Risk Staff

Follow Risk

Articles by Risk Staff

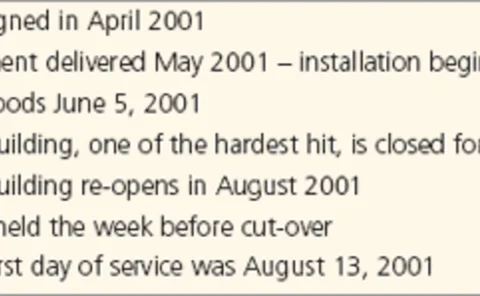

Calpine trades up

US power company Calpine installed a new trading floor this year due both to its own growth and its aim to provide more companies with energy services. Joe Marsh reports

Getting physical

Asset-backed trading strategies usually employ a combination of physicalpositions, which are subject to physical risk; and financial hedgingintruments, which are not. Here, Steve Leppard shows how value-at-risk,applied to this combined risk scenario, can…

Changing of the guard

Changes to the European gas market may further attract financial players, and tighten the rules in case of physical supply disruptions. Meanwhile changes in the UK gas market may lead to clearing at the hub. By James Ockenden

Ending the acrimony

Most utilities support hedging to mitigate price volatility, but are not sure how to communicate the benefits of hedging to their customers. Tim Simard of RiskAdvisory offers suggestions for improving the rate-hearing process

Trading techniques

A majority of merchant power plants built during the last few years in the US are combined-cycle units fired by natural gas. This article discusses asset-backed trading strategies for a merchant single-block power plant, showing how unit dispatches can…

UK traded gas market: What with liquidity?

The last two months have been a difficult time for UK gas traders; but Philippe Vedrenne and Marc Lansonneur from Gaselys say conditions will improve, leaving a market that may be stronger than ever

Balanced buying

Yijun Du and Xiaorui Hu present a general framework for applyingmodern portfolio theory to optimal natural gas procurements.They showthat successful natural gas procurement involves determining the optimalallocation between fixed-price and floating-price…

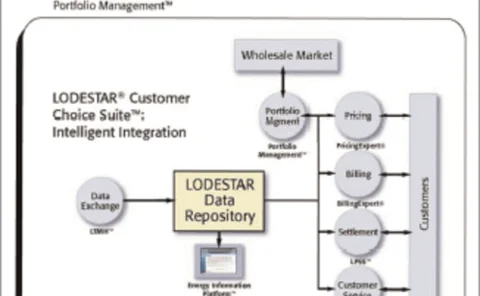

Strengthen your portfolio performance

Reduce costs and minimise exposure withLODESTAR® Portfolio ManagementTM

Weather wisdom with risk management

Mark Tawney from Swiss Re spells out the implications of not keeping an eye to the weather

Missing links

For utility companies with income streams linked to inflation, using inflation derivatives to match assets with liabilities easily and relatively cheaply must be the easy option? If only it were that simple. By John Ferry

A popular punt

Experts remain bullish about the flow of new money into catastrophe cover. But an influx of hedge funds backed increasingly by institutional capital has led to worries of a “domino effect”. By Maria Kielmas

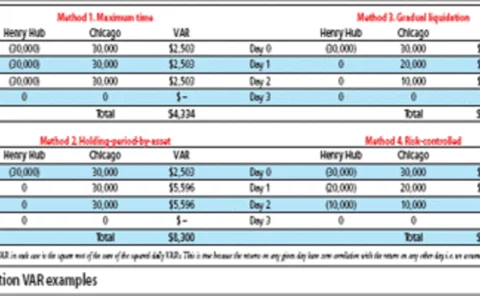

Risky liquidations

It is all too easy to go for the simplest solution when liquidating an energy portfolio of different positions. Brett Humphreys discusses some of the problems with appropriately calculating the VAR associated with liquidating a portfolio

Agree to disagree

Volatility in the dry freight market has led to the use of derivatives such as forward freight agreements and the development of other innovative products. But will they have a lasting impact on the energy markets? By Hann Ho

Taking cover

US energy companies are increasingly taking out terrorism cover, even though none has yet made a claim. This is partly because the cost of policy premiums is falling. But this trend may be under threat. Joe Marsh reports

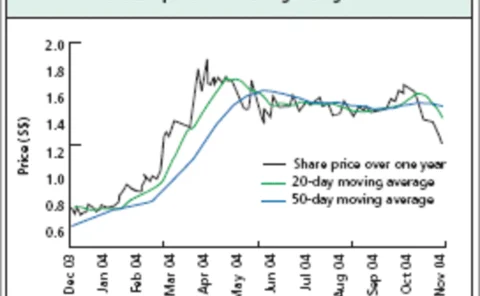

Playing monopoly

China Aviation Oil is well placed to benefit from China’s economic boom – thanks to its powerful jet-fuel supply monopoly. Yet there are still opportunities for those willing to develop new markets, finds James Ockenden

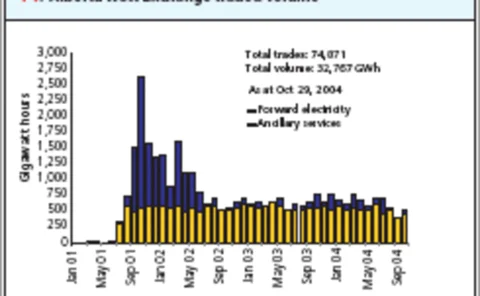

Clear intentions

The Alberta Watt Exchange in Calgary is already clearing over-the-counter electricity contracts and from next year will be able to clear natural gas as well. But how much liquidity will it attract? Joe Marsh reports

Ten years at the top

A decade of commodity rankings has seen many players come and go – but as James Ockenden finds, the top two investment banks, Morgan Stanley and Goldman Sachs, have been solid all the way

Ex-citations

Cutting Edge is one of the most popular sections in Energy Risk – the only energy magazine to run a full referee service for the academic community. The number of papers submitted has blossomed since our first paper three years ago. Here, Anusha Roy ,…

A surprising future

High oil prices are not triggering as large an upturn in oil exploration as was first expected, with many questioning how long the current situation will last. But high prices are having some rather unexpected effects. By Maria Kielmas

A slow squeeze

The oil price may have eased recently, but it remains high. What impact is this having on the global economy? Concerns remain for the long-term future of crude supply. Joe Marsh reports

A slice of the IPE

The fate of the Nymex Brent contract launched this month in Ireland – an undisguised attempt to grab business from the IPE – will be determined by Christmas, say Dublin floor traders. By Stella Farrington

Energising the US

Democratic presidential nominee John Kerry has plans to require the US to generate20% of its electricity from renewable sources. But just how different are Kerry’sand President Bush’s stances on energy policy? By Paul Lyon

Driving up the price

Nowhere has the spiralling cost of petroleum been more acutely felt than in the US, where the car is king. The rise is, of course, directly related to high crude oil prices, pushed ever higher by threats to production arising from worldwide political…