Exchanges

A good bet for 2005

2005 is forecast to be a tough year for many hedge funds, but the saturation of some of their traditional markets could prove a boon to the energy sector, finds Stella Farrington

European partnership plans emissions trading market

Pan-European exchange operator Euronext plans to launch an emissions trading market in March 2005 in conjunction with French electricity exchange Powernext and French state-owned investment bank Caisse des Dépôts et Consignations.

Caught short

Given the difficulty China Aviation Oil is having closing its remaining illiquid positions, its derivative trading losses may be greater than first thought. James Ockenden and Stella Farrington report

Sovereign solutions

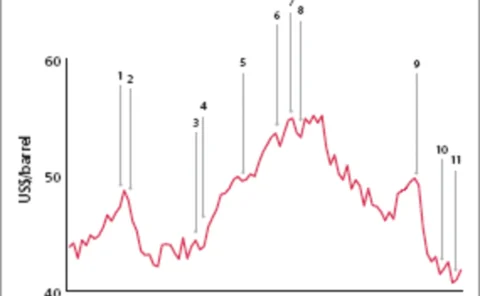

As we saw last month, most governments prefer stabilisation funds over hedging to protect against oil price risks. But multilateral institutions such as the World Bank advise otherwise. By Maria Kielmas

Oil price falls despite Opec cut

Oil prices fell Friday afternoon despite a decision by the Organisation of Petroleum Exporting Countries (Opec) to rein in current oversupply, effectively taking 1 million barrels a day off the market.

China Aviation Oil chief arrested

Chen Jiulin, the suspended chief executive of China Aviation Oil, has been arrested on his return to Singapore early Wednesday as investigations begin into the company’s huge trading losses.

Calpine trades up

US power company Calpine installed a new trading floor this year due both to its own growth and its aim to provide more companies with energy services. Joe Marsh reports

Dominion buys 310MW plant from Dynegy and NRG

Dominion Virginia Power, the power utility subsidiary of Dominion, today completed the purchase of the 310-megawatt Commonwealth power plant in Chesapeake, Virginia. The move is consistent with its aim of reducing the cost of long-term power purchase…

Energy users demand trading oversight

The debate continues over whether speculative traders are distorting energy prices, following a letter sent by the Industrial Energy Consumers of America (IECA) to Congress last week. “Energy markets have changed drastically, and regulatory oversight,…

EEX to launch spot carbon contract

German-based electronic exchange European Energy Exchange (EEX) is to launch a spot contract to trade EU carbon emissions allowances in January 2005.

Chicago Climate Exchange approved to trade futures

The Chicago Climate Futures Exchange (CCFE) obtained approval from the US Commodity Futures Trading Commission (CFTC) last week to trade emissions futures contracts.

BP pays $100,000 to settle wash trading charges

The energy round-trip trading scandal continues to rumble on, as BP America today paid $100,000 to the US Commodity Futures Trading Commission (CFTC) to settle charges of illegal wash trading. A wash or round-trip trade is one that produces neither a…

Dynegy to buy Sithe Energies from Exelon

Dynegy is set to reduce the effect of some of its loss-making tolling and financial swap contracts, buy power plants in the northeast US and acquire a supply agreement to increase stable cashflow and service debt.

Nymex to launch two new coal swap futures

The New York Mercantile Exchange (Nymex) will launch two new coal futures contracts – one for eastern coal and one for western coal – on its ClearPort trading platform on October 31.

Nymex to launch New England electricity futures contract

The New York Mercantile Exchange will introduce a New England swap futures contract on its ClearPort trading platform on October 31.

EEX launches daily CO 2 price index

The European Energy Exchange (EEX) will from today publish a reference price for the trade in CO 2 certificates throughout Europe on each trading day. The move comes in preparation for the European Union emissions trading scheme (ETS), which will start…

Nymex European launch imminent

Nymex aims to launch an open outcry exchange in Europe, most likely initially in Dublin using Nybot’s Finex facilities, according to president James Newsome.

18 EU states urged to implement energy law

Most European Union countries have not transposed the internal-market electricity and natural gas directives into national law, according to the European Commission. The commission today sent formal letters to 18 of the 25 EU member states asking them to…

A legal rollercoaster

US-based Polygon wants to see a better restructuring deal for British Energy’sshareholders. But the hedge fund faces a struggle to prevent the UK nuclear powergenerator from delisting. Joe Marsh reports

Nymex ends open-outcry trading of PJM monthly power futures

The New York Mercantile Exchange (Nymex) will move daytime trading of the PJM monthly electricity futures contract to ClearPort, its internet-based system, from the open-outcry trading floor on November 1.

Aquila completes $330m refinancing and pays off $430m loan

Kansas City-based energy company Aquila has made further moves to reduce its debt with two new 364-day unsecured financings: a $110 million revolving credit facility and a $220 million term loan facility. The company borrowed the full amount under the…

Dominion forward-sells shares to obtain equity on demand

Virginia-based energy company Dominion has forward-sold 10 million shares of its common stock in a block trade to JP Morgan Securities. The deal was done in connection with a forward-sale agreement between Dominion and investment bank Merrill Lynch. It…

Texan retail therapy

Certain large Texas electricity suppliers want to reduce debt following significantlosses. So their retail divisions are trying harder than ever to squeeze moreprofits from a fiercely competitive retail market. JoeMarsh reports

Good neighbours

Spanish and Portuguese energy market participants are hopeful that a joint Spanish-Portuguesepower market is imminent. But how competitive will the Portuguese side of themarket be? Joe Marsh reports