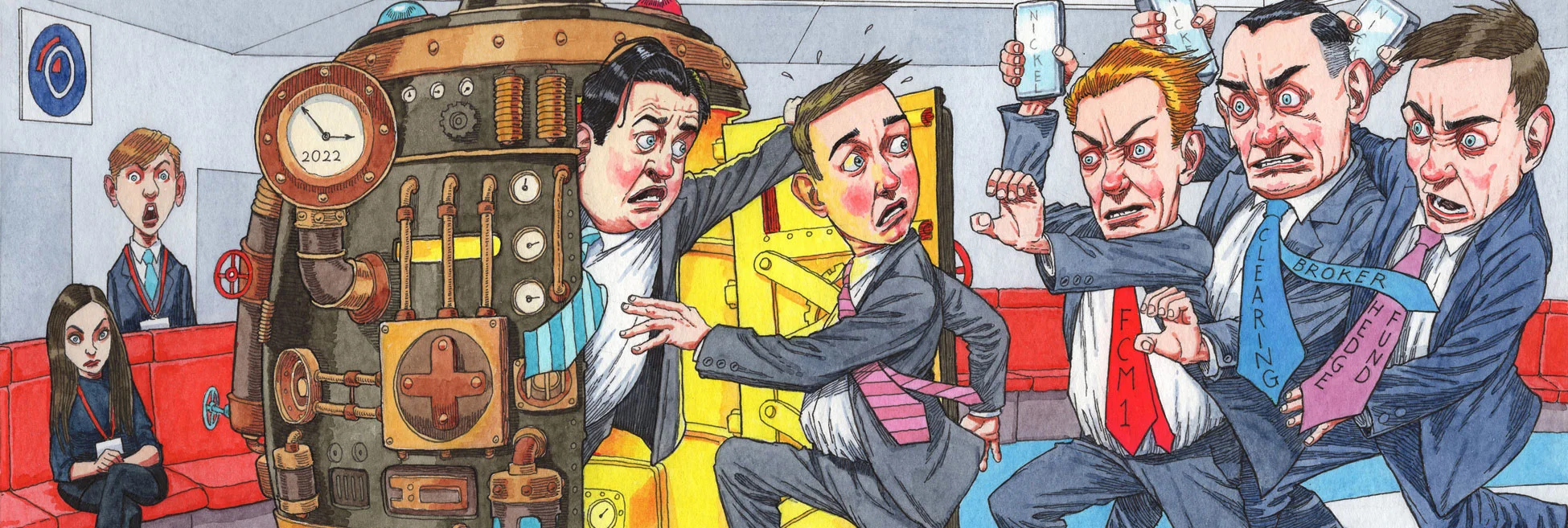

Back in time: a brief history of LME’s nickel meltdown

As prices went haywire, margin remained frozen and calls to suspend trading were rejected

On March 7, the nickel market was in trouble. In the 10 days since Russian troops crossed the Ukrainian border, beginning their abortive advance on Kyiv, prices for industrial metals had risen and fallen in lockstep. By 1:05pm that Monday, those correlations had shattered: while three-month copper was 5.2% above the previous day’s close, nickel contracts had lurched 44% higher, to $42,993 per tonne. The contract closed that day at $48,072.

That evening, the LME held talks with key market

More on Risk management

Energy firms revisit CTRM systems as tech advances

Energy executives mull how to tap into the explosion of new technologies entering the risk space, but systems selection must consider future business needs, writes Yefreed Ditta at Value Creed

CRO interview: Brett Humphreys

Brett Humphreys is head of risk management at environmental markets specialist Karbone. He talks to Energy Risk about the challenges of modelling outcomes in unpredictable times and how he’s approaching the risks at the top of his risk register

How geopolitical risk turned into a systemic stress test

Conflict over resources is reshaping markets in a way that goes beyond occasional risk premia

Energy Risk Debates: the influence of risk culture

The panellists examine different risk cultures and discuss the risk manager’s role and influence in creating a risk culture

Energy Risk reaction: Venezuela and oil sanctions

Energy Risk talks to Rob McLeod at Hartree Partners about the energy risk implications of the US’s control of Venezuelan oil

CRO interview: Shawnie McBride

NRG’s chief risk officer Shawnie McBride discusses the challenges of increasingly interconnected risks, fostering a risk culture and her most useful working habits

Increasingly interconnected risks require unified risk management

Operational risk is on the rise according to a Moody's survey, making unified risk management vital, say Sapna Amlani and Stephen Golliker

Energy Risk Europe Leaders’ Network: geopolitical risk

Energy Risk’s European Leaders’ Network had its first meeting in November to discuss the risks posed to energy firms by recent geopolitical developments