Environment-Renewables

King coal still fired up

Despite the soaring cost of emissions reduction credits, the EU emissions trading scheme has yet to dampen utilities’ demand for coal. But, finds Oliver Holtaway, it may affect their long-term investment decisions

No sign of a slowdown

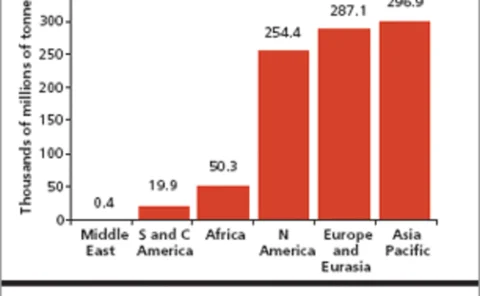

The fundamental outlook for coal looks price supportive for some years to come, but with other fuel prices sky high, coal looks set to retain its market share of electricity generation this decade. Stella Farrington reports

Evolution expands US west coast emissions brokerage ops

Energy broker Evolution Markets has expanded its environmental market operations for the western US with the hire of Laura Meadors, an expert in environmental market design and analysis. She is based in the San Francisco office, which opened in February…

Baiting the hook

End-users such as utilities and industrial companies are not showing the same keenness as hedge funds for trading weather derivatives, despite the efforts of banks, dealers and brokers to lure them in. By Joe Marsh

Pricing the weather

Pricing weather derivatives is different from valuing other derivatives contracts – actuarial methods play a greater role. Steve Jewson looks at the varied approaches available

Strength in numbers

Weather derivatives seem to have a bright future: the market is enjoying record liquidity levels as new players, trading ever more diverse products, flood into the market. Oliver Holtaway reports

ECX and Powernext team up on carbon trading

French electricity exchange Powernext and the Amsterdam-based European Climate Exchange (ECX) have agreed to jointly offer carbon futures and spot contracts. The partnership is complimentary, because ECX lists a futures contract and Powernext offers a CO…

New carbon brokerage targets non-power-sector SMEs

Three senior players in the European emissions trading market have launched Carbon Capital Markets, a broker-dealer service that targets small to medium-sized companies (SMEs) outside the power sector.

Powernext to launch spot carbon contract in late June

French electricity exchange Powernext will launch its delayed CO 2 emissions spot market on June 24, barring any technical or administrative difficulties among market members.

Spectron brokers first 'clean' spark spread

Energy broker Spectron has facilitated the UK’s first carbon-neutral, or 'clean', spark spread trade.

DrKW launches retail carbon product

Dresdner Kleinwort Wasserstein has paved the way for private investors to gain exposure to the carbon emissions market with a new securitised product.

ABN Amro expands commodity-trading team, opens Singapore office

Dutch bank ABN Amro has made several commodity trading and marketing hires in London and New York, and opened an office in Singapore.

Barclays Capital in first Leba carbon index trade

Barclays Capital has completed the first financial carbon trade using the new Leba Carbon Index for "a significant volume" of EU emissions allowances.

Point Carbon buys Natsource Scandinavia’s analysis unit

Carbon emissions consultancy Point Carbon has bought Natsource-Tullett Scandinavia, Europe’s largest power and gas analysis firm, but will disband Natsource’s Oslo brokerage operations. The move adds power and natural gas market analysis to Point Carbon…

All bases covered

In 1997, Norwegian energy firm Statoil implemented an enterprise-wide risk management system with the help of Goldman Sachs. Eight years on, few energy companies can rival its approach. Joe Marsh discovers why

IPE-ECX carbon futures contract faces fierce competition

London’s International Petroleum Exchange (IPE) and the Amsterdam-based European Climate Exchange (ECX) are set to offer CO 2 futures contracts under the EU Emissions Trading Scheme (ETS).

Turbulent times

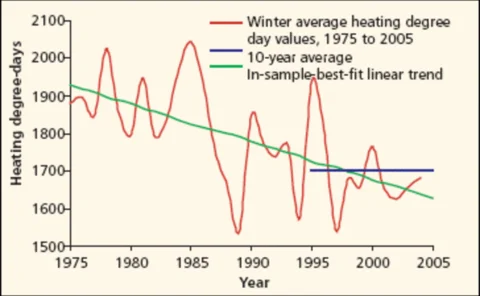

The new Renewable Sources Act obliges German utility companies to buy all the wind power generated in the country on any one day. And it is adding a new volatility to the German power market. By Stella Farrington

Greenpeace protest at IPE fuels debate on emissions trading

Greenpeace’s invasion of London’s International Petroleum Exchange (IPE) on Wednesday was intended to draw attention to the environmental impact of ‘big oil’ on the day the Kyoto Protocol came into force. However, by attacking an exchange that is about…

Risk Management Inc signs four utility clients

Risk Management Inc (RMI), a Chicago-based energy consultancy and brokerage, has signed up four new utility customers for its energy risk management and hedging services. The City of Glendale Water & Power and Pasadena Water & Power, both in California,…

Dutch-Norwegian power transmission link may spur electricity trading

A newly agreed Norway-Netherlands electricity transmission link will lead to power trading between the two countries, said Swiss power and automation technology group ABB. The link will also increase the reliability of electricity supply, said the…

London to be world carbon market centre

The UK’s early move into carbon emissions trading means London is now well placed to become a world centre for the emerging carbon market, UK Environment Minister Elliot Morley said Wednesday.

Saudi to up oil output to 12.5 million b/d

Saudi Arabia’s total oil production capacity is now at 11 million barrels a day (b/d) and plans are in place to increase it to 12.5 million b/d, Saudi Arabia’s Minister of Petroleum and Mineral Resources, Mr Ali Al-Naimi, said Monday.

Static emissions price “does not reflect fundamentals”

The European emissions trading market, with its static price over the last four to five weeks, “is not a good market,” and does not reflect fundamentals, said Chris Rowland, managing director of utilities research at Dresdner Kleinwort Wasserstein.

EEX to launch spot carbon contract

German-based electronic exchange European Energy Exchange (EEX) is to launch a spot contract to trade EU carbon emissions allowances in January 2005.