Exchanges

EEX to launch carbon derivatives contract

The European Energy Exchange (EEX) plans to launch a futures contract for carbon emissions allowances in October, pending regulatory approval.

Risk management key for freight, says Baltic Exchange chief

Baltic Exchange chief executive Jeremy Penn has stressed the importance of risk management at a forum of freight derivatives brokers and traders this week.

Nymex pit opens in London

Some 76 individuals and 12 companies showed up to trade Brent and gas oil futures on the first day of trade at the New York Mercantile Exchange’s London trading floor today (Monday).

Indian exchange to list IPE Brent crude futures

Oil traders in India will from September 15 be able to trade rupee-denominated Brent crude futures, settled monthly by reference to the benchmark IPE Brent crude futures contract.

Trading routes open

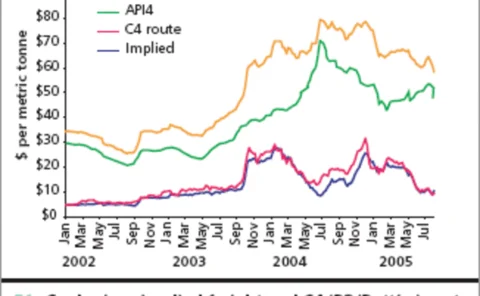

The coal and dry bulk shipping markets are tightly intertwined and the strong influence of each on the other provides some interesting arbitrage opportunities, which are starting to draw wider attention, writes Barry Parker

King coal still fired up

Despite the soaring cost of emissions reduction credits, the EU emissions trading scheme has yet to dampen utilities’ demand for coal. But, finds Oliver Holtaway, it may affect their long-term investment decisions

No sign of a slowdown

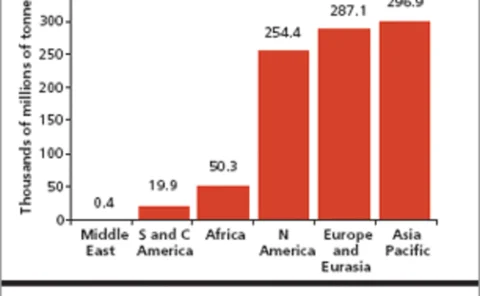

The fundamental outlook for coal looks price supportive for some years to come, but with other fuel prices sky high, coal looks set to retain its market share of electricity generation this decade. Stella Farrington reports

Coal facing changes

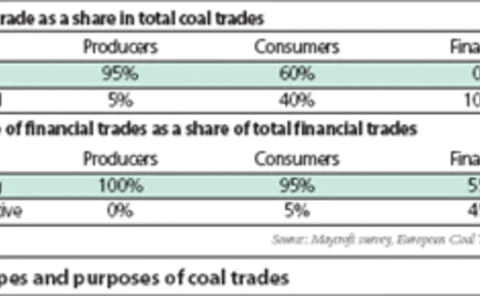

Coal derivatives trading is gaining popularity among coal consumers, producers and financial institutions in Europe, according to a recent survey of market players. Cyriel de Jong and Kasper Walet discuss the study’s results

A disciplined approach

E&P companies tend not to strategically hedge in a rising market. But there are good reasons for them to do so, and some are sticking to their hedging strategies, despite suffering losses on their derivatives contracts. By Joe Marsh

EEX launches French physical power futures

Germany’s European Energy Exchange (EEX) has started offering physical power futures with delivery in France, another step towards its stated aim of further ‘Europeanisation’. This is the second product the EEX has offered beyond German borders,…

TFS brokers first Nymex emissions contract

Global broker Tradition Financial Services (TFS) has brokered the first transaction on the New York Mercantile Exchange (Nymex) emissions futures contract.

Evolution expands US west coast emissions brokerage ops

Energy broker Evolution Markets has expanded its environmental market operations for the western US with the hire of Laura Meadors, an expert in environmental market design and analysis. She is based in the San Francisco office, which opened in February…

Strength in numbers

Weather derivatives seem to have a bright future: the market is enjoying record liquidity levels as new players, trading ever more diverse products, flood into the market. Oliver Holtaway reports

Belgian power exchange to launch early 2006

The Belgian day-ahead electricity market is due to start in early 2006 on the Belgian power exchange (Belpex) in a link-up with Dutch power exchange APX and French energy exchange Powernext. This is the first time three power exchanges will be linked…

The technology trap

Large banks are increasingly looking to energy trading to improve liquidity and develop relationships with large institutional and industrial clients. James Kemp looks at some of the technological challenges they face

A growing concern

Despite high natural gas prices, Canadian fertiliser maker Agrium has been posting strong profits, while some rivals have struggled. The company’s risk-management strategy has been a significant factor in its success. By Joe Marsh

Austrian Energy Exchange launches emissions trading

The Austrian Energy Exchange, EXAA, joined the ranks of European exchanges trading emissions yesterday with its first spot auction of European Union CO 2 allowances (EUAs).

ECX and Powernext team up on carbon trading

French electricity exchange Powernext and the Amsterdam-based European Climate Exchange (ECX) have agreed to jointly offer carbon futures and spot contracts. The partnership is complimentary, because ECX lists a futures contract and Powernext offers a CO…

Nymex to launch emissions futures on ClearPort

The New York Mercantile Exchange (Nymex) is to introduce sulphur dioxide (SO 2 ) and nitrogen oxide (NOx) futures contracts on Nymex ClearPort on June 19 for the June 20 trading session, the exchange said today.

Nymex to form Dubai oil futures exchange

The New York Mercantile Exchange (Nymex) and Dubai Holding are to form the Dubai Mercantile Exchange (DME) to trade sour crude and fuel oil in early 2006, the New York exchange announced today.

Clearing service launches for physical power in US

North American Energy Credit and Clearing (NECC), the Clearing Corporation (CCorp) and Atlanta-based commodity-trading platform IntercontinentalExchange (Ice) have launched a physical clearing service for the US energy markets.

Nord Pool names new head of financial markets, launches new contract

Oslo-based electricity exchange Nord Pool has made two new appointments and is about to launch a new contract for hedging the power price difference between the German and Nordic power markets.

Powernext to launch spot carbon contract in late June

French electricity exchange Powernext will launch its delayed CO 2 emissions spot market on June 24, barring any technical or administrative difficulties among market members.