Technology

DTE Energy Trading opts for Amerex STP solution

DTE Energy Trading, a subsidiary of Detroit-based DTE Energy, has implemented Amerex Energy’s straight-through processing (STP) product, Xcheck - a web-based trade confirmation system that replaces the manual process of generating, transmitting and…

SunGard acquires ASP pioneer Kiodex

SunGard has acquired New York based Kiodex, a supplier of web-based risk management, financial reporting, FAS 133 compliance and market data solutions for companies exposed to commodity price risk.

User Choice winners revealed

Energy Risk's first User Choice Awards have been a tremendous success, with over 450 valid votes showing which vendors and data providers are the preferred suppliers to the energy industry in 2004.

Looking to the east

Can power market operators in the new EU member states in eastern Europe gainthe liquidity they need to challenge either bilateral electricity contracts orthe established exchanges? Joe Marsh reports

Technology upload

There has been a recent upswing in the fortunes of energy risk software industry. And that is reflected in this year’s expanded technology vendor guide, making it the definitive guide to energy software and technology available

The troubleshooter

After struggling for a year with a difficult Triple Point installation, US energycompany Cinergy brought in energy IT veteran Joel McKnight. Nine months on, implementationand integration is complete. By Joe Marsh

King of convenience

The need for Sarbanes-Oxley certification has boosted sales of internet servicerisk systems, says web pioneer Martin Chavez of Kiodex. By James Ockenden

ABN to offer centralised power and gas clearing platform

Dutch bank ABN Amro today said it’s energy futures division is developing a platform to provide centralised over-the-counter (OTC) clearing for natural gas and power contracts at six European energy exchanges – UKPX, EEX, Endex, Powernext, IPE and…

The waiting game

The Italian power market has finally opened to competition, but how long willenergy users have to wait until they can trade on the new electricity exchange? Joe Marsh reports

Taking the slow road

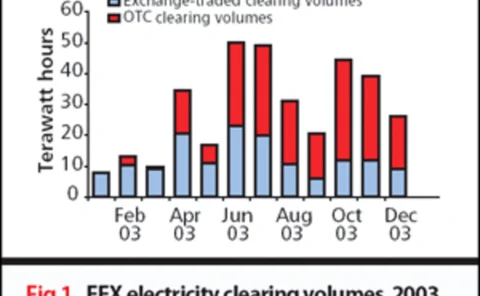

Recent developments suggest that clearing is likely to gain widespread acceptance in the European energy market. Market participants feel it is a question of how and when – not if – robust, liquid solutions will emerge. By Joe Marsh

Bouncing back

Business may be sluggish in the energy sector, but energy risk technology companiesare adapting to the tough market environment and proving their resilience, evenif that means partnering with rivals. By Paul Lyon

The future of ETRM

As generation, trading and retailing companies come out from under the dark cloud to prepare for what looks to be a brighter future, one issue has become critical – the need to upgrade outdated ETRM systems with 21st century architecture, portfolio…

A dark futurefor clearing

Clearing was the energy buzz word of early 2003. But as Clearing Bank Hannover goes into liquidation and the future of EnergyClear’s business remains uncertain, it seems energy clearing has lost its appeal. By Paul Lyon

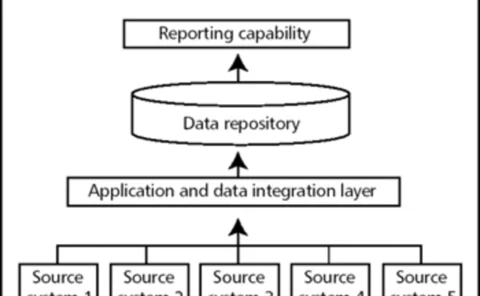

Getting it together

Data consolidation is now a vital foundation to any successful risk management implementation, as Dave Rose and Stuart Cook of The Structure Group report

System-ready for Sarbanes-Oxley

Energy companies are not alone in having to review their operations to comply with the Sarbanes-Oxley Act. Energy software suppliers, too, are looking at their systems, although most are confident they are already well prepared, finds Clive Davidson

Keeping up with the markets

The power trading sector has changed substantially in the past 12 months. Have trading and risk management software vendors kept pace? Kevin Foster reports

Avoiding STP failure

Entertaining as a Matrix-style spectre of a world governed by computers might be, for many involved in planning straight-through processing, seamless computing is the goal that every organisation should be trying to achieve, says Trayport’s Elliot Piggot

The software run-down

EPRM’s company-by-company listing of the leading energy software and information providers in the business, including a run-down of their clients

Running a smooth operation

Due to internal control scandals, process failures and the Sarbanes-Oxley Act, energy firms must keep an ever-closer eye on internal operations. Openlink’s Philip Wang and freelance author Jack King lay the basis for an operational risk framework

2003 system frontrunners

After the success of the 2002 systemfrontrunners section – where software companieshad the opportunity to highlight and showcasetheir technology and achievements – we arepleased to introduce the selection for 2003.

Trying to model reality

Quantitative credit risk models are a must-have in today’s energy industry. But human judgement is still needed, as Maria Kielmas discovers

Cross-border conundrums

Analysts at rating agency Standard & Poor’s Lee Munden and Paul Lund look at the future of cross-border trading in Europe, given the credit crises of 2002

The bigger they come…

The German market is at the heart of the European power business, but it has stuttered since its early promise, and has yet to set the pace for the region as a whole. From a new entrant’s point of view, this is only to be welcomed, argues Ben Tait

Judicial stalemate

German natural gas market liberalisation is stalled between the courts and a corporatist business culture, finds Maria Kielmas