Enterprise risk

As US hurricane activity falls, Asian weather risk rises

US weather conditions are purported to become more neutral this year, but forecasters are already looking to Asia as a potential risk management growth area. Pauline McCallion reports

Trading positions - June 2011

Energy Risk catches up with the latest appointments, promotions and departures in global commodity markets

Challenges ahead as US coal exports grow

The US coal market could be facing an about-turn with regards to exports and imports. Pauline McCallion looks at the potential implications for trading and risk management among US producers

Libya and beyond: legal implications of force majeure

Civil unrest in Libya continues to have a major impact on commodity traders with interests in the country. Andrew Ridings and Darren Wall discuss the issues facing traders and examine the legal implications

Carbon 101 - the carbon market explained

While the ultimate aim of carbon trading is simple, the various trading schemes and how they fit together is fairly complex. Daniel Bloch explains the background to the major carbon trading schemes and various mechanisms currently in operation

Energy Risk USA - 2011 conference highlights

The 2011 Energy Risk USA conference in Houston provided the chance to interact with industry peers and hear about the latest energy market developments.Ned Molloy and Pauline McCallion report

Dodd-Frank: Summary of rule-making progress so far

As regulators approach the end of the Dodd-Frank rule-making period, Energy Risk details the proposals so far and considers what lies ahead for the new regulatory regime. By Peter Madigan with additional reporting by Pauline McCallion

Turning points: Duke Energy’s CRO, Swati Daji

Nothing creates a good risk officer like challenging times, says Duke Energy’s CRO, Swati Daji. She talks to Pauline McCallion about managing risks through both the good and the bad

Energy Risk USA: could anti-manipulation rule curb energy activity?

Dodd-Frank manipulation rules could “chill” energy market and boost regulatory infrastructure costs: ER USA panel

Acquisition boosts awareness of carbon capture and storage

2Co takeover of Powerfuel could improve profile of carbon capture and storage

Trend towards in-house clearing could increase fees and admin

The LME is the latest exchange considering whether to build its own clearing business. If the trend continues, banks could face more fees and administration

Will ruling create agreement on regulatory jurisdiction?

The FERC’s $30m fine for former a Amaranth trader has set a strong precedent for market manipulation cases, but regulatory overall jurisdiction remains unclear. Pauline McCallion reports

Trading positions - May 2011

Energy Risk catches up with the latest appointments, promotions and departures in global commodity markets

Profile: Diana Higgins, Director Crediten

Assessing counterparty credit can require the skills of a private detective, says Diana Higgins, talking to Stella Farrington about her credit risk career and the changing role of the credit function

Sponsored Q&A: Accenture Risk Management

The Federal Energy Regulatory Commission (FERC) Orders will dictate change in the wholesale electricity markets this year, requiring all regional transmission organisations, independent system operators and participants to respond. Executive Director at…

Sponsored Q&A: LIM

The nature of data delivery has changed in recent years and prompted data management companies to offer more flexible delivery options in order to stay competitive. LIM, a Morningstar company, is developing its technological capabilities to provide a…

Q&A: Tony Hall at Duet Commodities Fund

After turning one of the highest proprietary trading profits in the history of Credit Suisse Commodities in 2009, Tony Hall launched hedge fund Duet Commodities Fund last year. He will be delivering the keynote talk at Energy Risk’s Commodities and…

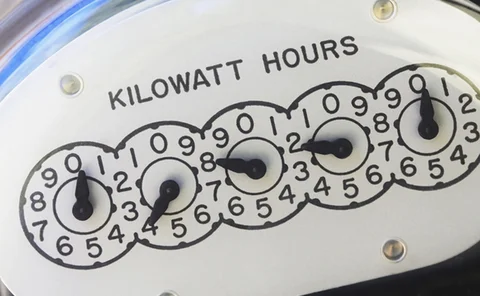

Can electricity demand response replace hedging?

How will greater use of demand response affect risk managers in the power sector? Pauline McCallion asks the experts

Incentivising CDM private sector investment

The Clean Development Mechanism plays a pivotal role in emissions reduction by incentivising investment in developing nations. Much effort has been put into CDM project development, but more should be done to generate additional demand for CDM…

Valuing non-standard load profile products

Load profile products in the European OTC power markets are attracting increasing attention. However, valuations for these non-standard products can be difficult, as Cregor Janssen and Jan Lueddeke discuss