Stella Farrington

Stella Farrington has been writing about developments in energy markets for over 20 years, working at Futures World News and Dow Jones Newswires before moving to Energy Risk in 2004. She spent eight years as the editor of Energy Risk and six years as a writer, before moving into her current role, in 2018, as Energy Risk’s head of content.

Follow Stella

Articles by Stella Farrington

Energy firms rely on patched-up solutions for reporting

Under new rules in Europe and the US, energy firms have to aggregate trade data from a variety of internal sources and report it to repositories. While it was hoped this process could lead to wider improvements in analytics, risk management and…

UK power market investigation overshadowed by EMR

A Competition and Markets Authority (CMA) probe into the UK power market, which may result in a radical shake-up of the sector, is coming amid major changes to the industry under Electricity Market Reform. How the CMA reconciles this will be closely…

Bespoke OTC reporting a struggle for energy firms

European energy trading firms say they are finding compliance with Emir trade reporting rules onerous and heavily reliant on manual intervention, particularly when it comes to non-standard trades

Moody's forecasts surprisingly stable UK power prices

Analysts at Moody's Investors Service believe UK electricity prices will remain steady until 2020, a prediction at odds with market consensus and government forecasts

Energy trading firms may rue the decline of quants

Quant finance transformed energy markets, but has been met with a lack of enthusiasm and investment since the financial crisis. That is a shame, say industry veterans, who point to a number of areas that could benefit from a renewed focus on quantitative…

UK electricity market likely to be hit by CMA probe

A shake-up of the UK power market is viewed as one likely outcome from a competition investigation into the country’s energy sector, but observers say the probe is being overshadowed by forthcoming regulatory reform

UK Electricity Market Reform welcomed by energy chiefs

Energy executives welcome the UK government's Electricity Market Reform at a conference in London, despite some differences between speakers on the finer details and likely future of the legislation

UK competition probe will 'rebuild trust' says EDF Energy chief

Vincent de Rivaz, the chief executive of supplier EDF Energy, says he supports a proposal by Ofgem to refer the UK energy market to the Competition and Markets Authority

Quants: how they shaped the modern energy market

Nowadays, quants are well established in energy trading. But the original introduction of quantitative techniques to the industry was far from straightforward, with a lot of hard work involved in adapting financial market models to the energy arena…

Tradition’s Pinchin looks back on successes and failures

David Pinchin, co-founder of Tradition Financial Services, speaks to Stella Farrington about his 30-year career in derivatives markets and how it informs his more recent work with disadvantaged youths

Carbon reform may be shaken by European Parliament vote

Proposals designed to address the problem of oversupply in the EU ETS – including the EC’s proposal for a market stability reserve – are likely to become harder to pass thanks to recent elections, say analysts

Quant energy models need greater emphasis on fundamentals

Boom in shale oil and gas extraction, and growth in renewables underline importance of reflecting fundamental factors in quant models, argue experts

OIES trying to fuel debate on energy markets, says Fattouh

Unlike other research houses, the Oxford Institute for Energy Studies does not toe a single editorial line and occasionally publishes opposing views on the same topic. But far from being a drawback, that is what makes the institute great, argues…

Power market coupling could spur derivatives activity

Market coupling may result in greater derivatives use and falling participation in both explicit auctions and physical nominations, survey finds

Firms expect power market coupling to have tangible impact

The process of power market coupling is continuing across Europe, with the largest and most ambitious project to date going live in February. But how do market participants feel about market coupling and how it will affect their businesses? Stella…

Renewables risk derailing benefits of EU power integration

Renewable subsidies and capacity payments threaten to quell advantages brought about by European electricity market coupling, complain industry participants

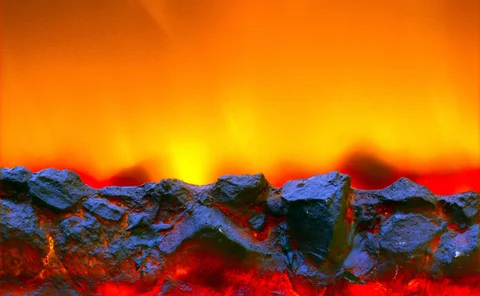

Coal derivatives market fosters burning ambition

Increased attention from both traders and hedgers is providing a boost to the coal derivatives market, say participants, fuelling the success of the API 8 index linked to Chinese coal imports and stimulating further product development efforts elsewhere…

Coal derivatives market fired up by new participants

Commodity traders and physical producers move into coal derivatives as major banks retreat

Off-the-shelf ETRM software taking off, survey reveals

Off-the-shelf energy trading and risk management (ETRM) systems are more popular than ever before, according to Energy Risk’s annual software survey. However, companies say they still require significant customisation and rarely meet all their ETRM needs…

Oil benchmarks need reform, says Vitol's Taylor

Oil industry needs to make issue of dwindling benchmark production a top priority, says Vitol chief

Energy firms' systems not ready for regulation, survey finds

ETRM systems are ill-prepared for financial and energy market regulation, according to Energy Risk survey

UK power special report

UK Electricity Market Reform will have major ramifications for power market participants. Stella Farrington explores the likely impact

UK power reforms set to make prices lower and more volatile

Market participants not doing enough to adjust to likely effects of EMR, say experts, including volatility and low prices

EMR may rescue UK renewable PPA market

UK Electricity Market Reform expected to give boost to flagging power purchase agreement market for renewable generators