Environment-Renewables

Judicial stalemate

German natural gas market liberalisation is stalled between the courts and a corporatist business culture, finds Maria Kielmas

Option pricing for power prices with spikes

European power prices are very volatile and subject to spikes, particularly in German and Dutch markets. Ronald Huisman and Cyriel de Jong examine the impact of spikes on option prices by comparing prices from a standard mean-reverting model and a regime…

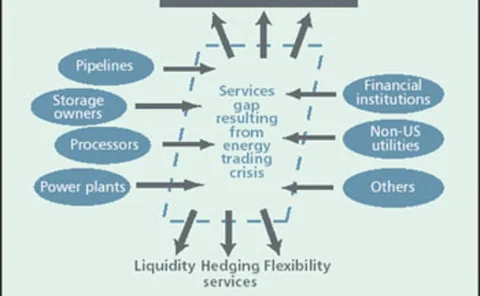

Who is left to manage risk?

The exodus of energy trading companies from the market has created a gap in managing risk. David Johnson and Ross Warriner of Protiviti report

Quality data and solutions for a challenging market

FAME provides today’s uncertain energy market with transparent information and the tools to analyse it

Demystifying credit risk

Satyan Malhotra, Fred Cohen and Rafael Cavestany formulate an analysis for the measurement of credit risk in the energy industry

Heeding the warning signs

Following the Enron bankruptcy, the use of bond-spread analysis has become increasingly important. Mark Williams looks at how firms can benefit from it

Proper procedures

Rajiv Arora examines the processes necessary for effectively measuring, managing and hedging credit risks

Clearing the way?

The German over-the-counter market has been growing quickly in recent years, but a series of shocks has sparked fears of credit risk exposure. Can trading regain recent highs and save the OTC market from credit-wary traders, asks Joel Hanley

At home and abroad

Given its location at the centre of Europe, Germany is the key to any future pan-European energy market. But some of its leading companies have their eyes on markets beyond continental Europe, reports Robin Lancaster

Out on its own

European countries tend to have an appointed power market regulator, but Germany has taken a self-regulatory approach. How does the electricity spot price behave as a result? Tobias Federico offers an econometric analysis

At the heart of Europe

As the rest of Europe has still to get fully to grips with cross-border energy trading in a liberalising environment, Germany, Austria and Switzerland are providing an example of a workable regional electricity market, says Eurof Thomas