Energy trading

Obama boosts biofuels and clean coal

US President Barack Obama has announced a series of measures designed to boost biofuel production and reduce US dependence on foreign oil.

BP CEO: Oil industry faces supply challenge

The oil industry will continue to face supply challenges in the long term, following China’s burgeoning demand for imports, said BP’s chief executive at the World Economic Forum in Davos, Switzerland.

Obama calls for comprehensive energy bill

In last night’s State of the Union address, President Barack Obama said he was eager to advance a bipartisan energy and climate change bill in the US Senate.

Gensler calls for tighter regulation of dealers

Commodity Futures Trading Commission (CFTC) chairman Gary Gensler refused to detail a timetable for imposing position limits on energy traders today, but called for tighter regulation of dealers in over-the-counter derivatives.

FMX Connect announces relaunch

FMX Connect has relaunched its online commodity and energy data portal.

United-Icap launches new technical analysis website

United-Icap, a division of Icap, has re-launched its website offering technical analysis for professional traders and individual investors.

UPDATED: Nymex follows Saudi sour crude endorsement with new contracts

Nymex is to launch two sour crude oil contracts after Saudi Aramco’s announcement this week that it will use the Argus Sour Crude Index (ASCI) as a benchmark for US sales from January 2010.

FirstEnergy Capital announces international expansion

FirstEnergy Capital, an energy-focused Canadian investment bank, has opened an office in London, England.

Obama awards $3.4bn in smart grid grants

President Barack Obama this week announced the largest single energy grid modernisation investment in US history.

Market focus: derivatives - Risky business

Companies that are heavy consumers of energy are particularly susceptible to market volatility. For such end-users, proper use of risk management techniques can mean make or break, says Eric Fishhaut of GlobalView

Evaluating credit & market exposure

Today’s volatile energy prices and the lower creditworthiness of some energy intensive users means energy providers have to assess counterparty risk thoroughly. David Coffman of GDF SUEZ Energy Resources provides some tips for assessing risk in the non…

Get ready for the revolution

Global events and climate change have fundamentally changed the face of energy procurement. Chris Bowden of Utilyx looks at the issues facing energy-intensive businesses in the UK

Buying smart

Guy Newsam, general manager at Muntons, a UK-based energy-intensive corporation, talks to Katie Holliday about how the company is addressing its exposure to volatile energy costs and carbon risk

White paper: Focused on the future – learning lessons from the past

In this white paper, Mark Konijnenberg, managing director commodities group at Citi, talks about developing trends in energy risk management since the extreme price volatility of 2008 and outlines how the group is keeping up to date with clients’ needs

Energy Risk -- New Website Video

Energy Risk editor Stella Farrington discusses the magazine's new online portal, and its benefits for the Energy Risk community.

Changing landscape

Not a year has passed since Energy Risk's 1994 launch without M&A activity between energy companies, banks or brokers. Roderick Bruce & Pauline McCallion chart the M&A history that forms today's players

Ukraine's next generation

DTEK, Ukraine's only privately owned power utility, wants to become a leading energy player linking Ukraine, Russia and Europe. Roderick Bruce meets Vitaly Butenko, DTEK's chief strategy officer, to discuss the company's progress and plans for expansion…

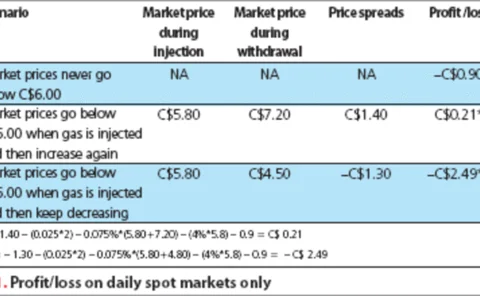

Storage strategies

Companies are increasingly realising they can use natural gas storage to add value to their bottom line. TransCanada’s Farzan Nathoo weighs up the strategies available for optimising value through storage

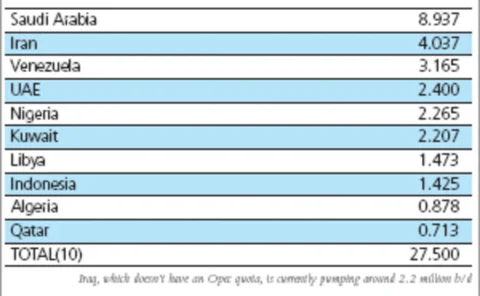

Has Opec lost control?

Minutes after Opec tried to cool scorching oil prices by announcing a hike in its output target, oil surged to record highs. Has Opec lost control, and is there anything it can do to bring prices down? Stella Farrington finds out

The battle for Brent

Open-outcry the IPE is over, but the debate over whether the screen can adequately replicate an oil market rages on, writes Stella Farrington