker Icap, but it is continuing to build a coal team. In mid-May, Sharon Millar, who previously traded paper and physical coal at UK utility RWE Innogy, joined…

Nymex to clear contracts on OTC oil and gas options

The New York Mercantile Exchange (Nymex) and broker Icap are set to launch an electronic market in options on oil and gas inventory statistics. The over-the-counter options will be offered through an auction process and cleared by Nymex.

GL Trade sets up gateway to EEX and signs up Calyon Financial

GL Trade, a Paris-based provider of financial data, clearing, trading and settlement soulutions, has set up a gateway to the Leipzig-based European Energy Exchange. Global derivatives broker Calyon Financial, formerly Carr Futures, has taken up this…

Energy clearing in Catch 22 situation, says Fitch

Denise Furey, New York-based senior director of global power at rating agency Fitch believes that the clearing of OTC energy derivative contracts is in something of a ‘Catch 22’ predicament. “We need standardization of contract documentation to get to…

LCH Clearnet set to clear US trades

LCH Clearnet, Europe's largest derivatives clearing house, has won approval from the US Commodity Futures Trading Commission to clear financial futures and options contracts on US exchanges.

Fair weather future

Judging from the success of the weather risk market in the Asia-Pacific region,the Chicago Mercantile Exchange couldn’t have picked a more opportune timeto launch Japanese weather futures. By Paul Lyon

The waiting game

The Italian power market has finally opened to competition, but how long willenergy users have to wait until they can trade on the new electricity exchange? Joe Marsh reports

Isda raises Basel-linked concerns

Bankers have been preparing for the implementation of the Basel II Capital Accordfor a number of years. But Isda says that it is still concerned about the effectthe Accord may have on the commodities markets. By Paul Lyon

Taking the slow road

Recent developments suggest that clearing is likely to gain widespread acceptance in the European energy market. Market participants feel it is a question of how and when – not if – robust, liquid solutions will emerge. By Joe Marsh

Ex-Merrill Lynch energy trader pleads guilty to fraud

At 24, Daniel Gordon headed Merrill Lynch’s energy trading business. He has now pleaded guilty to a $43 million fraud. Paul Lyon reports

LNG drive gears up

The global push for LNG has reached a new level – particularly in the US. Big players had projects rubber-stamped or proposed further terminals, and the inaugural LNG summit took place. Joe Marsh reports

The future of freight

The Baltic Exchange has recently shelved plans to offer freight derivatives,yet rising freight rates should aid the development of the embryonic forwardfreight agreement market. By Paul Lyon

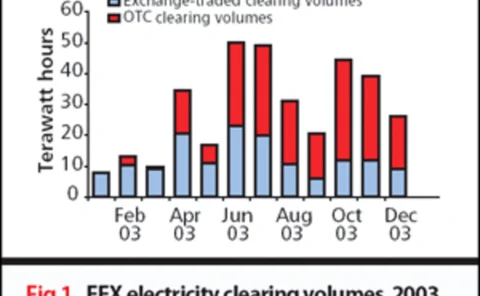

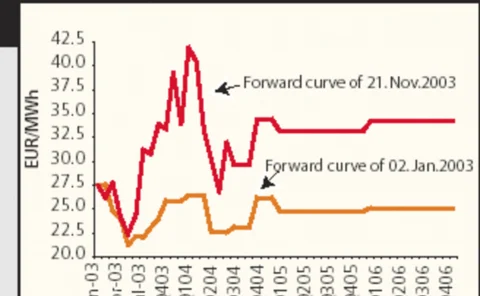

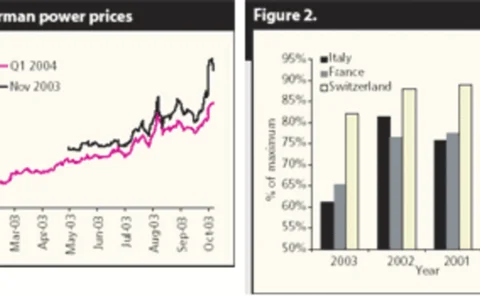

Searching for sellers in 2003

High volatility and rising prices in 2003 clearly above fundamental levels signal the need for improved guidelines from legislative institutions andeasily accessible information

The future of ETRM

As generation, trading and retailing companies come out from under the dark cloud to prepare for what looks to be a brighter future, one issue has become critical – the need to upgrade outdated ETRM systems with 21st century architecture, portfolio…

Weathering the problems

Weather derivatives can reduce or eliminate the potential economic disastersthat extreme weather can provoke. Ross McIntyre of Deutsche Bank examines thevarious ways in which weather can affect key industries and reviews the benefitsof weather derivatives