Financing

US refinancings suggest recovery

Do several big debt refinancings at US utilities mean energy companies are finally starting to emerge from their post-Enron and post-California crisis problems? Joe Marsh reports

Louise Kitchen

Growth potential is what makes Louise Kitchen tick, and she relishes the chanceto build up UBS’s energy trading team. By James Ockenden

Cautious comeback

Global consultancy PricewaterhouseCoopers says the slump in global merger andacquisition deal activity in the energy sector may have bottomed out and confidencecould be starting to return. By Joe Marsh

Calpine scraps $2.3 billion loan and junk bond sale

San Jose-based Calpine last month cancelled a $2.3 billion secured term loan and secured notes offering. Its wholly owned subsidiary, Calpine Generating (CalGen) Company (formerly Calpine Construction Finance Company II ) cancelled its offerings due to…

Energy finance house of the year

Winner: ABN Amro

Nybot in Nymex sights

Nymex aims to buy Nybot as part of its expansion and acquisition drive, according to Nymex president Robert Collins.

The deal deluge

Last year was certainly an interesting time for energy company financing, and some of the most important deals were completed just before year-end. Paul Lyon looks back at some of the major trends and asks what 2004 will hold

Winning players

A turbulent year in energy markets showed there was more competition between banks and oil majors, and further highlighted the need for a solution to the credit issues dogging energy companies and airlines. By James Ockenden

Banks grab distressed UK assets

Six European banks intend to buy around 10GW of distressed UK power assets usingfinancial instruments. But their main rival, MMC, says hard cash is needed towin the UK market. By James Ockenden

El Paso to cut debt by a third, while gas trader pleads guilty

US natural gas company El Paso – which has recently survived a bid toreplace its board and seen one of its tradersindicted – has unveiled aplan to significantly reduce its debt. By Joe Marsh

Cash upfront

Memphis Light, Gas & Water is readying a landmark bond sale to fund a prepay electricity contract with the Tennessee Valley Authority. But some fear the deal could set a dangerous precedent. By Paul Lyon

Flexible bonds

A depressed power market means major firms face an uphill struggle to refinancetheir debt. But a commodity hedge has given US energy giant Calpine Corp considerableflexibility in its $800 million bond issue. By James Ockenden

Nuclear renaissance

Both Canadian and US governments want to bring more nuclear power capacity online, but will the private investors come? By Catherine Lacoursière

TVA will go bust, say academics

US academics say that the Tennessee Valley Authority would be close to bankruptcy if it were not for the promise of a government bailout, reports Paul Lyon

Radioactiveliabilities

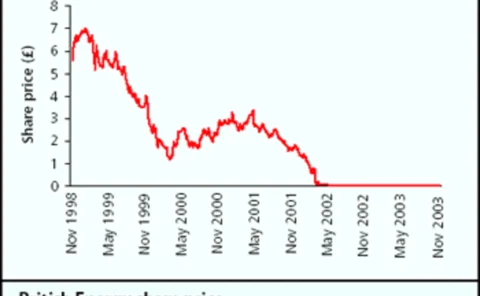

Creditors have agreed nuclear generator British Energy’s restructuring package. But without European Union agreement over the UK government’s £4 billion in subsidy, these creditor agreements could be meaningless. James Ockenden reports

A slow recovery

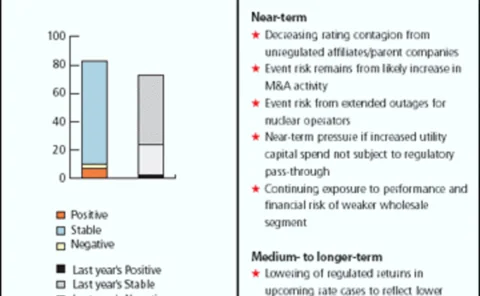

Recent research carried out by Fitch Ratings says the energy merchant sector has made great strides towards solving its near-term liquidity woes. But there is much work still to be done, finds Paul Lyon

Calpine completes project financing in Wisconsin

California power company Calpine Corp has completed a $230 million non-recourse project financing for its 600-megawatt (MW) gas-fuelled electricity-generating Riverside Energy Center in Beloit, Wisconsin.

Watching the home front

The growing international controversy about Iran’s nuclear ambitions as well as internal unrest may stall foreign investment in the country’s energy sector in a way that US sanctions have failed to do. Maria Kielmas reports

Tennessee’s valley of debt

Tennessee Valley Authority’s power plant financing arrangements should be measured as debt, says the US General Accounting Office, thereby putting further pressure on its politically sensitive and federally restricted debt levels. Paul Lyon reports

All talk, no action

Cancelled power plant auctions and the complexities of asset debt structures are bad news for the boutiques set up to acquire power assets. The boutiques talk a good business plan – but execution may prove troublesome, as Paul Lyon discovers

People swaps

SG reshuffles project finance and utilities divisions SG Corporate & Investment Banking, a subsidiary of Société Générale, has named Matthew Vickerstaff and Roger Bredder as the respective heads of project finance for Europe and the Americas. London…

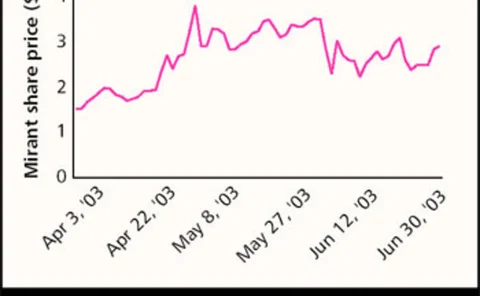

Mirant raises prospect of bankruptcy

Energy company Mirant asked its bank lenders to approve a pre-packaged bankruptcy plan in June, suggesting the Atlanta-based company could be forced to file for Chapter 11 bankruptcy.