Financing

Francois-Xavier Saint Macary

It can’t be easy hauling a whole commodities division overseas, but SG CIB veteran Francois-Xavier Saint Macary has big ambitions. By Oliver Holtaway

A good time to build

US utilities may need to spend more than $100 billion in the next 25 years on new power plants and transmission capacity. Richard McMahon looks at how utilities are assessing long-term risks and attracting potential investors

Trusts gain traction

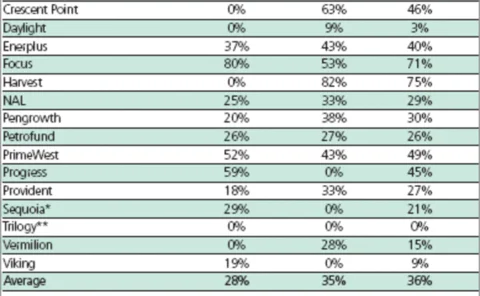

Canadian oil and gas companies are rushing to convert to royalty trusts, despite the stigma some attach to them. This is good news for the energy-hedging market, but some still have reservations about the trust sector. By Joe Marsh

ABN Amro expands commodity-trading team, opens Singapore office

Dutch bank ABN Amro has made several commodity trading and marketing hires in London and New York, and opened an office in Singapore.

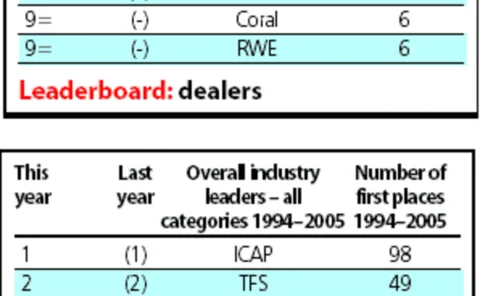

Rankings 2005

The energy markets gave corporates and funds plenty to think about in 2004 – and while the banks still dominate the rankings, some sectors have been taken over for the first time by energy companies. All is revealed in this year’s comprehensive round-up.

The experts excel

The fast and furious energy markets gave corporates and funds plenty to think about in 2004 – and while the banks still dominate the energy rankings, some sectors have been taken over for the first time by energy companies. By James Ockenden and Joe Marsh

A good bet for 2005

2005 is forecast to be a tough year for many hedge funds, but the saturation of some of their traditional markets could prove a boon to the energy sector, finds Stella Farrington

BofA reports improved commodity-trading income

North Carolina-based Bank of America yesterday reported revenues of $45 million from commodity trading in its full-year 2004 results, up from a loss of $45 million for 2003. The investment bank's recovery came amid strong overall financial results for…

A new breed of bond

Issuance of rate reduction bonds by utilities may be down, but the market is preparing for a surge in new asset-backed securities derived from the stranded cost model. By Catherine Lacoursiere

GE Commercial Finance Energy Financial Services to arrange and underwrite debt

Energy companies now have another option when it comes to choosing who will help finance a project or arrange a debt placement for them. GE Commercial Finance Energy Financial Services is to broaden its role as an equity and debt investor to include…

Bankrupt Mirant seeks more time to file restructuring plan

Bankrupt US energy marketer Mirant has sought a further 90 days in which to file its plan of reorganisation for emerging from Chapter 11 protection from creditors. It filed the request with the US Bankruptcy Court on Monday, and this would be the third…

CMS Energy to sell $200m of convertible senior notes

CMS Energy intends to offer for sale $200 million of convertible senior notes due on December 1, 2024, but would not reveal the rate of interest they will pay.

BarCap launches commodity-linked credit product

Fixed-income investors can now make use of a credit instrument that provides access to commodities as an asset class, says Barclays Capital. The investment bank has launched Apollo, a collateralised commodity obligation (CCO), which uses derivatives…

Merrill Lynch completes Entergy-Koch takeover

Investment bank Merrill Lynch today completed its acquisition of Entergy-Koch Trading (EKT), a venture of New Orleans-based energy company Entergy Corp and Kansas-based Koch Industries (see Energy Risk , October 2004, p.6).

OGE Energy gets $550m credit line

OGE Energy Corp has arranged two new revolving credit facilities totaling $550 million with a 16-bank group led by Wachovia Securities and JP Morgan Securities. The facilities replace $400 million of existing credit lines due to expire this year.

A legal rollercoaster

US-based Polygon wants to see a better restructuring deal for British Energy’sshareholders. But the hedge fund faces a struggle to prevent the UK nuclear powergenerator from delisting. Joe Marsh reports

Best laid plans

Growing interest in commodities on all sides mean energy products will be a good bet in 2005. And this has led to the increased popularity of new forms of structured correlation products. By James Ockenden and Joe Marsh

Allegheny Energy makes $152m from share sale

Pennsylvania-based Allegheny Energy has sold 10 million shares for $151.5 million to four institutional investors. The company intends to use the proceeds to reduce debt as part of its plan to repay $1.5 billion in debt by the end of 2005.

Oneok gets new $1bn financing and agrees to buy US gas co

Oklahoma-based energy company Oneok has obtained a five-year, $1 billion credit line from a group of banks to fund asset purchases. The company has also agreed to buy pipeline operator Northern Plains Natural Gas Company from asset acquisition company…

Aquila completes $330m refinancing and pays off $430m loan

Kansas City-based energy company Aquila has made further moves to reduce its debt with two new 364-day unsecured financings: a $110 million revolving credit facility and a $220 million term loan facility. The company borrowed the full amount under the…

Dominion forward-sells shares to obtain equity on demand

Virginia-based energy company Dominion has forward-sold 10 million shares of its common stock in a block trade to JP Morgan Securities. The deal was done in connection with a forward-sale agreement between Dominion and investment bank Merrill Lynch. It…

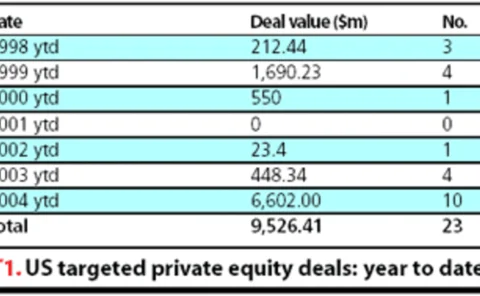

Buyouts are back

Private equity funds have been making bold inroads into energy markets in the past year – the number of deals has doubled since 2003, and the acquisitions are getting bigger. CatherineLacoursiere reports

SG sets up $100m credit facility for Kazakh energy company

SG Corporate & Investment Banking (SGCIB) said earlier this week that it has arranged an unsecured 66-month $100 million loan and hedging facility for Canada-based PetroKazakhstan Kumkol Resources (PKKR). PKKR is a subsidiary of PetroKazakhstan Inc, an…

Merrill Lynch snaps up Entergy-Koch Trading

Investment bank Merrill Lynch is set to acquire the energy trading businesses of Entergy-Koch Trading (EKT), a joint venture between New Orleans-based Entergy Corp and Koch Industries in Kansas. Energy Risk reported in June that the bank was a top…