FCMs brace for ‘tough winter’ of energy market disruption

Banks stress-test clients, add big margin multipliers to insulate against risk of 100% price moves

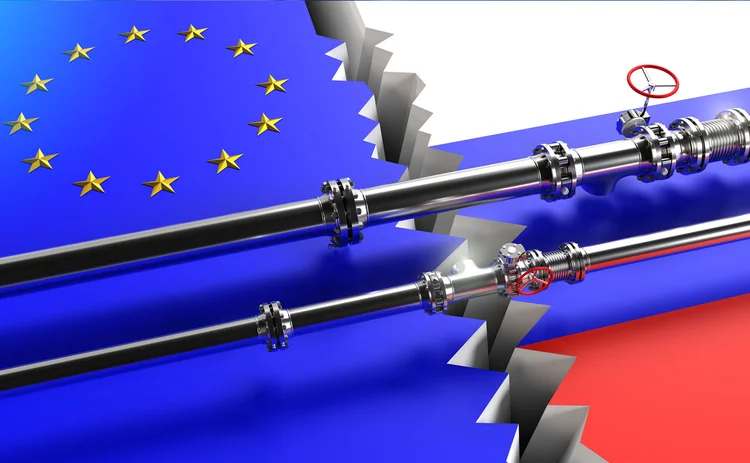

The risk of highly volatile energy prices this winter has sent a shiver down the spines of futures and options clearers, who are responding by upping client margin and running hypothetical stress scenarios. Companies and governments in Europe are scrambling to prepare in case Russia stops or reduces gas supplies at a time of peak annual demand.

“It’s going to be another tough winter, so we’re gearing up for that,” says a risk executive at a large US FCM. “We have created ad hoc scenarios that

More on Risk management

Energy firms revisit CTRM systems as tech advances

Energy executives mull how to tap into the explosion of new technologies entering the risk space, but systems selection must consider future business needs, writes Yefreed Ditta at Value Creed

CRO interview: Brett Humphreys

Brett Humphreys is head of risk management at environmental markets specialist Karbone. He talks to Energy Risk about the challenges of modelling outcomes in unpredictable times and how he’s approaching the risks at the top of his risk register

How geopolitical risk turned into a systemic stress test

Conflict over resources is reshaping markets in a way that goes beyond occasional risk premia

Energy Risk Debates: the influence of risk culture

The panellists examine different risk cultures and discuss the risk manager’s role and influence in creating a risk culture

Energy Risk reaction: Venezuela and oil sanctions

Energy Risk talks to Rob McLeod at Hartree Partners about the energy risk implications of the US’s control of Venezuelan oil

CRO interview: Shawnie McBride

NRG’s chief risk officer Shawnie McBride discusses the challenges of increasingly interconnected risks, fostering a risk culture and her most useful working habits

Increasingly interconnected risks require unified risk management

Operational risk is on the rise according to a Moody's survey, making unified risk management vital, say Sapna Amlani and Stephen Golliker

Energy Risk Europe Leaders’ Network: geopolitical risk

Energy Risk’s European Leaders’ Network had its first meeting in November to discuss the risks posed to energy firms by recent geopolitical developments