Risk Staff

Follow Risk

Articles by Risk Staff

Best laid plans

Growing interest in commodities on all sides mean energy products will be a good bet in 2005. And this has led to the increased popularity of new forms of structured correlation products. By James Ockenden and Joe Marsh

The windy city rules

The Chicago Climate Exchange is going from strength to strength if its new initiatives,new members and volumes are anything to go by. Here PaulLyon talks to CCX founderRichard Sandor about the exchange’s future

Avoiding the gas work

Ferc is exploring whether gas storage inventory details should be posted on adaily basis. How will this affect the development of the embryonic natural gasstorage swaps market? Paul Lyon reports

Earnings at risk

The structure of a typical energy portfolio often contains a different assetand contract mix from the simple derivatives instruments in a more standard portfolio.This requires a different approach to risk. Here, Les Clewlow and ChrisStrickland make the…

Found in translation

While risk managers have become focused on value-at-risk and similar risk metrics,these may not be the best way of communicating risk to stakeholders. BrettHumphreys discusses how to improve communications

Fabio Leoncini

Fabio Leoncini, head of the Italian association of energy suppliers and traders,outlines his efforts to get Italy’s energy market fully competitive. By Joe Marsh

Bilateral collateral

Until recently, there was little legal protection from foreign investment risk.But the past few years have seen the rise of the bilateral investment treaty(BIT). Matthew Saunders shows how BITs can benefit the energy sector

Pressure on Puhca

The US General Accounting Office is to investigate whether the SEC has been lax in its oversight of the Public Utility Holding Company Act. How will this affect firms subject to Puhca requirements? By Paul Lyon

A legal rollercoaster

US-based Polygon wants to see a better restructuring deal for British Energy’sshareholders. But the hedge fund faces a struggle to prevent the UK nuclear powergenerator from delisting. Joe Marsh reports

Pulp friction

In the latest of Energy Risk’s series of profiles featuring energy users’ riskmanagement and hedging strategies, Paul Lyon talks to Swedish pulp and papercompany SCA about how it deals with its sizeable energy exposures

Constant reminders

Enron has received court approval to emerge from one of the most expensive bankruptciesin history. But pending litigations and trials mean that the Enron spectre willstill loom large. By Paul Lyon

Storing up trouble

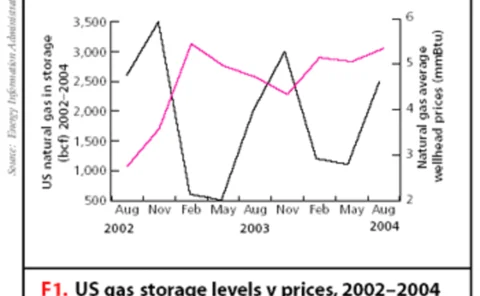

Utilities have become active hedgers against today’s high natural gas prices.In recent years, there has been a notable increase in both physical and financialhedging. Catherine Lacoursiere looks at whether storage is still a viable hedge

Auction advances

The Commonwealth of Virginia in the US has just completed an innovative auctionof nitrogen oxide emissions credits thanks to advice from Amerex and George MasonUniversity. Paul Lyon reports

James Newsome

James Newsome talks to James Ockenden about his position as Nymex’s newpresident, and how his previous chairmanship of the CFTC helps him in the role

Grain versus cane

Since Nybot listed a new futures contract for ethanol in May, the product hasemerged as a critical ingredient in US refining. Gasoline traders may find themselvesworrying about crop reports as much as they monitor Opec meetings and Nymex crude. Sandy…

Worth 1,000 words

There’s little point in spending time and money on extensive risk analysisif your audience is likely to switch off when you show your results. BrettHumphreys shows that sometimes, risk managers need to be able to telltheir stories well

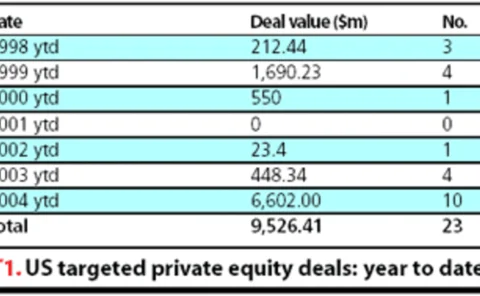

Buyouts are back

Private equity funds have been making bold inroads into energy markets in the past year – the number of deals has doubled since 2003, and the acquisitions are getting bigger. CatherineLacoursiere reports

Covering all the bases

Abstract: Many articles have discussed constructing models for either spot orforward prices. Yet none cover the whole process of constructing a joint modelfor both. Here, Andreas Huber and MonikaKrca develop a multi-factor model thatcaptures both the…

Teething troubles

Following decades of cloistered state control and the exit of a number of largeUS players, the Australian power market is going through a period of hiccups. Paul Lyon reports on the outlook for the country’s electricity sector

The matrix

Abstract: Portfolio-wide risk management requires a model that accounts correctlyfor the volatility of, and the correlations between electricity forward products.In this paper Kjersti Aas and KjetilK°aresen discuss a joint model for electricityforward…

A fresh landscape

Prebon Energy’s Kevin McDermott says that much has changed in the electricitybroking world post-Enron. And it’s all for the better. By Paul Lyon

A history lesson

Abstract: The size of bid/ask spreads in electricity options has both valuationand credit implications. Here, Ted Kury of The Energy Authority shows how toderive theoretical spreads using historical option price data so they can beused as liquidity…