Risk management

S&P to launch commodity sub-indexes amid US regulation fears

Ratings agency and financial research firm Standard & Poor’s (S&P) is to roll out two commodity-related sub-indexes that focus only on European and Asian contracts in response to fears the US Commodity Futures Trading Commission (CFTC) will make further…

Market cautious on Brazil’s 2010 oil bloc auction

News that Brazil is looking to auction more oil and gas blocs this year has met with a lukewarm reception from the oil markets as they await more clarity on the timing, production estimates and pending oil regulations, say analysts.

UK to focus on smart grids and nuclear power

Big investments into UK smart grids, offshore wind farms under the Renewable Obligation Certificates (ROC) scheme and nuclear power are on the agenda for both the Labour and Conservative parties in the run-up to the UK elections, as the country looks to…

Energy Risk: What's coming next?

Energy Risk brings you a snapshot of what's moving and shaking the markets with a special look at the continuing impact of the financial crisis on utilities.

IEA revises China oil outlook for 2010

The International Energy Agency (IEA) has revised its global oil demand forecast for the second time this year, following a double digit upwards surge in China’s year-on-year apparent oil demand in January.

Energy Risk: What's coming next?

Energy Risk brings you a snapshot of what's moving and shaking the markets with special on-the-ground live reports from the Carbon Market Insights conference in Amsterdam.

Two-thirds of ETRM users plan new systems in 2010

Some 67% of respondents to Energy Risk’s 2010 Software Survey say they will be investing in new energy trading risk management (ETRM) systems this year, to tackle dissatisfaction with the speed and usability of existing software systems, as well as…

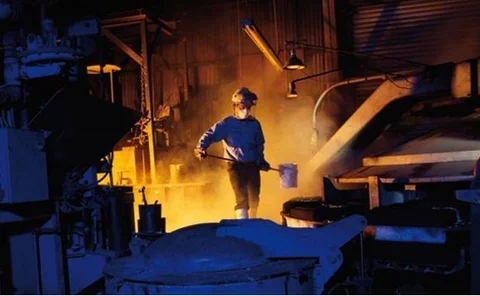

Shell: Nigerian oil and gas production is falling

Crude oil and gas production in Nigeria has fallen by around 30% over the past five years, following a slowdown in exploration and production activity in the country, says Ann Pickard, Shell’s regional executive vice-president of exploration and…

Romania bans OTC emissions trading to combat fraud

Romanian authorities have banned European Union carbon emissions allowances (EUA) in the over-the-counter derivatives market to prevent EUA tax fraud, after ruling that these contracts are now classed as equity securities and therefore can only be bought…

Market fears two-tier EU ETS post-2012

Following a lack of collective will to determine a binding agreement at the Climate Change conference in Copenhagen (Cop15), analysts say the West may take steps to either ban or restrict most Chinese certified emissions reduction (CER) credits in the…

Energy Risk: What's coming next?

Energy Risk brings you a snapshot of what's moving and shaking the markets.

Pass the microphone: Humphreys to Strickland

In this new column, an industry professional interviews a market expert of their choice. Next month the interviewee becomes the interviewer and chooses who to interview. The series is kicked off by Brett Humphreys putting his questions to Lacima Group’s…

WEF: Oil price spikes remain top 10 risk for 2010

Oil price spikes remain one of the World Economic Forum's (WEF) top 10 economic risks for 2010, with the risk-rating moving up to medium risk from low risk in 2009.

Lessons learnt in 2009

For risk managers, 2009 was about dealing with the aftermath of the financial crisis, revisiting models and putting greater emphasis on liquidity and cashflow risk. Katie Holliday talks to experts about the major lessons learnt this year

Profile: Brett Humphreys

In the last interview in the Profile series celebrating Energy Risk’s 15th anniversary, Brett Humphreys talks to Rachel Morison about how risk management has evolved

BarCap launches LNG services with Excelerate deal

Barclays Capital today launched a liquefied natural gas (LNG) services offering with a new agreement to market Excelerate Energy’s LNG cargoes in the northeast US market.

Risk Management After Lehman

Can the constants used by quants and risk managers be trusted in the post-Lehman environment? Chris Schlegel of Southern Company looks at some of the pitfalls risk managers need to look out for when using constants and assesses why they are both vitally…

Feeling Secure? Energy Risk's Risk Management Survey 2009

Budget constraints have become the biggest hindrance to effective risk management, and credit is the biggest risk to energy trading, according to respondents of Energy Risk’s 2009 Risk Management Survey. Rachel Morison presents the results

Market focus: derivatives - Risky business

Companies that are heavy consumers of energy are particularly susceptible to market volatility. For such end-users, proper use of risk management techniques can mean make or break, says Eric Fishhaut of GlobalView

Taking a health check

When global economic recovery eventually takes place, it is essential energy trading organisations are in a position to capitalise on market changes. Julie Shochat and Ryan Rogers of Enite set out some guidelines

Get ready for the revolution

Global events and climate change have fundamentally changed the face of energy procurement. Chris Bowden of Utilyx looks at the issues facing energy-intensive businesses in the UK