Exchanges

Nymex’s side-by-side trading seen as deathknell to floor

The New York Mercantile Exchange (Nymex) will introduce side-by-side electronic and open-outcry trading in its physically settled energy futures contracts in the second quarter of 2006.

SGX and CBOT to partner on commodities

The Singapore Exchange (SGX) and Chicago Board of Trade (CBOT) will launch a joint commodities derivative exchange early this year, marking a step towards fulfilling SGX's strategy to be an Asian gateway. Joe Marsh reports

Credit - Energising credit

Traditional credit instruments can be used to mitigate credit risk in the energy sector, despite the unique risk management challenges, says Chris Coovrey

A comeback for coal

With gas prices soaring, it seems inevitable that coal - the Cinderella of energy resources - is bound to return to the forefront. But how long will it last? asks Eric Fishnaut

Commodities Count 2006

The recent swell in energy market participants means the battle for dominance has never been fiercer, but the increased competition means ever-more sophisticated product offerings, finds Stella Farrington

Possible CME move for Nymex muddies the waters

The Chicago Mercantile Exchange's potential bid for a stake in the New York Mercantile Exchange could further heighten tensions at Nymex over the agreed deal with General Atlantic. That's if the CME comes up with a concrete proposal

Duke Energy to adopt Cinergy trading approach

Following the transfer of its energy derivatives portfolio to Barclays Capital, Duke Energy is targeting a lower-risk trading strategy pioneered by Cinergy, the company it is buying

BarCap takes on Duke trading book

Barclays Capital will acquire and manage the bulk of Duke Energy North America’s (DENA) power and gas derivatives contracts, as part of parent Duke Energy Corp’s takeover of US utility Cinergy.

Weather fund Pyrenees closes, traders set up weather desk at Sempra

Weather hedge fund Pyrenees Capital Management closed at the end of October, a year after its launch, and two of the company’s three staff have moved to energy trader Sempra Commodities to set up a new weather desk.

Nice price for Ice as exchange floats

Atlanta-based energy-trading platform IntercontinentalExchange (Ice) hit the ground running as a public company today, pricing at $26 per share – at the top of its $24-$26 target range.

Powernext launches weather indexes

French electricity exchange Powernext – in partnership with Météo France (the French meteorological office) – today started offering national European temperature indexes.

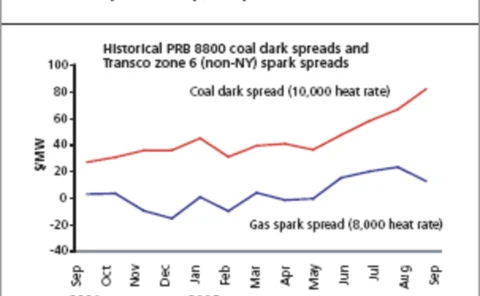

Counting on coal

NRG Energy's move to buy Texas Genco seems a wise one for a company with strong dark-spread exposure, but it has its risks, despite the target company being backed by an active hedging programme. Joe Marsh reports

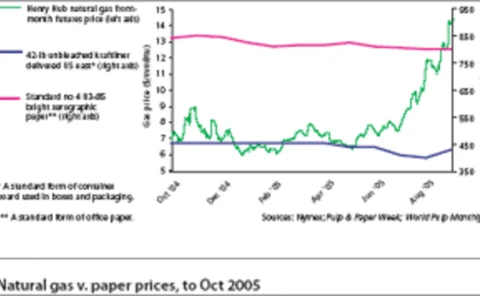

Papering over the cracks

High energy prices are forcing pulp-and-paper makers to take action against falling profits, yet most companies are still shying away from energy price hedging. But that situation may be slowly changing. Joe Marsh reports

Playing power games

Thanks to increasing consolidation, it seems the country-specific energy exchange will soon be a thing of the past in Europe. But is this level of competition premature?

Endex lists Belgian power forwards

Dutch electricity exchange Endex started listing Belgian power forwards today. Belgian utility Electrabel and German utility Essent did the first trade today, a November baseload contract.

Tullett Prebon forms wet freight derivatives venture

Tullett Prebon, part of Collins Stewart Tullett, is the latest interdealer broker to partner with a shipping broker to offer forward freight agreements (FFAs). It has started a venture with three international shipping brokers with the aim of…

BEAU TAYLOR

Beau Taylor , global head of energy at JP Morgan, plans to turn the bank from a niche participant into a dominant player in the energy markets. By Joe Marsh