Environment-Renewables

European emissions trading on track

The EU emissions trading scheme is on track to start in January 2005, with the European Commission having approved 16 out of 25 of the EU member National Allocation Plans that lie at the heart of the scheme, said Peter Vis, acting head of the Industrial…

A legal rollercoaster

US-based Polygon wants to see a better restructuring deal for British Energy’sshareholders. But the hedge fund faces a struggle to prevent the UK nuclear powergenerator from delisting. Joe Marsh reports

Offshore wind to be big business, says new Fitch MD

Offshore wind projects and the newly expanded European Union will both bring good opportunities to Fitch Ratings over the coming 18 to 24 months, according to the Fitch Energy Group’s new European, Middle East and Africa (EMEA) managing director Andrew…

Teething troubles

Following decades of cloistered state control and the exit of a number of largeUS players, the Australian power market is going through a period of hiccups. Paul Lyon reports on the outlook for the country’s electricity sector

Evolution looks west with Unger

Evolution Markets is expanding to provide brokerage services to the California emissions trading markets. Leading the company’s efforts in San Francisco is Samantha Unger, one of the California emissions markets’ most experienced brokers.

Nordic volumes heading south

Nordic region electricity trading volumes are falling fast, which is damagingprofits at Oslo-based power exchange Nord Pool. The company may face postinga loss for 2004 if it cannot reverse this trend. Joe Marsh reports

EC fails emissions scheme, says E&Y director

The European Commission’s failure to challenge eight EU national allocation plans undermines Europe’s ability to meet its carbon dioxide emissions reduction targets agreed under the Kyoto Protocol according to Ernst & Young’s director of emissions…

Banks make first Isda emissions trade

Investment banks Dresdner Kleinwort Wasserstein and Fortis Bank have made the first ever trade of European Union emission allowances (EUAs) using an annex to the International Swaps and Derivatives Association (Isda) Master Agreement.

EU adopts linking directive...

The European parliament has given the thumbs-up to the so-called linking directiveallowing companies within member states to benefit from emissions projects outsideof the EU. By James Ockenden and Paul Lyon

Governments face carbon allocation legal action

European governments face legal action from industry if they fail to provide carbon allocation plans by the end of the year, according to Peter Vis of the climate change unit of the European Commission.

European companies outline concerns over emissions trading

Corporates are expressing concern at the ramifications of the European UnionEmissions Trading Scheme – just as EU member states finalise their nationalallocation plans. By Paul Lyon

Norway's Statoil sets up emissions trading unit

Norwegian energy company Statoil has formed a unit for trading carbon dioxide emissions. The Oslo-based firm said: “The Norwegian emissions trading regime will govern Statoil’s involvement in the purchase and sale of carbon quotas.”

Nuclear stockpile

The US Nuclear Regulatory Commission has come under fire for not adequately monitoring the decommissioning funds of nuclear power plants. But the NRC says the criticism is unwarranted. By Paul Lyon

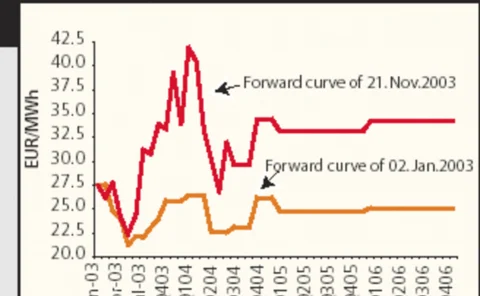

Searching for sellers in 2003

High volatility and rising prices in 2003 clearly above fundamental levels signal the need for improved guidelines from legislative institutions andeasily accessible information

Weathering the problems

Weather derivatives can reduce or eliminate the potential economic disastersthat extreme weather can provoke. Ross McIntyre of Deutsche Bank examines thevarious ways in which weather can affect key industries and reviews the benefitsof weather derivatives

Scaling the credit cliff

How are designers of credit risk software reacting to the new credit realities of the energy trading sector? Kevin Foster talks to some leading companies to find out

A clear answer to credit problems

US firm PA Consulting is working with a number of major US energy companies to set up a one-off trade netting scheme. Kevin Foster investigates the proposals

Standing out from the crowd

Credit risk management groups can differentiate themselves from their competitors through their different capabilities. Randy Baker and Brett Humphreys explain how

Post-delivery problems

The credit exposures that arise from trading physical and financial energy are inherently more complicated and volatile than those encountered in trading purely financial products. Richard Sage looks at the different elements to be considered

Cross-border conundrums

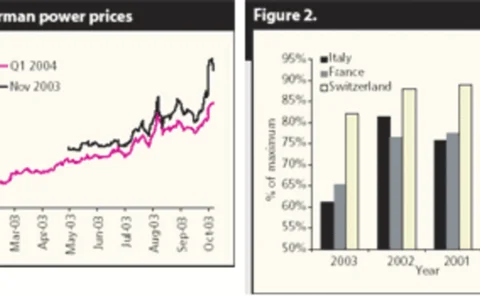

Analysts at rating agency Standard & Poor’s Lee Munden and Paul Lund look at the future of cross-border trading in Europe, given the credit crises of 2002

Delaying the inevitable?

As Reliant Resources celebrates a $6.2 billion refinancing deal, some in the industry say such deals are merely postponing problems that are bound to resurface. James Ockenden reports

Ahead of the green game

Given the efforts they have already made to reduce emissions, many German firms do not share their environment minister’s enthusiasm for the EU’s new, obligatory cross-border greenhouse gas emissions trading market. Jessica McCallin reports