Gas

New FCA deadline for power and gas forwards ‘more realistic’, says industry

A decision to delay a deadline for brokers to review their classifications of physically settled gas and power forwards by two months has been welcomed by industry participants

Acer investigated 10 potential breaches of Remit in 2012

Acer probed 10 cases under Remit in 2012, agency says, in report that sheds light on the development of monitoring regime

Remit insider trading rules continue to confuse energy traders

Despite coming into force in December 2011, Remit insider trading rules continue to raise questions among energy traders

Liquidity seen as top concern for energy risk managers

Falling over-the-counter energy volumes in Europe and the US push liquidity to top of risk management agenda

Energy Risk Europe: Good times over for Europe's traders, says RWE's Krebber

Strain caused by regulation and renewables means European energy traders must adapt to survive, says RWE Supply & Trading CFO

The importance of trading to smart energy business models

Expertise in energy trading is vital to the success of smart energy business models, which rely on integrating decentralised generation assets with the wholesale energy market. That presents an opportunity for firms with the right skills, argue Jim…

European regulators get to grips with Remit monitoring

By mid-2014, the Regulation on Wholesale Energy Market Integrity and Transparency is expected to see European energy market participants reporting masses of information about their trading activity to regulators. How do regulators intend to use this data…

Energy Risk Glossary 2013

The Energy Risk Glossary: the most comprehensive reference source for anyone involved in the global energy markets

Gas market participants rail against mandatory bundling

The Agency for the Cooperation of Energy Regulators hopes a new network code on capacity allocation will promote a more efficient and open gas market in Europe. But market participants warn the principle of mandatory bundling embedded in the code could…

Ferc won’t appeal Hunter ruling, says Wellinghoff

Ferc chairman says agency won’t appeal ruling against it, but will seek to persuade Congress to change the law

Natural gas producers step up hedging

Hedging by North American natural gas producers increases as prices rebound

Basis trading to emerge in European gas

Natural gas basis swaps increasingly used in over-the-counter market and could eventually trade on exchanges

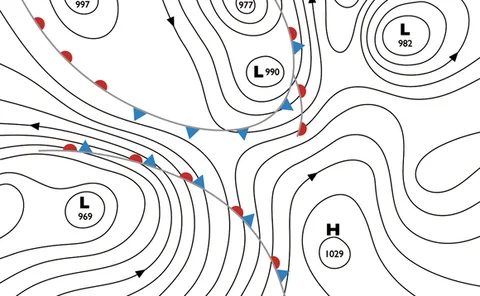

Energy firms tune in to weather forecasts

As weather forecasting becomes more accurate, utilities and banks are increasingly turning to it – not only to predict power and gas demand – but also to find arbitrage opportunities, writes Gillian Carr

Is risk modelling keeping up with the energy market?

Lean times in energy and commodity derivatives trading have caused a cutback in the amount of time and resources spent on energy risk modelling – a worrying trend that could leave firms unprepared for future market challenges, argue some experts. Mark…

New breed of upstream oil & gas firms have increased appetite for hedging

The growth of master limited partnerships in the North American energy sector is creating a new breed of exploration and production companies with an increased appetite for hedging. The biggest of these, Linn Energy, has hedged 100% of its production out…

Growing pressure to de-link European oil and gas prices

Gazprom’s latest renegotiations of its long-term gas supply contracts resulted in lower prices for the buyers, but no attempt to move away from oil indexation. But with spot gas prices in Europe forecast to remain depressed, the pressure to de-link oil…

Brazil’s electricity & gas markets

In this exclusive interview, the chief finance officer of Brazilian utility Cemig, Luiz Fernando Rolla, speaks with Gillian Carr about the development of the emerging Brazilian power and gas markets, and his company’s future plans

Risk management strategy low priority for many European energy buyers: survey

Most respondents think oil prices will rise – but few have risk management policies in place to cope with it

Enterprise-wide risk management: The power of cashflow-based metrics

The risks faced by energy/commodity firms need to be assessed via metrics that allow for longer-term outlooks and incorporate risks from asset-backed trading. In the second article in this series, Chris Strickland discusses the range of such metrics…

Turning points: First Utility’s Ian McCaig

First Utility’s Ian McCaig talks to Jay Maroo about the diverse career that led to his recent appointment as chief executive and his passion about changing energy buying habits in the UK

Energy Risk Deals of the Year 2012: SG CIB's Russian gas field financing

Société Générale Corporate & Investment Banking arrange €1.1bn financing for gas field in northern Russia

Energy Risk Deals of the Year 2012: BarCap's VPP deal with Chesapeake

Barclays Capital pioneers new volumetric payment deal with Chesapeake that allows more investors to take part

How relevant is VAR for energy markets?

Despite its many limitations, value-at-risk (VAR) is still the most commonly used risk profile measuring tool in the energy industry. In this first article in a new series, Chris Strickland discusses why the energy industry’s love affair with VAR could…