Weather risk

Weather house of the year: Parameter Climate

Energy Risk Awards 2025: Advisory firm takes unique approach to scale weather derivatives markets

Weather house of the year: Endurance Global Weather

Team crafts innovative wind contracts to manage generators’ unique risks

Data provider of the year: StatWeather

StatWeather has impressed energy trading firms with the accuracy of its long-range forecasts, including during the North American polar vortex in late 2013 and early 2014

Weather house of the year: Munich Re Trading

The weather derivatives specialist has won praise for its consistent, high-quality service

Managing risk in agricultural commodities

Agricultural commodities are rarely written about in the mainstream financial media, and often only hit the headlines when an extreme weather event or natural disaster affects supply and prices.

Looking back: El Niño boosts weather derivatives

Liquidity in the OTC weather derivatives market has suffered repeated false starts over the years, including one reported by Energy Risk in December 1997 with the onset of the El Niño weather pattern

Weather House of the Year: Swiss Re

Swiss Re has continued to innovate in weather risk management during the past year, playing a key role in a landmark hydropower transaction with the World Bank

Polar vortex revives interest in gas and power hedging

A brutally cold winter in the eastern US has roiled natural gas and power markets and shocked energy consumers that had grown accustomed to cheap, abundant shale gas. Such firms are now hedging more actively, Alexander Osipovich finds

Renewables expected to drive demand for weather derivatives

Weather risk management firms predict renewables and thinner energy market liquidity will drive growth

Real to set sights on renewables after acquisition by Munich Re

Purchase of RenRe Energy Advisors could lead to new weather hedging tools for renewable energy

Energy firms tune in to weather forecasts

As weather forecasting becomes more accurate, utilities and banks are increasingly turning to it – not only to predict power and gas demand – but also to find arbitrage opportunities, writes Gillian Carr

Energy companies increase weather hedging

As temperatures rise and extreme events grow more common, energy companies have stepped up their hedging of weather risk, according to market participants. Alexander Osipovich reports

Weather House of the Year: RenRe Energy Advisors Ltd

RenRe Energy Advisors Ltd (Real) has won the Weather House of the Year award for the third year running after a successful 2011 in which it executed transactions on five continents, completed its first wind resource hedge for a major UK utility, and…

Energy Risk USA: Storms, warm winter, fuel interest in weather derivatives

The extreme weather that hit North America recently has spurred interest in tools designed to hedge weather risk, according to participants speaking at Energy Risk USA

Special report - Weather risk

This month's special report looks explores the state of play in the innovative weather derivatives market

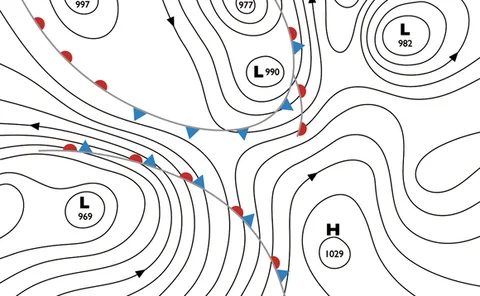

Weather risk: gauging the exposure

There is now an array of instruments available to hedge weather exposure, but evaluating that exposure is far harder than quantifying standard exposures such as commodity price risk. Garth Renne and Shaun Hatch discuss approaches to analysing wind and…

What lies ahead for weather risk management?

While products and participation continue to evolve, more education will be crucial to boosting weather derivatives use, experts say. Pauline McCallion speaks to market participants about how to continue the market’s evolution