Risk Staff

Follow Risk

Articles by Risk Staff

Iberdrola’s inroads

Spanish utility Iberdrola supplied almost a third of its home country’selectricity in 2003. And with a joint Iberian energy market scheduled to startin March, the firm has plans for further expansion into Portugal. By Joe Marsh

Good neighbours

Spanish and Portuguese energy market participants are hopeful that a joint Spanish-Portuguesepower market is imminent. But how competitive will the Portuguese side of themarket be? Joe Marsh reports

Texan retail therapy

Certain large Texas electricity suppliers want to reduce debt following significantlosses. So their retail divisions are trying harder than ever to squeeze moreprofits from a fiercely competitive retail market. JoeMarsh reports

Shaping the curve

A shaped forward curve is important for both trading and risk management. Here, Giorgio Cabibbo and Stefano Fiorenzani provide a model for shaping electricityforward curves that is consistent with both financial theory and market practice.Here, they…

SunGard acquires ASP pioneer Kiodex

SunGard has acquired New York based Kiodex, a supplier of web-based risk management, financial reporting, FAS 133 compliance and market data solutions for companies exposed to commodity price risk.

Samantha Unger

Evolution Market’s newest broker has achieved industry veteran status after just five years inemissions markets. James Ockenden talks to Samantha Unger

Huberator’s hopes

APX and Fluxys subsidiary Huberator are planning to launch a gas exchange forthe Zeebrugge hub in early 2005. But is an exchange really needed by the tradingcommunity? Paul Lyon reports

All systems go

More than 450 of you voted and voiced your concerns in Energy Risk’s inaugural User Choice Awards. Below we show which suppliers you voted for as top of their field in the energy business this year

Dealings in diesel

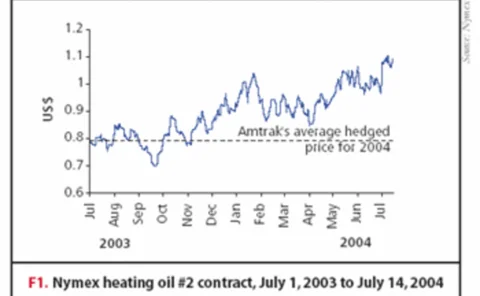

In the latest in a series of articles in which Energy Risk profiles energy users’ risk management and hedging strategies, Joe Marsh talks to US rail company Amtrakabout how it deals with its fuel exposures

Putin’s endgame

The geopolitical premium on oil prices is rising as Russia pursues its ‘oligarchs’. Catherine Lacoursiere reports on the wider effects of Russian oil giant Yukos’ collapse

Looking to the east

Can power market operators in the new EU member states in eastern Europe gainthe liquidity they need to challenge either bilateral electricity contracts orthe established exchanges? Joe Marsh reports

Raining information

Weather data is becoming increasingly accessible and more detailed, and – in Europe at least – publicly available data looks set to become less costly. Joe Marsh reports oncurrent developments in the weather risk market

Accepting responsibility

Alex Schippers heads ABN Amro’s weather team – arguably one of the most innovative desks in Europe. Here he talks to Paul Lyon about the state of the global weather risk market

Weather wrap-up

Energy Risk’s inaugural weather derivatives survey shows that traders and end-users appearto be confident about the state of their business, despite high-profile exitsfrom the industry in recent years. Paul Lyon analyses the results

Following the trend

The analysis of historical meterological data is vital for structuring weatherderivatives. But how should weather traders deal with the trends that may existsin the data? Steve Jewson and JeremyPenzer investigate

Singing in the rain

Melbourne-based Southern Hydro Partnership signed its first precipitation hedgelast year – a landmark deal that paved the way for a number of other contractsto protect itself from the risk of low rainfall. Paul Lyon reports

Building load links

In the third article in this series, Les Clewlow , ChrisStrickland and MichaelBooth show how the Monte Carlo techniques used in previous articles can accuratelyhighlight the crucial relationship between price and load – a complex correlationaffecting the…

Vertical take-off

As UK supplier Centrica narrows its focus to fund an asset acquisition spree, James Ockenden finds the ‘asset-light’ utility model has finallybeen buried and a move towards ‘vertical integration’ is now thestrategy of choice

A decent exposure

Most energy companies have a portfolio of over-the-counter energy derivativesthat could have significant credit exposures. In this paper, RafaelMendible examines the credit exposure of these derivatives, its relationto volatility,and its relation to…

Viva lost vegas

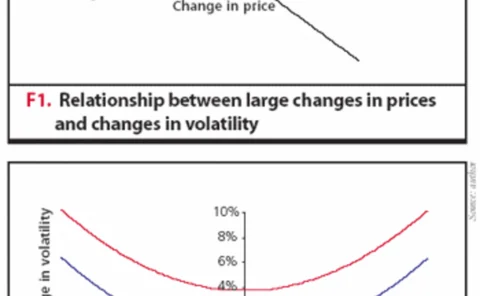

Brett Humphreys discusses the problems of calculating true value-at-risk on aconcentrated options portfolio – in particular, the various pitfalls thatcan befall a risk manager in ignoring vega risk – and considers ways ofhandling these issues

Wolverine to be market maker for Japanese weather futures

Wolverine Trading, the Chicago-based energy trading company, will be the lead market maker for Japanese weather futures soon to be offered by the Chicago Mercantile Exchange (CME).

The liquidity makers

Hedge funds are bringing liquidity to the structured end of commodity markets,and some – such as Citadel – are even trading in physical energyproducts. This can only make energy markets more efficient, finds James Ockenden

At ease with ethanol

Central Illinois Energy, a US farming co-op, is in the process of building anethanol plant. And it has already started to think about hedging, reflectingthe growing sophistication of the US ethanol market. PaulLyon reports