Energy transition

Switching off to save cash

High electricity price volatility over the European summer has raised awareness of interruptible power contracts, finds James Ockenden

Farms weather power shortages

Farmers in both hemispheres are struggling to cope with heat waves and droughts while pondering the prospect of future power supply disruptions, finds Maria Kielmas

LNG could rescue the US

Sandy Fielden of energy market specialist Logical Information Machines looks at a potential solution to the US natural gas supply crisis: liquefied natural gas

All talk, no action

Cancelled power plant auctions and the complexities of asset debt structures are bad news for the boutiques set up to acquire power assets. The boutiques talk a good business plan – but execution may prove troublesome, as Paul Lyon discovers

People Swaps

ABN Amro hires global energy trading head Dutch bank ABN Amro has hired Jonathan Arginteanu to the newly created positionof senior vice-president and deputy head of global energy trading operationsin New York. He was previously head of rival bank BNP…

LNG not a short-term supply fix, warns US research firm

Liquified natural gas (LNG) will have a minimal impact on a significant US gas storage shortfall in the winter of 2003/2004, despite its long-term promise, says Energy Security Analysis Inc (Esai), a Boston-based research firm.

Austrian rail firm on the risk management fast track

Austria’s largest electricity consumer, rail firm Österreichische Bundesbahnen, talks to EPRM about its energy risk management strategy. And, as Paul Lyon discovers, other end-users could learn from the innovative company

In search of power solutions

Blackouts across Italy in early July highlight the need for power plant investment – and the new market operator says promotion of derivatives trading is necessary to encourage such investment. But producers are yet to bite, finds James Ockenden

US coal trading picks up steam

While the coal market awaits pricing indexes to reinvigorate trading, emissions trading is getting a boost from increased coal burning. Catherine Lacoursière reports

People swaps

SG reshuffles project finance and utilities divisions SG Corporate & Investment Banking, a subsidiary of Société Générale, has named Matthew Vickerstaff and Roger Bredder as the respective heads of project finance for Europe and the Americas. London…

LNG may not fix gas supply problem

Despite its long-term promise, liquified natural gas (LNG) will only have a minimal impact on a significant US gas storage shortfall in the winter of 2003/2004, says Energy Security Analysis Inc (Esai), a Boston-based research firm.

US pushes agreement on carbon storage research

The US government has launched an international research and development programme to reduce power plant emissions by pumping carbon dioxide (CO2) into deep storage.

California’s master plan

California’s energy regulators have an action plan to upgrade the electricity system. But if they don’t add generation, shortages could again hit. Kevin Foster reports

Seeking an end to manipulation

Renewed allegations of manipulation of natural gas pipeline capacity in the US have been partly blamed on regulatory complacency. How can regulators put an end to the problems dogging the gas markets? Catherine Lacoursière reports

...while AEP exits Nordic energy trading

Ohio-based American Electric Power (AEP) last month completed its exit from theNordic energy trading market. The management team responsible for AEP’sactivities in the Nordic region will assume AEP’s Nordic trading book,office leases and related…

US power sector decline slows, says Fitch

The US power sector has seen little more than a slowing in the rate of its declinein 2003, said Richard Hunter, managing director of rating agency Fitch’sglobal power group, in May.

David Mooney

With 34 trading offices active in 40 countries, Swiss commodity trading house Trafigura is no small concern. But while the firm – perhaps best known for its oil, petroleum products and metals trading activities – employs some 600 energy traders worldwide…

Kiodex adds more energy forward curves

Kiodex, an energy risk management technology company based in New York, willadd five new forward curves to its global market data offering, it told delegatesat EPRM’s May congress in Houston.

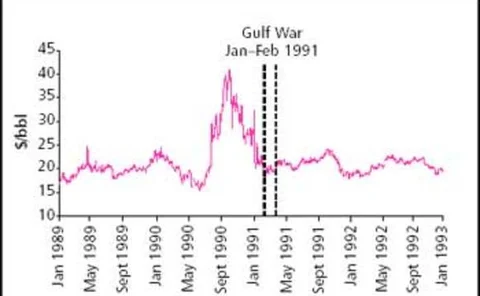

Detecting market transitions: from backwardation to contango and back

Svetlana Borovkova looks at detecting market transitions between backwardation and contango states using the forward curve. In this first part of a two-part article, she introduces two change indicators, which she applies to oil futures prices. Next…

CROs seen as vital for restoring confidence

Chief risk officers (CROs) have a vital role in helping shape the future of thetroubled energy sector and should report directly to their company’s boardif investor confidence is to be rebuilt in the industry. Vincent Kaminski, seniorvice-president of…

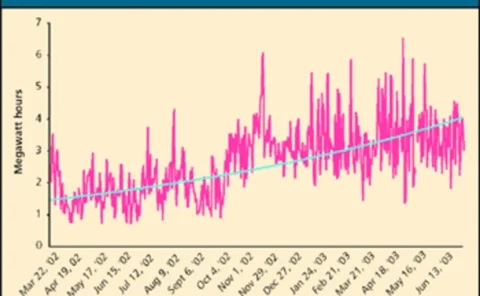

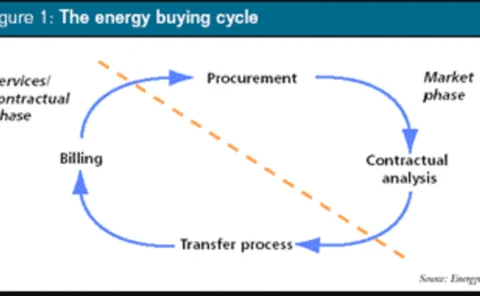

Buying your way out of trouble

UK high-street retailer Littlewoods has saved £1.5 million through an energy risk management and procurement programme. Utilyx’s Nigel Cornwall looks at how other companies can reduce energy costs through purchase programmes

Wanted: cash for new lines

Can Ferc’s standard market design encourage much-needed investment in the US power grid and develop a merchant model for transmission assets? By Kevin Foster

Speculate away

A new report argues that speculative trading in the crude oil markets contributes far less to volatility than its critics suggest. Kevin Foster looks at the arguments