Utilities

UK power market investigation overshadowed by EMR

A Competition and Markets Authority (CMA) probe into the UK power market, which may result in a radical shake-up of the sector, is coming amid major changes to the industry under Electricity Market Reform. How the CMA reconciles this will be closely…

US utilities invest in shale gas wells as long-term hedges

Florida Power & Light becomes latest US utility to pursue acquisition of natural gas production assets as risk management strategy

Energy Risk unveils lifetime achievement award winners

Energy Risk has named the winners of its 20th Anniversary Lifetime Achievement Awards – a special one-off prize recognising 20 individuals who have contributed to the development of commodity trading and risk management

UK electricity market likely to be hit by CMA probe

A shake-up of the UK power market is viewed as one likely outcome from a competition investigation into the country’s energy sector, but observers say the probe is being overshadowed by forthcoming regulatory reform

UK Electricity Market Reform welcomed by energy chiefs

Energy executives welcome the UK government's Electricity Market Reform at a conference in London, despite some differences between speakers on the finer details and likely future of the legislation

Innovation of the Year Award: Energy Fundamentals

Energy Fundamentals's European Power System Insight platform combines quality data with sophisticated, yet accessible, modelling capabilities

Energy Risk Manager of the Year: GDF Suez Trading

As banks retreat from commodity market, GDF Suez Trading is expanding its risk management business and broadening its geographic reach

UK power market licence changes ‘no silver bullet’

Ofgem’s moves to increase electricity market liquidity for small suppliers are a step in the right direction, but more must be done, argue market participants

Energy firms beg CFTC for clarity on commodity options

Utilities, oil producers and trading firms are urging the CFTC to issue clarification on contracts with embedded volumetric optionality

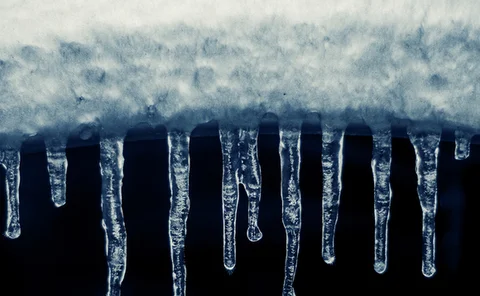

Polar vortex revives interest in gas and power hedging

A brutally cold winter in the eastern US has roiled natural gas and power markets and shocked energy consumers that had grown accustomed to cheap, abundant shale gas. Such firms are now hedging more actively, Alexander Osipovich finds

Cutting edge: Modelling dependence of price spikes in Australian electricity markets

The deregulation of Australian electricity markets has brought several challenges, including the possibility of price spikes, which expose market participants to significant risks. As Adebayo Aderounmu and Rodney Wolff outline, these spikes are hard to…

Stadtwerke München grapples with regulation and risk management

At Stadtwerke München, one of Germany’s largest municipal utilities, many of the issues facing risk management are different from those affecting big commercial energy firms. But concerns about the impact of financial regulation run just as high. Mark…

Danske Commodities chief reflects on altered energy landscape

While Europe’s traditional energy firms have been suffering, Danske Commodities saw a 75% leap in profits for 2012. Chief executive Torben Nordal Clausen speaks to Gillian Carr

US power hedging suffers from low prices

Low power prices have dented the need for electricity producers and consumers to hedge with derivatives, while regulatory reform is also making life difficult for market-makers. But market participants are optimistic the trend could be reversed. Pauline…

Energy firms increasingly using stress tests to cope with regulatory change

Utilities and other energy firms are working hard to refine and enhance the scenarios they use for stress testing. Given recent market events, the impact of regulatory change and large-scale liquidity crises are taking on an increasingly important role…

Coal derivatives activity rises in Europe and US despite differences

The market for coal is being drastically reshaped by changes in the pattern of global supply and demand. In both Europe and the US, this is causing an increase in coal derivatives trading, albeit for different reasons. Gillian Carr investigates

Counterparties abandon US public utilities over Dodd-Frank fears

Publicly owned utilities say a growing number of energy companies are refusing to trade with them ahead of the deadline for swap dealer registration

Boultwood steps down as CRO of Constellation Energy

Move follows merger with Exelon Corporation. Risk management at the combined company will now be run by Exelon CRO, Joseph Glace

Power and utilities M&A declines in volume but grows in value: Ernst & Young

Slow global economic recovery led to weak M&A activity in the global power and utilities sector in the first quarter of 2012, but deal value increased almost 20% from the previous quarter

Sponsored statement: Navita

Many foreseen and unanticipated events are conspiring to push utilities, operators and producers critically closer towards smart energy preparedness. Navita Systems’ Anette Nordskog and Jo Morten Sletner discuss the move

Turning Points: Larry Kellerman, CEO Quantum Utility Generation

A career so far spent pushing the boundaries of the US power market has lead Larry Kellerman of Quantum Utility Generation to the world of private equity. Pauline McCallion finds out more

US renewable energy: A carrot and stick approach

Pauline McCallion examines current risks surrounding the development of renewable energy resources in the US

US legislators try new tack for energy bill

RES bill should boost renewable energy development and RECs trading but is unlikely to pass this year