News

Commodity prices seen as greatest threat to recovery: poll

Rising commodity prices pose the biggest risk to recovery after the 2008 global financial crisis, according to a risk.net poll

Constellation/Exelon deal signals more power M&A fervour

Low power demand and gas prices drive further US power consolidation as companies try to increase margins through cost reductions

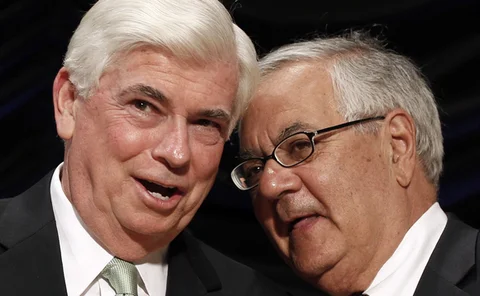

CFTC regulators favour extending Dodd-Frank comment period

CFTC cost and timing concerns continue; FTRs and commodity forwards exempted from swaps definition

Experts question North American LNG exports

Price differentials make LNG exports viable but price future risk could hamper projects; credit-worthy partner is key

UK carbon floor seen raising power prices across Europe

Electricity prices could rise as the UK sets a minimum floor price for carbon

CME Group's Raia joins Goldman Sachs

Joseph Raia today started working at Goldman Sachs, after announcing his resignation as CME Group's managing director for energy and metals marketing at the beginning of the month

Widespread unease over planned position limits rules

Reservations remain among firms involved in commodity trading about a new position limits regime that could be implemented under the Dodd-Frank Wall Street Reform Act, while support continues from anti-speculation campaigners

Position limits deluge continues

Group bombards CFTC with comments on Dodd-Frank position limits; final rule delay expected; quantity unlikely to trump quality says expert

Oil and oil products markets buffeted by tsunami

Oil prices have fluctuated in the wake of the political upheavals in the Middle East and the tsunami disaster in Japan. Ned Molloy reports on the latest market developments

Japan crisis forces rethink over energy supplies

Fears over LNG supplies being diverted from Europe to Japan are receding but a rethink on energy strategies remains as energy markets react to Japan’s crisis. Rebecca Hampson reports

US: Natural gas push not expected to affect prices

Government boost to nat gas use could have longer-term price impact, or may not lower energy prices at all: analysts

UK-Netherlands electricity cable starts commercial operations

BritNed is the first electricity interconnector between the two countries and has a capacity of 1000MW which can flow in either direction depending on relative supply and demand.

S&P: Negative hedging outlook for nat gas producers

High natural gas supply, weak prices to continue; non-investment grade producers to suffer as current hedges roll off

Time runs out for position limits comments

CFTC’s latest position limits plan attracts thousands of comments; opinion deeply divided; new commissioner to affect final vote

Further uncertainty for US carbon trading

Californian carbon cap-and-trade scheme suffers legal set-back on road to 2012 start date

MEFF launches central clearing for electricity derivatives

Increased liquidity in the Spanish market necessitates netting and reduction of counterparty risk, says managing director

LNG supplies for EU could be diverted to Japan

European LNG supplies could be under threat as they become vulnerable to diversion into Japan

HSBC looking to expand into gas and coal

The bank has already added oil products to its offering through a partnership with Totsa, but is looking at other areas in energy and commodities markets

Gas groups rethink regulatory issues

Global co-ordination needed between gas regulators and operators; international group to report on infrastructure and environment in 2012

Ex-CFTC enforcement head: Dodd-Frank anti-manipulation standard unclear

Anti-manipulation proposal could be challenged if made law; former CFTC enforcement director calls for clear standard based on precedent

Experts discuss need for commodity speculation

Squeezing out speculative capital will affect commodity market liquidity, regulator must engage with market to prevent unintended consequences

US power M&A: lively activity expected in 2011

Dynegy’s deal-making efforts may be floundering, but the outlook for the rest of the sector is that mergers and acquisitions activity will flourish in 2011, finds Pauline McCallion

Oil options “frenzy” as corporates shift hedges in response to Mideast crisis

The sharp increase in oil price volatility resulting from political upheaval in Libya and the Middle East has pushed the volume of oil options traded to an all-time high. Ned Molloy reports

CME slams potentially stricter position limit rules

CME Group chief executive slams proposed position limit regulations as “unnecessary”