Enterprise risk

Trading positions - December 2010

Energy Risk catches up with the latest appointments, promotions and departures in global commodity markets

Proprietary trading conundrum

With implementation of the Dodd-Frank Act due to start next year, Alex Davis examines how the commodities markets stand to be affected by the Volcker rule

Q&A - Tom Lewis, CEO of the Green Exchange

Hot on the heels of the closure of the Chicago Climate Exchange, Nymex’s Green Exchange is preparing to become fully independent in January. However, is there scope for another environmental platform? Katie Holliday talks to Green Exchange’s CEO, Tom…

Carbon report: State of play for US cap and trade

As climate change slips off the national political agenda in the US, Pauline McCallion looks at the carbon cap-and-trade opportunities available at a state and regional level

Ex-UNFCCC chief: no legally binding agreement at Cop16

Yvo De Boer, previous executive secretary of the United Nations Framework Convention on Climate Change (UNFCCC) says that there will be no legally binding agreement drawn out at COP16

Malaysian Airlines cuts hedging programme

Malaysian Airlines (MAS) reduced its jet fuel hedging capacity amid uncertain price movements

Flexibility needed for risk management, say experts

Central and eastern European managers debate regional and global risk management strategies at Energy Risk's Central and East European conference in Warsaw

CEE power exchanges debate consolidation

Central and eastern European power officials debate prospects for a regional trading platform at Energy Risk's Central and East European conference in Warsaw.

Commissioner presses to speed up Dodd-Frank rule-making

CFTC continues derivatives reform rule-making, staff and commissioners concerned about timetable and resources

Sponsored Q&A: Standard Bank

With African roots and a presence in 17 African countries and 33 countries worldwide, Standard Bank has been working with commodities clients since 1994. In 2006, the bank hired Janelle Matharoo as managing director, global head of energy sales & trading…

Energy Risk Europe 2010

Energy Risk's 2010 annual Europe conference brought leading chief risk officers, quantitative analysts and regulators to London to discuss key risk management issues

Turning Points: Thomas McMahon, CEO Singapore Mercantile Exchange

The Singapore Mercantile Exchange’s chief executive Thomas McMahon tells Alex Davis about the lure of the trading floor and the events that have shaped his approach to risk

London conference report

Energy risk managers met in London in October for Energy Risk’s Europe 2010 conference to discuss the latest developments and prospects for the energy and commodities markets as the economic recovery takes root amid sweeping regulatory changes. Katie…

Energy Risk Asia Awards 2010 - photos

Highlights from the Energy Risk Asia Awards 2010 awards ceremony, held in Singapore on September 29, where we celebrated this year’s winners

Singapore conference report

Energy risk managers, end-users and producers from across Asia gathered for Energy Risk’s annual conference in Singapore in September to discuss how energy and commodities markets will evolve and face the challenges that lay ahead. Lianna Brinded reports

Nuclear industry weighs short-term pain for long-term gains

With increased use of nuclear energy currently the EU’s most likely route to ensuing both security of supply and low carbon emissions, Alex Davis examines the impact such a policy could have for energy risk managers

Q&A – Standard Chartered Bank’s Afaq Khan

Commodities derivatives are used in the West for speculative trading as well as a hedging method to cover commercial risk. Lianna Brinded looks at sharia-compliant products and their role in energy and commodity risk management

US regulators turn light on rule-making and enforcement

As energy companies work to comply with a range of new industry rules, how can risk managers ensure a robust compliance regime that is in step with the changing regulatory environment? Pauline McCallion finds out

Trading positions - November 2010

Energy Risk catches up with the latest appointments, promotions and departures in the global commodity markets

Uncertainty over phase III EU carbon plans a ‘nightmare’

Risk managers face a CDM ‘nightmare’ when managing their carbon portfolios in the face of post-2012 uncertainties, according to carbon market experts, as Katie Holliday reports

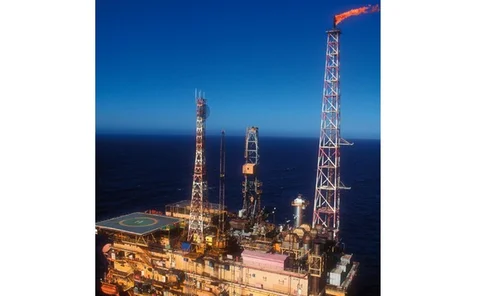

Petrobras raises the stake for unconventional oil

The Petrobras share sale at the end of September set a world record, with $70 billion raised. Alex Davis examines how this is a good omen for risk appetite in deep-water drilling

Optimising and hedging power generation assets

The head of risk at Spanish utility company Endesa speaks to Lianna Brinded about the co-ordination of optimisation and hedging of power generation assets.