Financing

Lessons in loaning

Lenders and borrowers alike are becoming ever more innovative at a worrying time for energy company financing. But will the new ideas catch on? Paul Lyon reports

Own, sell or restructure

UK and US utilities are presently saddled with a lot of debt, thanks to overcapacity and low power prices. But what’s the best way for these firms to deal with the power plants they don’t need? By Jessica McCallin

Delaying the inevitable?

As Reliant Resources celebrates a $6.2 billion refinancing deal, some in the industry say such deals are merely postponing problems that are bound to resurface. James Ockenden reports

Bearing the brunt

Building contractor bankruptcies of have recently stressed the credit profiles of several power projects in the US. Standard & Poor’s Scott Taylor and Tobias Hsieh look at how sponsors and lenders responded and the effects on the various parties

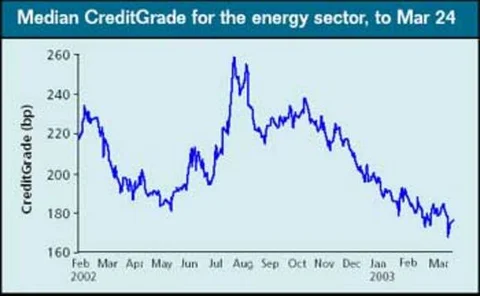

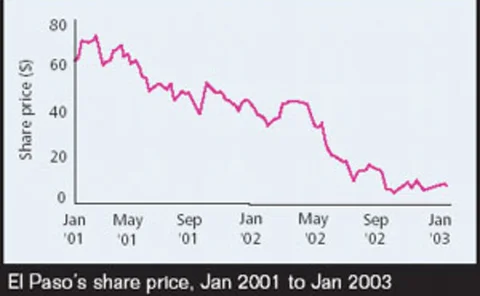

Credit watch

In this month’s analysis of energy firms’ credit quality via Riskmetrics’ CreditGrades tool, Williams and El Paso are among those with tighter spreads

Clearer waters for ratings

Despite a credit ratings crisis in the energy markets, the prognosis for natural gas companies looks stable, finds Shifa Rahman

High oil and gas prices enhancing credit quality

The ‘war premium’ is propping up oil and gas prices and oil firms’ balance sheets. But debt levels and quality of assets are still king. Catherine Lacoursière reports

Setting a new pace

‘Broken records and shattered dreams’ was the headline for last year’s exchange review – but it could easily have been appropriate for this year’s. Certain exchanges have reported stellar growth, while others are suffering, for various reasons. By Joel…