Energy trading

Enter the scrum

A surprise Opec headline can throw the market into a tailspin, but gathering the news can be even more frenetic. In March, one scrum even resulted in broken bones. Stella Farrington writes from Iran

A shift in perspective

As far as the electricity market is concerned, the EU emissions trading scheme is aimed only at the generation side of the market. But end users also affect carbon emissions levels. This could represent a missed opportunity. Here, Oliver Rix, Phil Grant…

Ethanol

The production of ethanol – a component of gasoline – is growing fast, which has led to the imminent launch of two ethanol futures contracts and a joint production venture involving Sempra Energy. By Joe Marsh

A bid for power

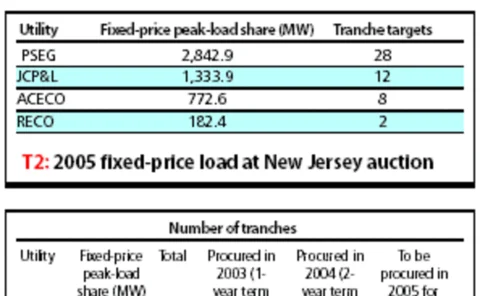

Clock auctions are a fairly recent method for utilities of procuring electricity from suppliers, but only New Jersey has an established process. Yet Ohio and Illinois are showing interest. Joe Marsh reports

Smoke without fire

The market for US financial coal swaps may be starting to show a little potential, but some major obstacles still remain before it catches alight – not least a widely accepted price index. By Joe Marsh

If the cap fits...

Legal compliance seems the only way to achieve cuts in carbon dioxide emissions. Europe is leading the way, but the US is some way from a similar approach, despite a regional initiative sparking some interest. Joe Marsh reports

Blending the rules

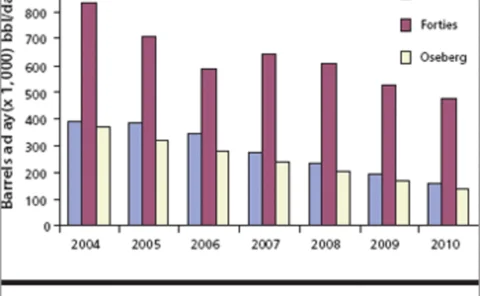

The speed of decline of North Sea crude raises fresh concerns over the suitability of the North Sea as a benchmark, and to worries over the value of long-dated derivatives contracts. By Stella Farrington

Bridging the gas gap

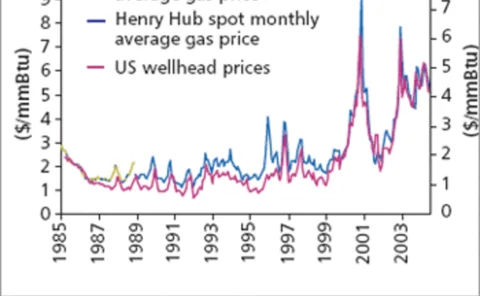

Volatility in the natural gas markets shows no sign of any let-up, which means that managing basis risk at Henry Hub continues to spur demand for increasingly innovative derivatives products. Catherine Lacoursiere reports

Clear intentions

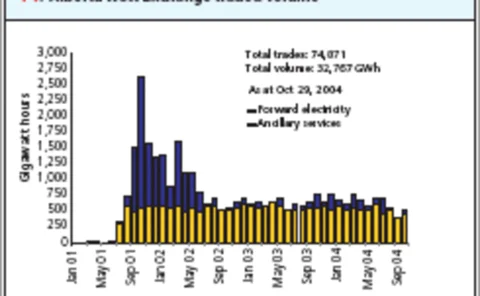

The Alberta Watt Exchange in Calgary is already clearing over-the-counter electricity contracts and from next year will be able to clear natural gas as well. But how much liquidity will it attract? Joe Marsh reports

Avoiding the gas work

Ferc is exploring whether gas storage inventory details should be posted on adaily basis. How will this affect the development of the embryonic natural gasstorage swaps market? Paul Lyon reports

Auction advances

The Commonwealth of Virginia in the US has just completed an innovative auctionof nitrogen oxide emissions credits thanks to advice from Amerex and George MasonUniversity. Paul Lyon reports

Pulp friction

In the latest of Energy Risk’s series of profiles featuring energy users’ riskmanagement and hedging strategies, Paul Lyon talks to Swedish pulp and papercompany SCA about how it deals with its sizeable energy exposures

The standard is set

Continuing last month’s focus on documentation under which commoditiesare traded on the UK’s National Balancing Point and Belgium’s ZeebruggeHub, using Isda’s European Gas Annex. By Agnes Bizet and Kevin Wulwik

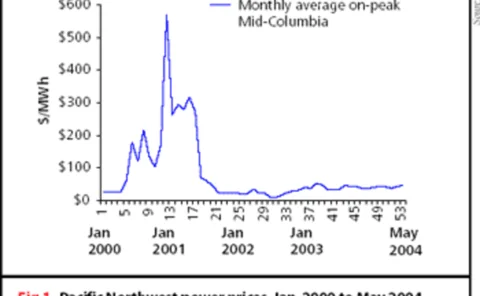

Northwest in excess

The Bonneville Power Administration’s power buyback scheme to tackle electricity shortages in the US Pacific Northwest in 2001 has worked rather too well. The region was left with bankrupt aluminium producers and a surplus of power that is not proving…

Hedging on the fly

In the first of a series of articles profiling energy users and their risk managementstrategies, we take a look at Texas-based Southwest Airlines, one of the mostactive hedgers in the aviation industry. By Joe Marsh

The cost of optimism

Petroleum engineers and financial regulators have never spoken the same language,as the recent Royal Dutch/Shell debacle has shown. And this has led to confusionover state oil reserves. By Maria Kielmas

Unlimited liability

Potential liabilities for European nuclear operators are set to rise sharply.Financial guarantees for nuclear operators will have to be restructured. Aregovernments and the insurance industry up to the task? MariaKielmas reports

Rethinking regulation

Market manipulation and inaccurate pricing led to the reregulation of Ontario’s electricity market. But at the right price, the Canadian province may see a revival of competition, reports CatherineLacoursière

Storage strategies

Abstract: Salt-dome storage facilities are a flexible way to take advantage of arbitrage opportunities in the natural gas market. Kislay Sinha and colleagues at Arizona Public Service discuss the valuation of a storage asset, examine ways of capturing…

Flying high

The US airline industry is struggling due to high jet fuel prices. Accordingly, one trade association is urging the Bush administration to change its oil purchasing strategy. By Paul Lyon

Protection treaty

Matthew Saunders , of law firm DLA, introduces the bilateral investment treaty which, though often overlooked, can be an effective method of affording legal protection for energy investments and minimising energy project risk

Capital calculations

The latest Committee of Chief Risk Officers white paper offers capital adequacy guidelines for energy merchants. But why should energy firms perform these calculations? Glyn Holton asks whether the CCRO has missed the point

In pursuit of the eurobarrel

The markets say they do not want oil prices in euros. But denominating internationalcrude prices in euros is a political ambition the European Union seems determinedto pursue – starting with Russia. MariaKielmas reports

Contract killing

The California Public Utilities Commission wants to renegotiate long-term contractsthe Department of Water Resources entered into during the state’s energycrisis. So far, Ferc has been less than receptive to the request. By Paul Lyon