Risk Staff

Follow Risk

Articles by Risk Staff

Sovereign solutions

As we saw last month, most governments prefer stabilisation funds over hedging to protect against oil price risks. But multilateral institutions such as the World Bank advise otherwise. By Maria Kielmas

Caught short

Given the difficulty China Aviation Oil is having closing its remaining illiquid positions, its derivative trading losses may be greater than first thought. James Ockenden and Stella Farrington report

Double exposure

Continuing our series on applications of Monte Carlo simulation to applied problems in energy risk management, Les Clewlow , Chris Strickland , Oleg Zakharov, and Scott Browne look at potential future exposure and the analogous measure of expected credit…

The ETS law is an ass

Consultant Chris Cook offers a sceptical view of the development of European emissions trading, and suggests a new global energy solution based on an alternative to the financial market paradigm

Powering prices

The UK supplies the lowest priced power in Europe, and its Department of Trade and Industry wants to keep it that way. So it has published a report uncovering how the European Emissions Trading Scheme will affect power prices across Europe. By James…

Open for business

The EU Emissions Trading Scheme began this month, but much of the success of the fledgling carbon market will hinge on the behaviour of the 5,000 small companies who make up the bulk of the market. By Stella Farrington

A Kyoto windfall

Heavy polluters needing to reduce emissions under new EU legislation may find a solution in the developing world under Kyoto’s Clean Development Mechanism. Stella Farrington reports

Trading techniques

Merchant generators make daily decisions on how to get the most from their assets.How much capacity should be sold in the day-ahead market and how much shouldbe set aside for the hourly market are seldom-studied but thorny questions. ShulangChen looks at…

Benchmark in limbo

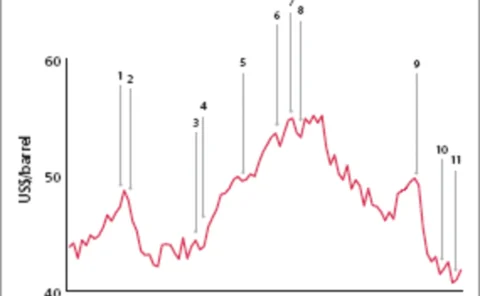

The development of a spot market for crude oil in the 1980s eventually led to oil futures trading and the need for benchmark pricing. With oil prices fluctuating wildly in the region in tandem with markets across the globe, theneed for price transparency…

Evolution in energy

The price of oil has undoubtedly been the top story in the energy sector overthe past year or so, but examined over a period of 10 years, the picture looksmore stable. If there’s one trend that has changed the energy markets inthe past decade, it has to…

The Energy Risk Team

The Energy Risk team of 2004 (above) wishes to thank its loyal readers, advertisers, sponsors and contributors for supporting the magazine through 10 years of tremendous market development. James Ockenden looks back over its history

The famous fifty

To celebrate Energy Risk’s 10th birthday, we have created the Energy Risk Hall of Fame: a group of individuals whose commitment and contribution to energy markets makes them a foundation of this business. Introduced by James Ockenden

AsiaRisk Awards

Here we feature two outstanding winners from our sister publication AsiaRisk’s Annual Awards, published in October. Thanks largely to Macquarie Bank, alternative investments are gaining a real foothold in Australia, while Westpac has been instumental in…

Ten years of trading

As an analyst and software designer who has spent the past ten years working closely with energy markets, Sandy Fielden had no problem identifying what had the most impact on his world in that time – technology. A regular Energy Risk contributor for some…

Back in power

As George W. Bush settles back into the White House for his second term, experts analyse the influence his energy and foreign policies may have on the energy industry both domestically and abroad. By Stella Farrington

Wolfgang Schollnberger

WOLFGANG SCHOLLNBERGER has spent 37 eventful years in the oil and gas industry. He talks to Stella Farrington about his vision for a sustainable energy mix

Oiling the wheels

Bribery and corruption is a hot topic, not least in the energy sector. Energy Risk this month looks at recent high-profile cases and what governments are doing to combat the problem. By Daren Allen and Kelly Williams

Volatility conspiracy

The concept of volatility is universally used by quantitative analysts. But is it a concrete idea or a false friend? And does it even exist? Energy quant Neil Palmer takes a look at its mysteries

The perfect balance

For most governments, hedging oil price risks on the financial markets is not impossible. But it is politically difficult. Most find instead opt for establishing ‘rainy day’ stabilisation funds. By Maria Kielmas

BITs in pieces

Argentina is launching a direct attack on the validity of investment treaties, and other countries may be about to follow its lead. How are investors responding to the challenge? Maria Kielmas reports

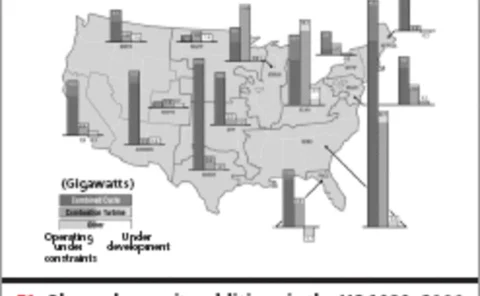

Utility 2025: a vision

Power companies will face enormous political, societal, and technological change over the next 20 years. Douglas Houseman and Dennis Taylor of Capgemini look at how the utility of the future should embrace change

Caring competition

What are the theoretical consequences of restructuring electricity markets on emissions? Here, Benoît Sévi shows that changes in supply and consumption and restructuring for competition has environmental effects, and argues that strong public policies…