Weather risk

Powernext launches weather indexes

French electricity exchange Powernext – in partnership with Météo France (the French meteorological office) – today started offering national European temperature indexes.

Shelter from the storm

Energy companies are showing increased interest in hurricane derivatives, a specialist product that can provide an additional layer of protection on top of insurance. Joe Marsh reports

Baiting the hook

End-users such as utilities and industrial companies are not showing the same keenness as hedge funds for trading weather derivatives, despite the efforts of banks, dealers and brokers to lure them in. By Joe Marsh

Growing up fast

Weather trading is seeing strong volume growth in the US, largely due to the influx of hedge funds into the market. Why such a big increase in interest, and what sort of strategies are the funds adopting? By Joe Marsh

Pricing the weather

Pricing weather derivatives is different from valuing other derivatives contracts – actuarial methods play a greater role. Steve Jewson looks at the varied approaches available

Strength in numbers

Weather derivatives seem to have a bright future: the market is enjoying record liquidity levels as new players, trading ever more diverse products, flood into the market. Oliver Holtaway reports

Editor

"Although end-users seem slow to enter the weather space, hedge funds already see it as a hotspot"

Making an impact

It can affect as much as 20% of the US economy, and nearly every industry worldwide is affected by it. But blaming poor results on the weather is no longer an excuse: weather derivatives are on the rise. Eric Fishhaut reports from Chicago on the growth…

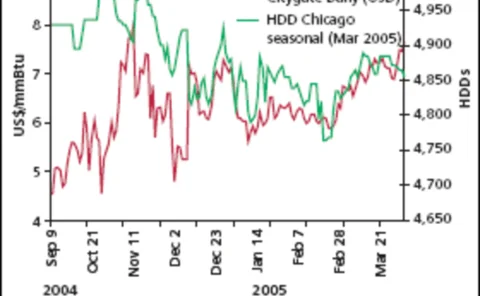

Weatherproofing the VAR

The weather derivatives market shares some similarities with other markets, but applying existing models can sometimes have disastrous results. Brett Humphreys and Eric Raleigh discuss how weather derivatives differ from financial derivatives and how we…

Growing up fast

Weather trading is seeing strong volume growth in the US, largely due to the influx of hedge funds into the market. Why such a big increase in interest, and what sort of strategies are the funds adopting? By Joe Marsh

Former Swiss Re weather experts launch hedge fund

Weather risk veterans Mark Tawney and Bill Windle, who left global reinsurer Swiss Re on July 7, are starting a hedge fund, named Takara, Energy Risk has learned. Weather trader Bill MacLauchlan departed Swiss Re at the same time, for personal reasons.

CME to launch more weather contracts

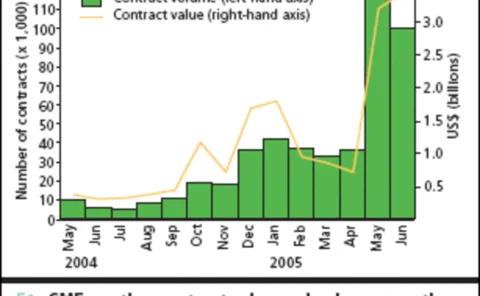

The Chicago Mercantile Exchange (CME) is set to list weather derivatives contracts for more cities in the US and Europe and to introduce two new types of weather contracts - probably by early July. Demand for CME weather contracts is fast increasing: as…

CME weather trading volumes already past those of 2004

Weather derivatives trading volumes for 2005 on the Chicago Mercantile Exchange have already surpassed last year's volumes, said the exchange yesterday. The number of contracts traded this year hit 124,177 on April 12, compared with 122,987 for the whole…

Weather wisdom with risk management

Mark Tawney from Swiss Re spells out the implications of not keeping an eye to the weather

Weather Board of Trade's Parker joins NIF

Dan Parker, formerly chief executive of Atlanta-based Weather Board of Trade (WBOT), has joined NIF Weather Risk Management, a division of New York-based insurance holding company NIF Group. He plans to use a weather index originally developed for use by…

Bright future for weather derivatives, finds survey

Energy Risk has completed its inaugural weather derivatives survey and the results show that traders appear to be confident about the state of their business, despite high profile exits from the industry in recent years.

Singing in the rain

Melbourne-based Southern Hydro Partnership signed its first precipitation hedgelast year – a landmark deal that paved the way for a number of other contractsto protect itself from the risk of low rainfall. Paul Lyon reports

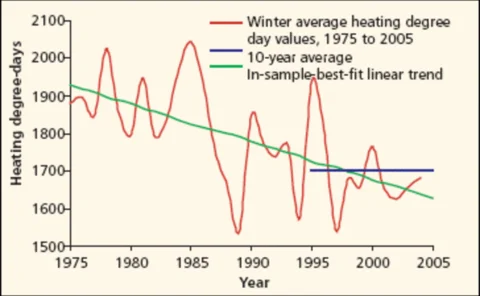

Following the trend

The analysis of historical meterological data is vital for structuring weatherderivatives. But how should weather traders deal with the trends that may existsin the data? Steve Jewson and JeremyPenzer investigate

Weather wrap-up

Energy Risk’s inaugural weather derivatives survey shows that traders and end-users appearto be confident about the state of their business, despite high-profile exitsfrom the industry in recent years. Paul Lyon analyses the results

Accepting responsibility

Alex Schippers heads ABN Amro’s weather team – arguably one of the most innovative desks in Europe. Here he talks to Paul Lyon about the state of the global weather risk market

Raining information

Weather data is becoming increasingly accessible and more detailed, and – in Europe at least – publicly available data looks set to become less costly. Joe Marsh reports oncurrent developments in the weather risk market

PSEG sets up weather desk

New Jersey-based utility Public Service Enterprise Group (PSEG) has established a weather derivatives desk. The desk is headed by Roman Kosecki.

Nymex and Tiffe consider weather derivatives

Both the New York Mercantile Exchange (Nymex) and The Tokyo International Financial Futures Exchange (Tiffe) are considering launching weather contracts.

Wolverine to be market maker for Japanese weather futures

Wolverine Trading, the Chicago-based energy trading company, will be the lead market maker for Japanese weather futures soon to be offered by the Chicago Mercantile Exchange (CME).