Feature

Navigating a troubled road

Don Stowers finds the online energy trading market place as competitive as ever, with several new platforms ready to enter the fray

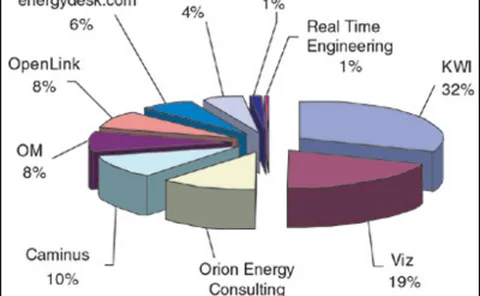

Many are called, few are chosen

The market for power trading technology in Europe is mirroring the energy industry in the intensity of its competition. Benjamin Tait reports

Growing quietly

The liberalised German markets now allow large industrial end-users to manage their energy price risk. But, while the competition to manage their exposures is large, these firms are playing their cards close to their chests, reports Joel Hanley

Clearing the way?

The German over-the-counter market has been growing quickly in recent years, but a series of shocks has sparked fears of credit risk exposure. Can trading regain recent highs and save the OTC market from credit-wary traders, asks Joel Hanley

At home and abroad

Given its location at the centre of Europe, Germany is the key to any future pan-European energy market. But some of its leading companies have their eyes on markets beyond continental Europe, reports Robin Lancaster

Out on its own

European countries tend to have an appointed power market regulator, but Germany has taken a self-regulatory approach. How does the electricity spot price behave as a result? Tobias Federico offers an econometric analysis

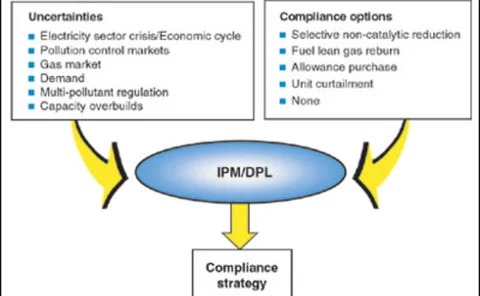

Controlling power

Maggi Shippy-Ksionsk and Stefan Ulreich explain how portfolio risk management gives a company control over its energy procurement

At the heart of Europe

As the rest of Europe has still to get fully to grips with cross-border energy trading in a liberalising environment, Germany, Austria and Switzerland are providing an example of a workable regional electricity market, says Eurof Thomas

Two hubs or one?

Independent traders are desperate for a hub that will provide real liquidity and help force the Ruhrgas-dominated German natural gas market to open to competition. Peter Joy reports

Opening up Germany’s gas market

The German government has yet to step forward and commit to the European objective of an internal market for natural gas. Dr Jörg Spicker of Aquila Energy GmbH says now is the time for action

Weather risk solutions

The weather risk management industry is showing encouraging development around the world. Element Re outlines its strategy for keeping up with the growing needs of the market-place

Knowing your limits

Value-at-risk limits are widely used risk management instruments. But issues over the allocation of Var limits remain, says Brett Humphreys

Not just a quick fix

Real options are an accepted risk management technique in the energy sector. Kevin Foster takes a look at how are they being used and what factors are affecting their development and implementation

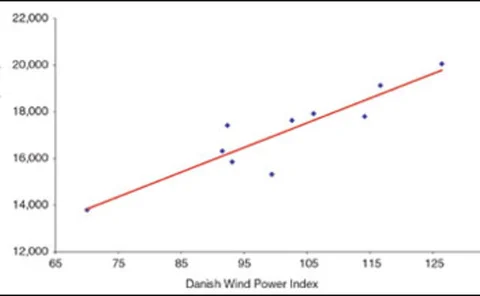

When the wind doesn’t blow

In light of the increased interest in investing in renewable energy following the publication of the EU renewables directive in September, David Pethick, Rebecca Calder and Chris Clancy suggest a method of reducing wind risk

Airlines tackle price turbulence

Industry woes force airlines to get serious about improving efficiencies, including implementing new hedging and procurement tools, as Don Stowers discovers

A hedge by any other name

It is one of the most commonly used phrases in risk management parlance, but what exactly is meant by the term ‘hedge’? Here we propose a new definition. By Brett Humphreys

Trading software: tailored to maturity

It is critical that an energy company looking to acquire risk management and trading software be aware of its current as well as future needs. By Fred Cohen and Satyan Malhotra

Setting a new pace

‘Broken records and shattered dreams’ was the headline for last year’s exchange review – but it could easily have been appropriate for this year’s. Certain exchanges have reported stellar growth, while others are suffering, for various reasons. By Joel…

On a slow road

Many in the energy industry are touting Italy as the next country in Europe to fully open its energy market to competition. But on closer examination, the country has a long way to go if it is to emulate the UK, the Nordic region and Germany. By Robin…

LNG comes in from the cold

Will the current rise in activity in the liquefied natural gas industry result in the product being traded in the same way as other commodities? By Eurof Thomas

Oil giants look to gas and power trading

Despite the fall of energy trader Enron, Shell and BP are both seeking to develop their wholesale trading side, and have selected Tibco’s systems to help them do so. By Don Stowers

Where now for Nordic?

The Nordic electricity sector is usually held up as the best working market in the world. We investigate why it is so successful and what it plans to do now that other countries in Europe are opening up their power sectors. By Joel Hanley

Poor relations

Here EPRM outlines an approach for sorting out common problems relating to calculating correlation measures in value-at-risk. By Brett Humphreys

Deutsches data duel

Statistical analysis of competing meteorological data from two different sources in Germany might lead to disparate views of weather risk management. By Bob Dischel