Financing

Possible CME move for Nymex muddies the waters

The Chicago Mercantile Exchange's potential bid for a stake in the New York Mercantile Exchange could further heighten tensions at Nymex over the agreed deal with General Atlantic. That's if the CME comes up with a concrete proposal

Prepay agreements - The ten-year pitch

Standard & Poor's recently passed the $1 billion mark in terms of natural gas prepayment deals it has rated since 2003. Joe Marsh looks at how these work and why municipal utilities might want to consider them

SocGen opens Calgary office, launches Canadian energy-services partnership

SG Corporate & Investment Banking (SG CIB) has partnered with Calgary-based energy-sector investment dealer FirstEnergy Capital Corp to jointly offer energy-financing services to the firms’ Canadian clients. SG CIB, part of French bank Société Générale,…

Nice price for Ice as exchange floats

Atlanta-based energy-trading platform IntercontinentalExchange (Ice) hit the ground running as a public company today, pricing at $26 per share – at the top of its $24-$26 target range.

CFO Burns to leave Mirant after Chapter 11

Michele Burns, who has overseen the recent Chapter 11 restructuring of US energy marketer Mirant, will leave the company once it has emerged from bankruptcy.

National Bank of Canada reunites heavy hitters for energy push

National Bank of Canada (NBC) has expanded its energy derivatives team in Calgary with three new managing directors, with the aim of attracting more utility and energy-consumer customers.

Energy trading helps JP Morgan post record results

Energy-trading revenues played a big role in bringing JP Morgan a 2005 third-quarter net profit of $2.5 billion, up from $1.4 billion in 2004. This was on the back of third-quarter net revenues of $15.6 billion, up from $13.6 billion in the same period…

US physical clearing firm gets credit support from CSFB

Investment bank Credit Suisse First Boston is to provide credit support for North American Energy Credit and Clearing’s (NECC’s) services in physical energy markets.

BEAU TAYLOR

Beau Taylor , global head of energy at JP Morgan, plans to turn the bank from a niche participant into a dominant player in the energy markets. By Joe Marsh

Finance and faith

Islamic shari’a law may prohibit interest, but far from discouraging investment, shari’a-compliant structured project finance looks set to grow – particularly in the energy arena, as Maria Kielmas reports

Nymex plans to sell 10% stake to private equity firm

The New York Mercantile Exchange (Nymex) has signalled its intention to sell a 10% equity stake to General Atlantic, a US-based private equity firm, for $135 million.

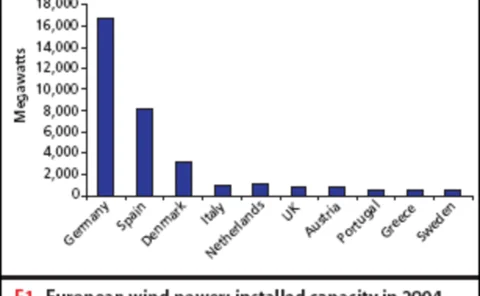

Blowing hot and cold

Across Europe, government enthusiasm and support for wind energy will dictate the ability for wind project sponsors to refinance project loans via the bond market. Jan Willem Plantagie of Standard & Poor’s explains

Louise Kitchen joins Deutsche

Louise Kitchen will join Deutsche Bank as managing director and global head of commodities structuring and marketing within its global markets division, the firm has announced.