Enterprise risk

Trading positions

Energy Risk catches up with the latest appointments, promotions and departures in global commodity markets

EDF gets green light to invest in US nuclear

French energy company EDF and Constellation Energy, a Baltimore, Maryland-based power generator, have received regulatory approval for a nuclear joint venture announced in January.

FirstEnergy Capital announces international expansion

FirstEnergy Capital, an energy-focused Canadian investment bank, has opened an office in London, England.

Saudi Aramco switches to Argus Sour Crude Index

Saudi Arabia’s national oil company Saudi Aramco is to use the Argus Sour Crude Index (ASCI) published by Argus Media as the benchmark price for all grades of crude oil sold to US customers from January 2010.

Parity Energy introduces WhenTech valuations

Electronic trading platform Parity Energy has launched real-time option pricing through a collaboration with WhenTech Markets, a risk management and pricing software programme.

$12m US carbon offset deal announced

Goldman Sachs, Blue Source and CE2 Carbon Capital have announced details of a $12 million US carbon offset transaction.

StanChart signs $500m risk-sharing deal with Ofid

A $500 million trade-finance agreement has been signed between global bank Standard Chartered and the Organisation of Petroleum Exporting Countries Fund for International Development (Ofid), which aims to boost world trade flows for emerging market banks.

Sponsored statement: Perilous markets demand enterprise-wide risk management

Rampant volatility, illiquidity, dramatically shifting relationships between physical products and financial instruments and the scarcity of credit are stressing energy and commodity markets like never before. Against this backdrop of uncertainty, says…

Corporate profile: VTB Capital: A new entrant in the commodities market

Sergei Timokhovitch, Global Head of Commodities, discusses VTB Capital’s ambitious plans to develop its commodity business in these risky operating environments

Corporate statement: Are you re-evaluating your energy risk management provider?

Many energy-price-dependent organisations, such as utilities, independent power producers and oil and gas producers, saw their hedges at risk with the crumbling balance sheets of several key hedge providers. The global credit crisis has forced many…

Cutting edge: Visualising value-at-risk

Risk transparency is an important yet elusive goal of any risk management process. One challenge is to understand the diversification effects of the portfolio elements. Wentao Zhao and Kevin Kindall introduce a graphical technique based on value-at-risk…

Market focus: derivatives - Risky business

Companies that are heavy consumers of energy are particularly susceptible to market volatility. For such end-users, proper use of risk management techniques can mean make or break, says Eric Fishhaut of GlobalView

Evaluating credit & market exposure

Today’s volatile energy prices and the lower creditworthiness of some energy intensive users means energy providers have to assess counterparty risk thoroughly. David Coffman of GDF SUEZ Energy Resources provides some tips for assessing risk in the non…

Taking a health check

When global economic recovery eventually takes place, it is essential energy trading organisations are in a position to capitalise on market changes. Julie Shochat and Ryan Rogers of Enite set out some guidelines

Get ready for the revolution

Global events and climate change have fundamentally changed the face of energy procurement. Chris Bowden of Utilyx looks at the issues facing energy-intensive businesses in the UK

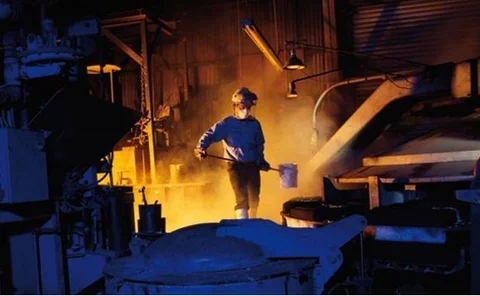

Building demand

One year after the collapse of Lehmans, fundamentals for the energy and metals markets continue to evolve, with emerging market demand, especially from China, set to have an increasing impact. Pauline McCallion discusses the outlook with experts

Trading positions

Energy Risk catches up with the latest appointments, promotions and departures in global commodities markets

CFTC boosts transparency with new report

The expansion of the CFTC’s Commitments of Traders report has garnered industry support in its attempt to enhance market transparency. Pauline McCallion reports

Corporate profile: Gazprom Marketing & Trading: energetic expansion

2009 marks 10 years since Gazprom Marketing & Trading was founded in the UK. Following another year of record financial results in 2008, the company’s executive team discusses Gazprom’s expansion into a leading global cross-commodity marketing and…