Energy transition

Struggling for integration

Political issues are stalling Mexico’s energy sector reform just as the country is poised to become a major natural gas importer, reports Maria Kielmas

Quality data and solutions for a challenging market

FAME provides today’s uncertain energy market with transparent information and the tools to analyse it

El Paso helps RiskMetrics adapt

RiskMetrics Group, a company more often associated with the financial sector, is implementing its risk solution software at energy firm El Paso Corp. How is it adapting the software to the specifics of the energy sector? Kevin Foster reports

A long road to deregulation

Prospex Research’s Ben Tait reports on Spain and Portugal’s progress in integrating their power markets. High ambitions for deregulation are proving difficult to achieve

All clear for energy

Several organisations have brought over-the-counter clearing to the US energy markets over the past six months. Kevin Foster assesses their progress and asks whether they can all survive

Looking to the long term

After years of public debate, the European Commission, energy companies and governments of gas-producing countries all seem to agree that long-term gas contracts are here to stay. So why is it still such a big issue, asks Maria Kielmas

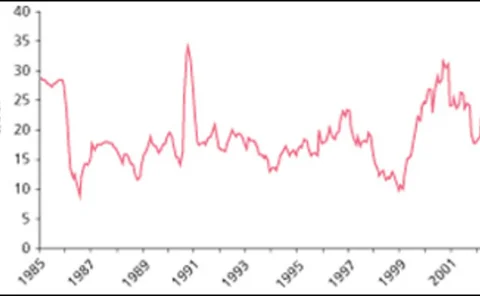

Fighting oil volatility

Oil cartel Opec froze its production output level at its last meeting in September. With war in Iraq on the cards, Shifa Rahman reports on the future of oil volatility

Going short under the SMD

Scott Greene, Mark Niehaus and Pankaj Sahay of PricewaterhouseCoopers look at the effect of settling a short position in the day-ahead market under the Federal Energy Regulatory Commission’s proposed standard market design

Doing the maths: physical value-at-risk

ABB’s William Rutz and Bob Fesmire investigate new tools that calculate physical value-at-risk based on simulations of generating resources and power transactions

Estimating oil price volatility: a Garch model

Nikolai Sidorenko, Michael Baron and Michael Rosenberg present a general framework for modelling energy price volatility. These models explain the volatility persistence and clustering present in many commodity prices. In addition, they can incorporate…

Through the looking glass

Unlike oil and natural gas, electricity generally suffers poor price transparency. Rachel Jacobson of FAME Information Services looks at power price discovery mechanisms in the US

Out of the zone: nodal pricing takes hold

Congestion-constrained US electricity markets are likely to find relief with the arrival of a new pricing regime, reports Catherine Lacoursière

A towering success

There is more to the Malaysian oil and natural gas giant Petronas than its impressive headquarters. One of Asia’s biggest energy players is finding new ways of branching out, as Joel Hanley discovers

Online trading moves forward

Online energy trading seems to have a bright future, despite the two biggest players – Dynegy Direct and EnronOnline – leaving the market, finds Catherine Lacoursière

Let’s get physical

Credit Lyonnais Rouse Derivatives is a commodity trader moving into natural gas trading. And not just on the financial side, as Joel Hanley discovers

Comeback in the old USSR

Russia is on the verge of becoming the world’s leading energy superpower, but a lack of investment looks set to hamper its development. Joel Hanley reports

Trouble at the paper mill

Maria Kielmas asks how energy users in Scandinavia are coping with medium-term price uncertainties and the threat of increased environmental legislation

A tight ship in rough waters

Power prices in the UK have fallen dramatically in recent months. What can the UK’s biggest power producer do to prevent more losses in this difficult market? Joel Hanley profiles British Energy

Cleaning up in California

As oil majors embrace the use of ethanol in Californian gasoline, analysts are warning that it will cause a rise in prices at the pump, as Kevin Foster discovers