News

Over half a billion CERs at risk of homelessness post-2012

Restrictions to which offset credits will be acceptable after 2012 could leave 530 million credits ‘homeless’, but demand from Japan and NZ may fill the gap finds Katie Holliday

Oil hedging strategies revised after Irish bail-out

Oil hedging strategies are being revised after Irish bail-out pushes up oil prices. Lianna Brinded investigates whethere recent oil price spikes will be sustainable over the long term

US: FERC renewables plan causes concern

Wind energy lobby group fears that FERC’s plan to create level playing field for renewables could ‘exacerbate discrimination’ within the sector. Pauline McCallion reports

Video: Q&A with Trevor Morgan

Trevor Morgan of the International Energy Agency (IEA) talks to Energy Risk about phasing out fossil fuel subsidies, unconventional gas, why Copenhagen was a failure and the outlook for renewables.

Video: Central and Eastern Europe Conference special report

Energy Risk traveled to Warsaw, Poland for the its Central and Eastern Europe Conference. High-profile market participants from the region attended the event and discussed the progress and potential going forward.

Ex-UNFCCC chief: no legally binding agreement at Cop16

Yvo De Boer, previous executive secretary of the United Nations Framework Convention on Climate Change (UNFCCC) says that there will be no legally binding agreement drawn out at COP16

Malaysian Airlines cuts hedging programme

Malaysian Airlines (MAS) reduced its jet fuel hedging capacity amid uncertain price movements

CME’s CCP to clear Middle East products and reduce 'black swans'

Clearport courts emerging market derivative exchange products in a bid to reduce systemic risk in commodity markets

UK wants to be global hub for green finance

The UK is hoping to re-fire momentum for international climate change agreements at Cancun to help it become the global centre for green finance

Irish bailout forces oil hedging strategies revision

Oil hedging strategies to be revised after Irish bailout pushes up oil prices

Major players show support for California carbon trading

First California Carbon Allowance forward underlines US interest in trading, contract standards to evolve as activity increases

Flexibility needed for risk management, say experts

Central and eastern European managers debate regional and global risk management strategies at Energy Risk's Central and East European conference in Warsaw

CEE power exchanges debate consolidation

Central and eastern European power officials debate prospects for a regional trading platform at Energy Risk's Central and East European conference in Warsaw.

Rising gas prices to force power hedging strategy re-evaluation

Risk managers say gas price rises will force a rethink on current hedging strategies for power generation assets.

Commissioner presses to speed up Dodd-Frank rule-making

CFTC continues derivatives reform rule-making, staff and commissioners concerned about timetable and resources

Nat gas hedging hit by regulation and fundamentals

Experts link drop in natural gas trading activity and liquidity to fundamentals and regulatory uncertainty

DME's Q3 results point to struggle for crude futures

The Dubai Mercantile Exchange’s latest trading results reveal low liquidity levels for its key oil futures contract, despite a face-value surge in trading volumes

States expected to maintain US cap-and-trade momentum

A 'handful' of states will implement carbon cap-and-trade without congressional legislation, according to industry players

Energy Risk Europe 2010

Energy Risk's 2010 annual Europe conference brought leading chief risk officers, quantitative analysts and regulators to London to discuss key risk management issues

Uncertainty over phase III EU carbon plans a ‘nightmare’

Risk managers face a CDM ‘nightmare’ when managing their carbon portfolios in the face of post-2012 uncertainties, according to carbon market experts, as Katie Holliday reports

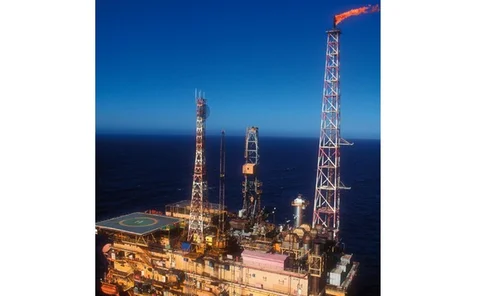

Petrobras raises the stake for unconventional oil

The Petrobras share sale at the end of September set a world record, with $70 billion raised. Alex Davis examines how this is a good omen for risk appetite in deep-water drilling

US interim reporting rule attracts timing concerns

In a bid to stick to the timetable for the implementation of aggregate position limits for the US OTC markets, has the CFTC jumped the gun? Pauline McCallion reports

Data aggregation is largest daily risk issue for energy and commodities

Data aggregation is the most difficult energy trading risk management issue an energy firm deals with on a daily basis, says Centrica Energy’s risk reporting manager when speaking to Lianna Brinded at the Energy Risk Europe conference in London