Risk management

Commodity focus: Eurex is Entering the Commodities Space

Ralf Huesmann, Product Strategy, discusses Eurex’s increased activity in alternative asset classes as market trends change and appetites increase

Corporate statement: Are you re-evaluating your energy risk management provider?

Many energy-price-dependent organisations, such as utilities, independent power producers and oil and gas producers, saw their hedges at risk with the crumbling balance sheets of several key hedge providers. The global credit crisis has forced many…

Cutting edge: Visualising value-at-risk

Risk transparency is an important yet elusive goal of any risk management process. One challenge is to understand the diversification effects of the portfolio elements. Wentao Zhao and Kevin Kindall introduce a graphical technique based on value-at-risk…

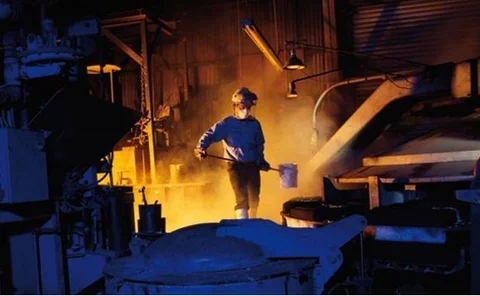

Market focus: derivatives - Risky business

Companies that are heavy consumers of energy are particularly susceptible to market volatility. For such end-users, proper use of risk management techniques can mean make or break, says Eric Fishhaut of GlobalView

Evaluating credit & market exposure

Today’s volatile energy prices and the lower creditworthiness of some energy intensive users means energy providers have to assess counterparty risk thoroughly. David Coffman of GDF SUEZ Energy Resources provides some tips for assessing risk in the non…

Taking a health check

When global economic recovery eventually takes place, it is essential energy trading organisations are in a position to capitalise on market changes. Julie Shochat and Ryan Rogers of Enite set out some guidelines

Get ready for the revolution

Global events and climate change have fundamentally changed the face of energy procurement. Chris Bowden of Utilyx looks at the issues facing energy-intensive businesses in the UK

Buying smart

Guy Newsam, general manager at Muntons, a UK-based energy-intensive corporation, talks to Katie Holliday about how the company is addressing its exposure to volatile energy costs and carbon risk

Navigating the energy market

Gary Worby, managing director at EnergyQuote, speaks to Roderick Bruce about increasing energy market complexity and how end-users can achieve optimal energy purchasing

Building demand

One year after the collapse of Lehmans, fundamentals for the energy and metals markets continue to evolve, with emerging market demand, especially from China, set to have an increasing impact. Pauline McCallion discusses the outlook with experts

Trading positions

Energy Risk catches up with the latest appointments, promotions and departures in global commodities markets

White paper: Focused on the future – learning lessons from the past

In this white paper, Mark Konijnenberg, managing director commodities group at Citi, talks about developing trends in energy risk management since the extreme price volatility of 2008 and outlines how the group is keeping up to date with clients’ needs

Market report: A New Era of Accountability and Flexibility Shapes ETRM Requirements

Amphora discusses how ETRM systems reduce the compliance burden and meet the needs of increased regulatory scrutiny and, ultimately, help traders make more informed decisions

Sponsored Q&A: The evolution of ETRM software

Energy Risk convened representatives from Amphora, Murex, OpenLink, RiskAdvisory and SunGard Kiodex to discuss the the development of ETRM software, the challenges being faced and solutions that are being implemented and deployed by these leaders in the…

RWE Supply & Trading introduces continental gas financial swap contract

RWE Supply & Trading (RWEST), the trading arm of German power company RWE, has developed a financially settled gas swap contract targeted at non-physical players in the gas markets.